Article Text

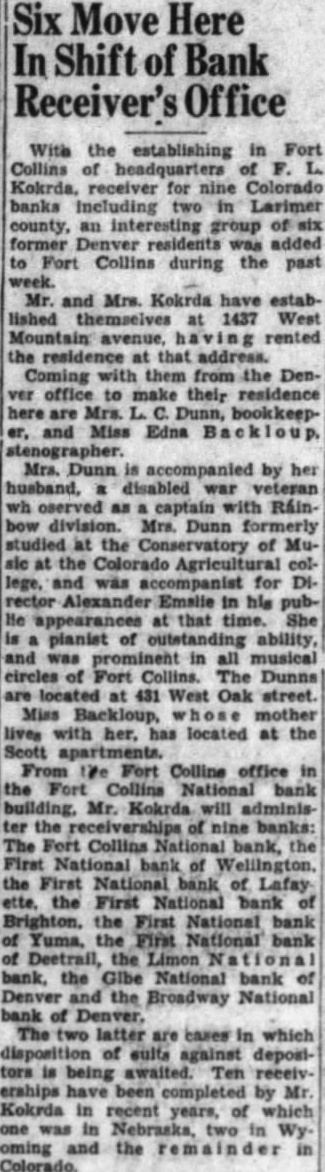

Six Move Here In Shift of Bank Receiver's Office With the establishing in Fort Collins of headquarters of F. Kokrda. receiver for nine Colorado banks two in Larimer county, an interesting former Denver residents was added to Fort Collins during the past week. Mr. and Mrs. Kokrda have established themselves at 1437 West Mountain avenue, rented the residence at that address. Coming with them from Denver office to make their residence here are Mrs. Dunn, bookkeeper, and Miss Edna Mrs. Dunn accompanied by her husband, disabled war veteran wh oserved as captain with Ráindivision. Mrs. Dunn formerly studied at the Conservatory of Music at the Colorado Agricultural college, and was accompanist for DIAlexander Emalie in his pubHe appearances at that time. She planist of ability, prominent in all musical circles of Fort Collins. The Dunns are located at 431 West Oak street. Miss Backloup, mother lives with has located at the Scott apartments. From life Fort Colline office in the Fort Collins National bank building, Mr. Kokrda will administer the receiverships of nine banks: The Fort Collins National bank. the First National bank of Wellington, the First National bank of Lafay ette, the First National bank of Brighton, the First National bank Yuma, the First National bank of Deetrail, the Limon bank, the Glbe National bank of Denver and the Broadway National bank of Denver. The two latter are bases in which disposition of suits against depositors is being awaited. Ten receiverships been completed by Mr. Kokrda in recent years, of which one was in in Wy. oming and the Colorado.