Article Text

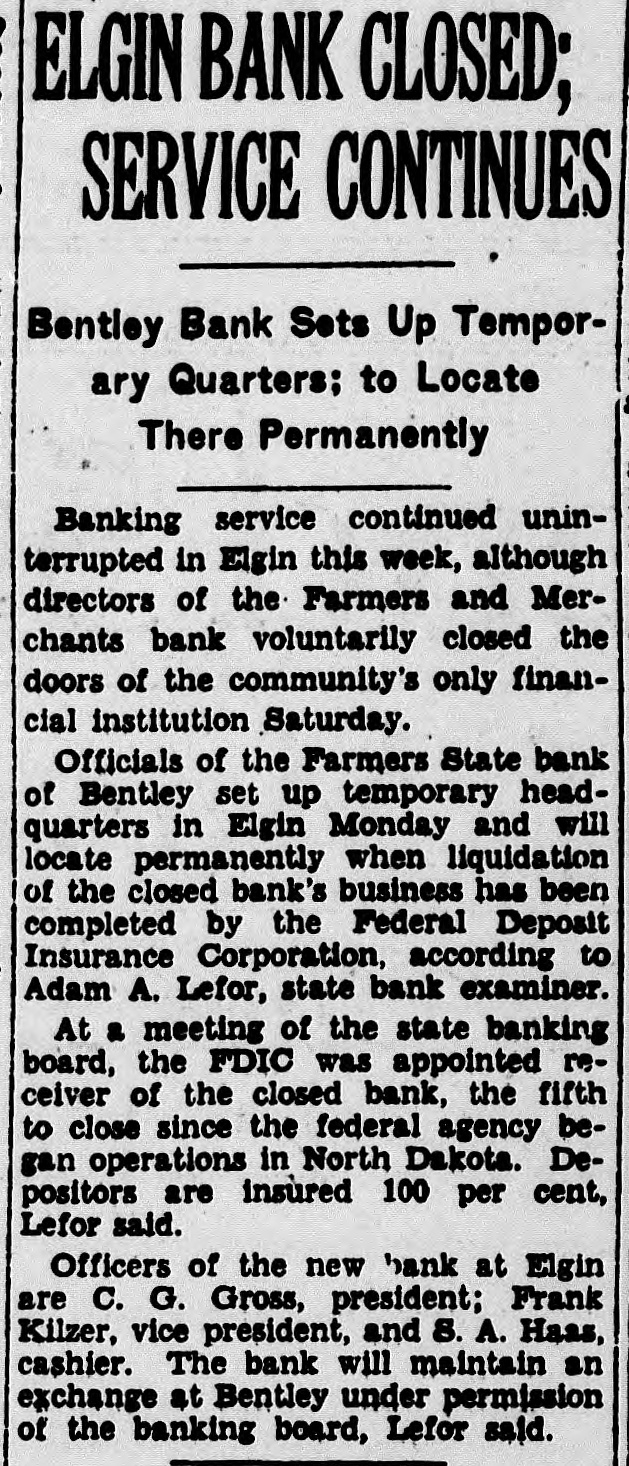

ELGIN BANK CLOSED; SERVICE CONTINUES Bentley Bank Sets Up Temporary Quarters; to Locate There Permanently Banking service continued uninterrupted in Elgin this week, although directors of the. Farmers and Merchants bank voluntarily closed the doors of the community's only financial institution Saturday. Officials of the Farmers State bank of Bentley set up temporary headquarters in Elgin Monday and will locate permanently when liquidation of the closed bank's business has been completed by the Federal Deposit Insurance Corporation, according to Adam A. Lefor, state bank examiner. At a meeting of the state banking board, the FDIC was appointed receiver of the closed bank, the fifth to close since the federal agency began operations in North Dakota. Depositors are insured 100 per cent, Lefor said. Officers of the new bank at Elgin are C. G. Gross, president; Frank Kilzer, vice president, and 8. A. Haas, cashier. The bank will maintain an exchange at Bentley under permission of the banking board, Lefor said.