Click image to open full size in new tab

Article Text

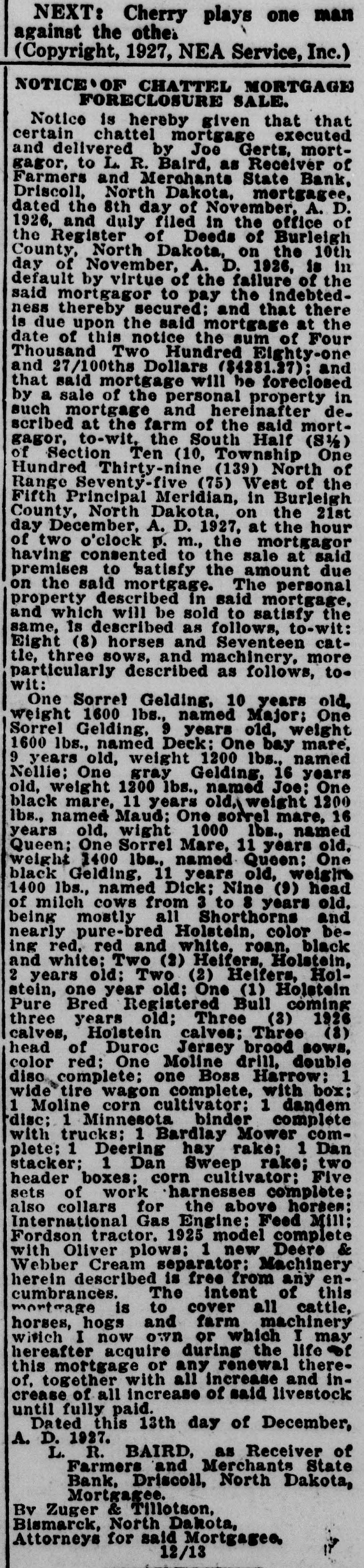

NEXT: Cherry plays one man against the other (Copyright, 1927, NEA Service, Inc.) NOTICE'OF CHATTEL MORTGAGE FORECLOSURE SALE. Notice is hereby given that that certain chattel mortgage executed and delivered by Joe Gerts, mortgagor, to L. R. Baird, as Receiver of Farmers and Merchants State Bank, Driscoll, North Dakota, mortgagee, dated the 8th day of November, A. D. 1926, and duly filed in the office of the Register of Deeds of Burleigh County, North Dakota, on the 10th day of November, A. D. 1926, is in default by virtue of the failure of the said mortgagor to pay the indebtedness thereby secured; and that there is due upon the said mortgage at the date of this notice the sum of Four Thousand Two Hundred Eighty-one and 27/100ths Dollars ($4281.27); and that said mortgage will he foreclosed by a sale of the personal property in such mortgage and hereinafter de. scribed at the farm of the said mortgagor, to-wit, the South Half (S½) of Section Ten (10, Township One Hundred Thirty-nine (139) North of Range Seventy-five (75) West of the Fifth Principal Meridian, in Burleigh County, North Dakota, on the 21st day December, A. D. 1927, at the hour of two o'clock p. m., the mortgagor having consented to the sale at said premises to 'satisfy the amount due on the said mortgage. The personal property described in said mortgage, and which will be sold to satisfy the same, Is described as follows, to-wit: Eight (8) horses and Seventeen cattle, three sows, and machinery, more particularly described as follows, towit: One Sorrel Gelding, 10 years old, weight 1600 lbs., named Major; One Sorrel Gelding, 9 years old, weight 1600 lbs., named Deck: One bay mare, 9 years old, weight 1200 lbs., named Nellie; One gray Gelding. 16 years old, weight 1200 lbs., named Joe; One black mare, 11 years old, weight 1200 lbs., named Maud; One sorrel mare, 16 years old, wight 1000 1bs., named Queen; One Sorrel Mare, 11 years old, weight 1400 lbs., named Queen; One black Gelding, 11 years old, weight 1400 lbs., named Dick; Nine (9) head of milch cows from 3 to 8 years old, being mostly all Shorthorns and nearly pure-bred Holstein, color being red. red and white, roan, black and white: Two (2) Heifers, Holstein, 2 years old; Two (2) Heifers, Holstein, one year old; One (1) Holstein Pure Bred Registered Bull coming three years old; Three (3) 1926 calves, Holstein calves; Three (8) head of Duroc Jersey brood sows, color red; One Moline drill, double disc complete; one Boss Harrow; 1 wide tire wagon complete, with box; 1 Moline corn cultivator: 1 dandem disc; 1 Minnesota binder complete with trucks; 1 Bardlay Mower complete; 1 Deering hay rake; 1 Dan stacker; 1 Dan Sweep rake; two header boxes; corn cultivator; Five sets of work harnesses complete; also collars for the above horses: International Gas Engine: Feed Mill; Fordson tractor. 1925 model complete with Oliver plows; 1 new Deere & Webber Cream separator; Machinery herein described is free from any encumbrances. The intent of this mortgage is to cover all cattle, horses, hogs and farm machinery with I now own or which I may hereafter acquire during the life of this mortgage or any renewal thereof, together with all increase and increase of all increase of said livestock until fully paid. Dated this 13th day of December, A. D. 1927. L. R. BAIRD, as Receiver of Farmers and Merchants State Bank, Driscoll, North Dakota, Mortgagee. By Zuger & Tillotson, Bismarck, North Dakota, Attorneys for said Mortgagee, 12/13