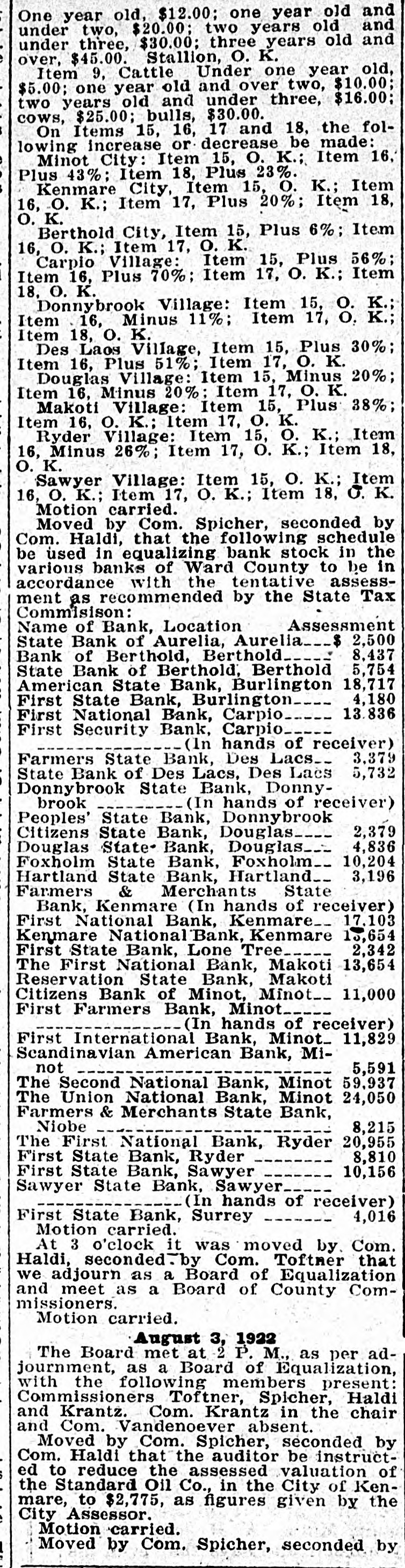

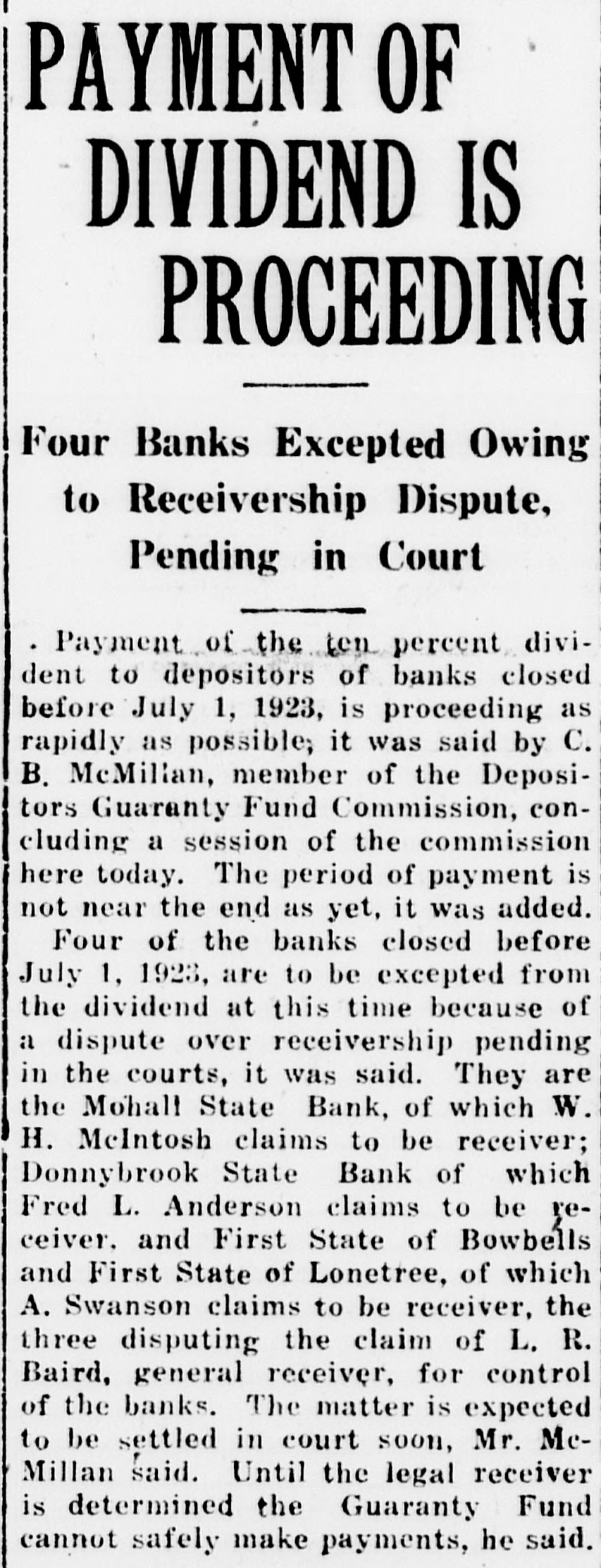

Article Text

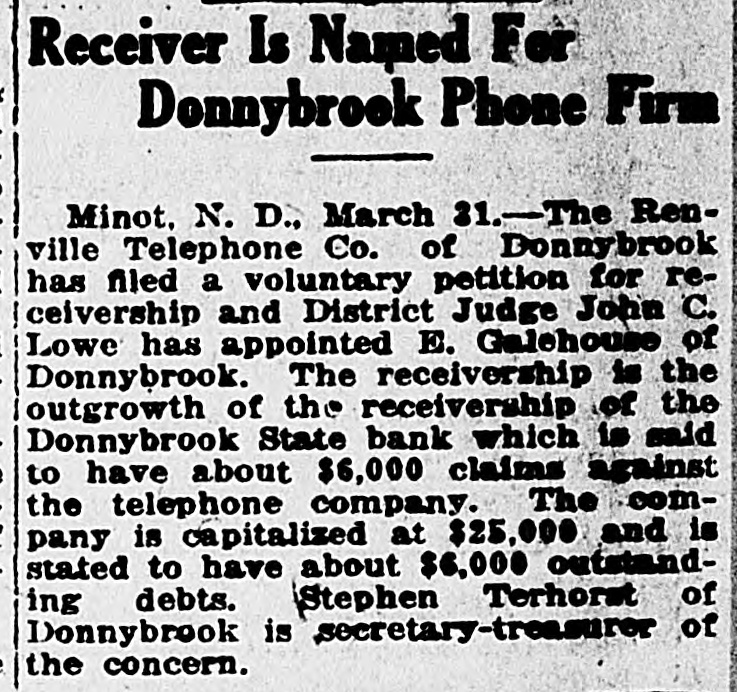

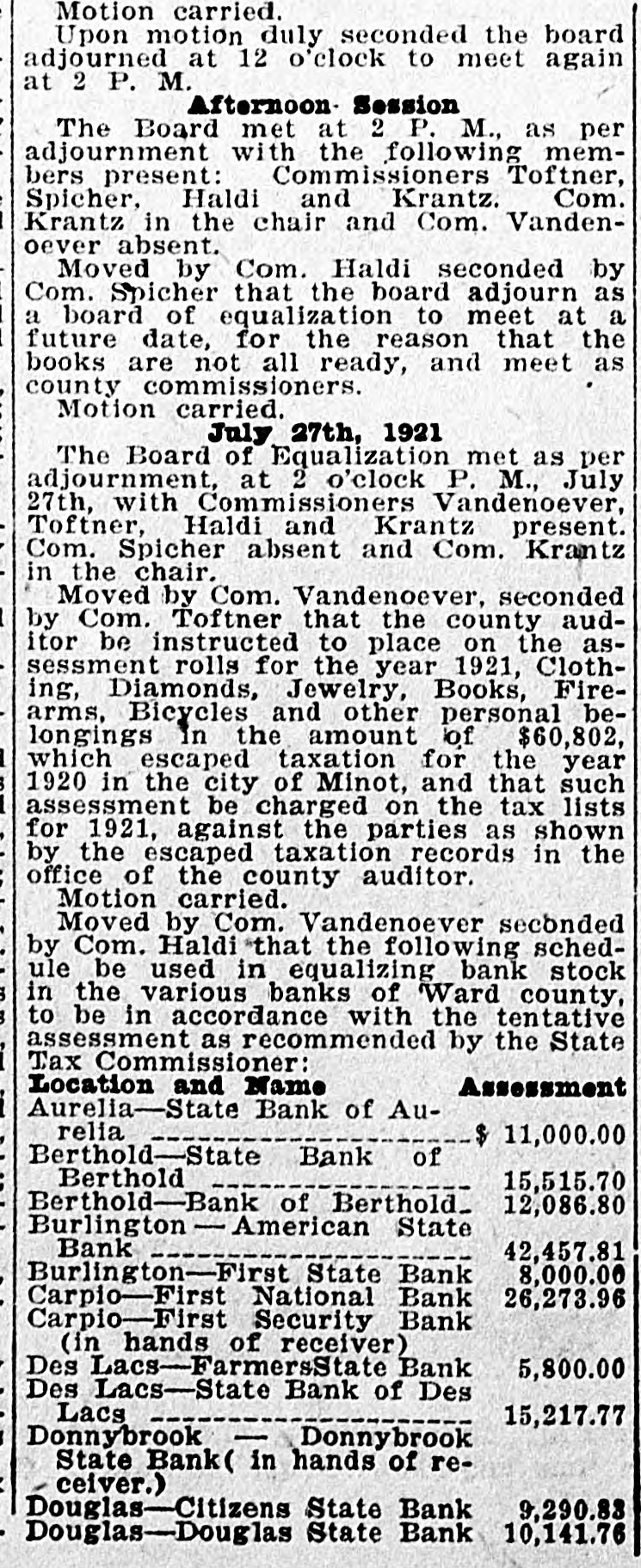

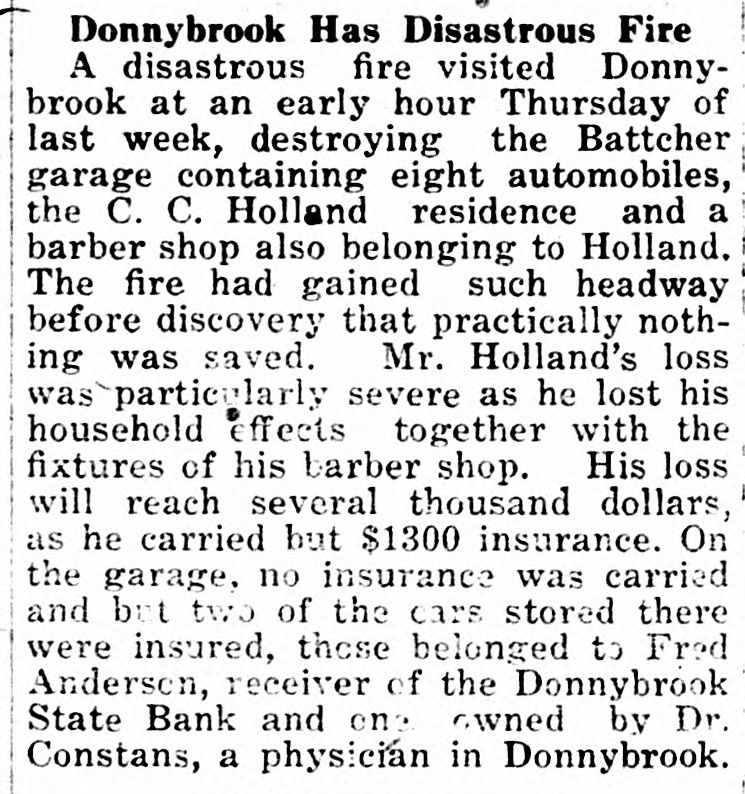

erty bonds, war savings stamps, etc.; in which funds have been inv sted bitt they are of minor importance air this time. It is with the items as listed above that the people of the state are chiefly concerned and about which they appear to wish information. So here are a few points which appear from an analysis of the facts quoted above. (Tabular statement of liabilities of closed banks, together with many details from the audit report, appears on page 3.) Closed Banks. The table on another page shows the amount of funds tied up in the banks of the state which had closed up to February 1. amounting to $909,829.27. In this connection it should be noted that receivers have been appointed for eleven of these institutions, and that the process of liquidation has begun, or is about to begin. The liquidating process for all of them. however, is certain to be slow. In the report recently issued by the state industrial commission as to the condition of the Bank of North Dakota allusion was made to the funds tied up in those closed banks and the depositors' guaranty fund was cited as a means by which the state bank would get-its money back. It should be remembered in this connection, however, that the largest amount which can bc raised under this act during the year is $260,000. Outside of the collateral which it now holds in pledge for loans, etc., the Bank of North Dakota must take its chances. with the other creditors of the various defunct institutions. It may be noted here that the guaranty fund commission comes in for onehalf of all-liquidation assets until its claim against each institution is satisfled. In some of these closed banks the liabilities to the state are many times the total of their capital and surplus. For example, the Tolley State bank's capital and surplus amounted to $20,000, while at the time 11 closed it had re-deposits from the Bank of North Dakota of $35,115.05. and other liabilities to the same bank of $28,473.80. making the total liabilities of the institution to the Bank of North Dakota $63,588.85. Another example is the Donnybrook State bank which at the time it closed,had a capital and surplus of $33,400 and liabilities to the Bank of North Dakota totalling $93,431. So much for the relations of the Bank of North Dakota to the banks which have been closed. 4 Relations With Live Banks. Now as to the relations of the Bank of North Dakota with going banks. As previously stated, the bank has $7,040,899.19 re-deposited in some 700 banks of the state. Of this however, A large portion is concentrated in 39 banks which appear to be especially favored. The re-deposits in the other 600 or more banks of the state average less than $10,000 per bank. In the same way the total liabilities of all the banks of the state to the Bank of North Dakota amounted on December 3, 1920, to $11,606,098.23. Of this sum $2,464,408.76 was owed by the 39 favored banks to which allusion was just made. This is of interest in connection with the statement made under oath Friday before the house audit committee by F. W. Cathro, manager of the Bank of North Dakota, when he said that there had been no favoritAMS am Date 5.00