Click image to open full size in new tab

Article Text

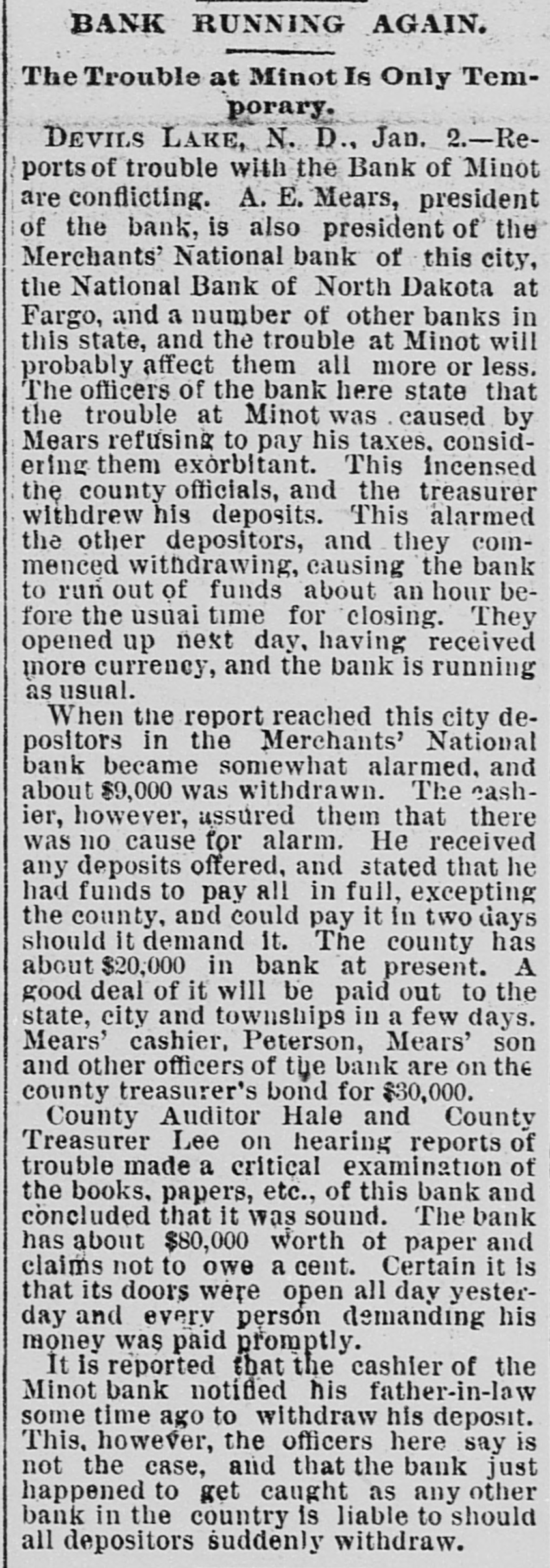

BANK RUNNING AGAIN. The Trouble at Minot Is Only Temporary. DEVILS LAKE, N. D., Jan. 2.-Reports of trouble with the Bank of Minot are conflicting. A. E. Mears, president of the bank, is also president of the Merchants' National bank of this city, the National Bank of North Dakota at Fargo, and a number of other banks in this state, and the trouble at Minot will probably affect them all more or less. The officers of the bank here state that the trouble at Minot was caused by Mears refusing to pay his taxes, considering them exorbitant. This incensed the county officials, and the treasurer withdrew his deposits. This alarmed the other depositors, and they commenced withdrawing, causing the bank to run out of funds about an hour before the usual time for closing. They opened up next day, having received more currency, and the bank is running as usual. When the report reached this city depositors in the Merchants' National bank became somewhat alarmed, and about $9,000 was withdrawn. The cashier, however, assured them that there was no cause for alarm. He received any deposits offered, and stated that he had funds to pay all in full, excepting the county, and could pay it in two days should it demand it. The county has about $20,000 in bank at present. A good deal of it will be paid out to the state, city and townships in a few days. Mears' cashier, Peterson, Mears' son and other officers of the bank are on the county treasurer's bond for $30,000. County Auditor Hale and County Treasurer Lee on hearing reports of trouble made a critical examination of the books, papers, etc., of this bank and concluded that it was sound. The bank has about $80,000 worth of paper and claims not to owe a cent. Certain it is that its doors were open all day yesterday and every person demanding his money was paid promptly. It is reported that the cashier of the Minot bank notified his father-in-law some time ago to withdraw his deposit. This, however, the officers here say is not the case, and that the bank just happened to get caught as any other bank in the country is liable to should all depositors suddenly withdraw.