Article Text

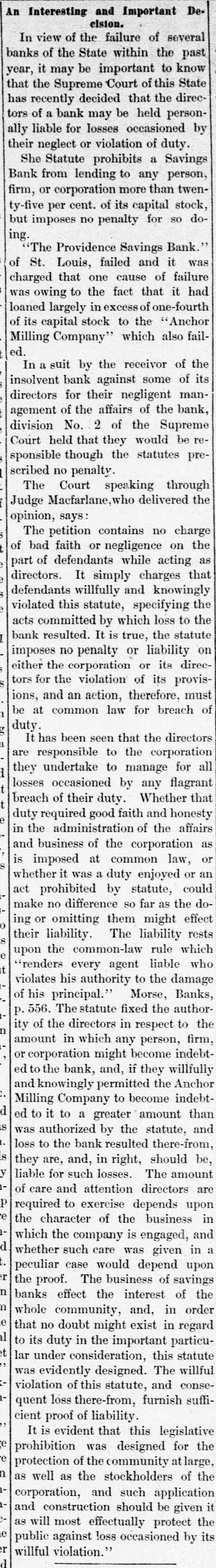

# An Interesting and Important Decision. In view of the failure of several banks of the State within the past year, it may be important to know that the Supreme Court of this State has recently decided that the directors of a bank may be held personally liable for losses occasioned by their neglect or violation of duty. She Statute prohibits a Savings Bank from lending to any person, firm, or corporation more than twenty-five per cent. of its capital stock, but imposes no penalty for so doing. "The Providence Savings Bank" of St. Louis, failed and it was charged that one cause of failure was owing to the fact that it had loaned largely in excess of one-fourth of its capital stock to the "Anchor Milling Company" which also failed. In a suit by the receivor of the insolvent bank against some of its directors for their negligent management of the affairs of the bank, division No. 2 of the Supreme Court held that they would be responsible though the statutes prescribed no penalty. The Court speaking through Judge Macfarlane, who delivered the opinion, says: The petition contains no charge of bad faith or negligence on the part of defendants while acting as directors. It simply charges that defendants willfully and knowingly violated this statute, specifying the acts committed by which loss to the bank resulted. It is true, the statute imposes no penalty or liability on either the corporation or its directors for the violation of its provisions, and an action, therefore, must be at common law for breach of duty. It has been seen that the directors are responsible to the corporation they undertake to manage for all losses occasioned by any flagrant breach of their duty. Whether that duty required good faith and honesty in the administration of the affairs and business of the corporation as is imposed at common law, or whether it was a duty enjoyed or an act prohibited by statute, could make no difference so far as the doing or omitting them might effect their liability. The liability rests upon the common-law rule which "renders every agent liable who violates his authority to the damage of his principal." Morse, Banks, p. 556. The statute fixed the authority of the directors in respect to the amount in which any person, firm, or corporation might become indebted to the bank, and, if they willfully and knowingly permitted the Anchor Milling Company to become indebted to it to a greater amount than was authorized by the statute, and loss to the bank resulted there-from, they are, and, in right, should be, liable for such losses. The amount of care and attention directors are required to exercise depends upon the character of the business in which the company is engaged, and whether such care was given in a peculiar case would depend upon the proof. The business of savings banks effect the interest of the whole community, and, in order that no doubt might exist in regard to its duty in the important particular under consideration, this statute was evidently designed. The willful violation of this statute, and consequent loss there-from, furnish sufficient proof of liability. It is evident that this legislative prohibition was designed for the protection of the community at large, as well as the stockholders of the corporation, and such application and construction should be given it as will most effectually protect the public against loss occasioned by its willful violation."