Article Text

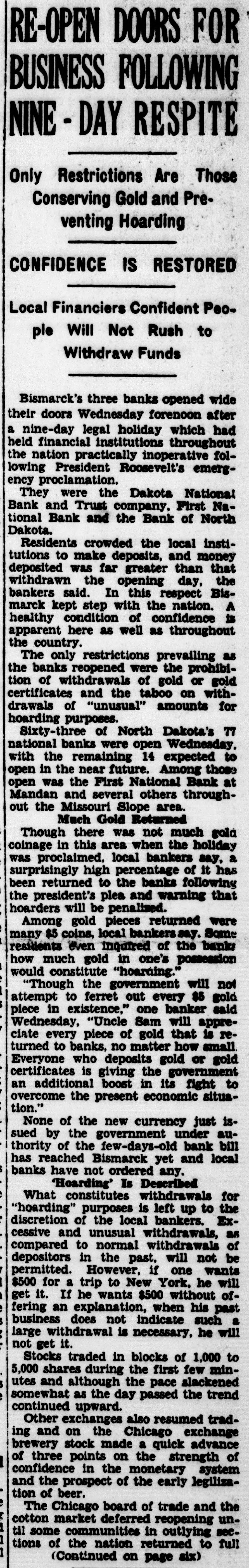

RE-OPEN DOORS FOR BUSINESS FOLLOWING NINE - DAY RESPITE Only Restrictions Are Those Conserving Gold and Preventing Hoarding CONFIDENCE IS RESTORED Local Financiers Confident Peopie Will Not Rush to Withdraw Funds Bismarck's three banks opened wide their doors Wednesday forenoon after a nine-day legal holiday which had held financial institutions throughout the nation practically inoperative following President Roosevelt's emergency proclamation. They were the Dakota National Bank and Trust company. First National Bank and the Bank of North Dakota. Residents crowded the local institutions to make deposits, and money deposited was far greater than that withdrawn the opening day, the bankers said. In this respect Bismarck kept step with the nation. A healthy condition of confidence is apparent here as well as throughout the country. The only restrictions prevailing as the banks reopened were the prohibition of withdrawals of gold or gold certificates and the taboo on withdrawals of "unusual" amounts for hoarding purposes. Sixty-three of North Dakota's 77 national banks were open Wednesday, with the remaining 14 expected to open in the near future. Among those open was the First National Bank at Mandan and several others throughout the Missouri Slope area. Much Gold Returned Though there was not much gold coinage in this area when the holiday was proclaimed, local bankers say, a surprisingly high percentage of it has been returned to the banks following the president's plea and warning that hoarders will be penalised. Among gold pieces returned were many $5 coins, local bankers say. Some residents even inquired of the banks how much gold in one's possession would constitute "hoarning." "Though the government will not attempt to ferret out every $5 gold piece in existence," one banker said Wednesday, "Uncle Sam will appreciate every piece of gold that is returned to banks, no matter how small. Everyone who deposits gold or gold certificates is giving the government an additional boost in its fight to overcome the present economic situation." None of the new currency just issued by the government under authority of the few-days-old bank bill has reached Bismarck yet and local banks have not ordered any. 'Hoarding' Is Described What constitutes withdrawals for "hoarding" purposes is left up to the discretion of the local bankers. Excessive and unusual withdrawals, as compared to normal withdrawals of depositors in the past, will not be permitted. However, if one wants $500 for a trip to New York, he will get it. If he wants $500 without offering an explanation, when his past business does not indicate such a large withdrawal is necessary, he will not get it. Stocks traded in blocks of 1,000 to 5,000 shares during the first few minutes and although the pace slackened somewhat as the day passed the trend continued upward. Other exchanges also resumed trading and on the Chicago exchange brewery stock made a quick advance of three points on the strength of confidence in the monetary system and the prospect of the early legilization of beer. The Chicago board of trade and the cotton market deferred reopening until some communities in outlying sections of the nation returned to full (Continued on page six)