Article Text

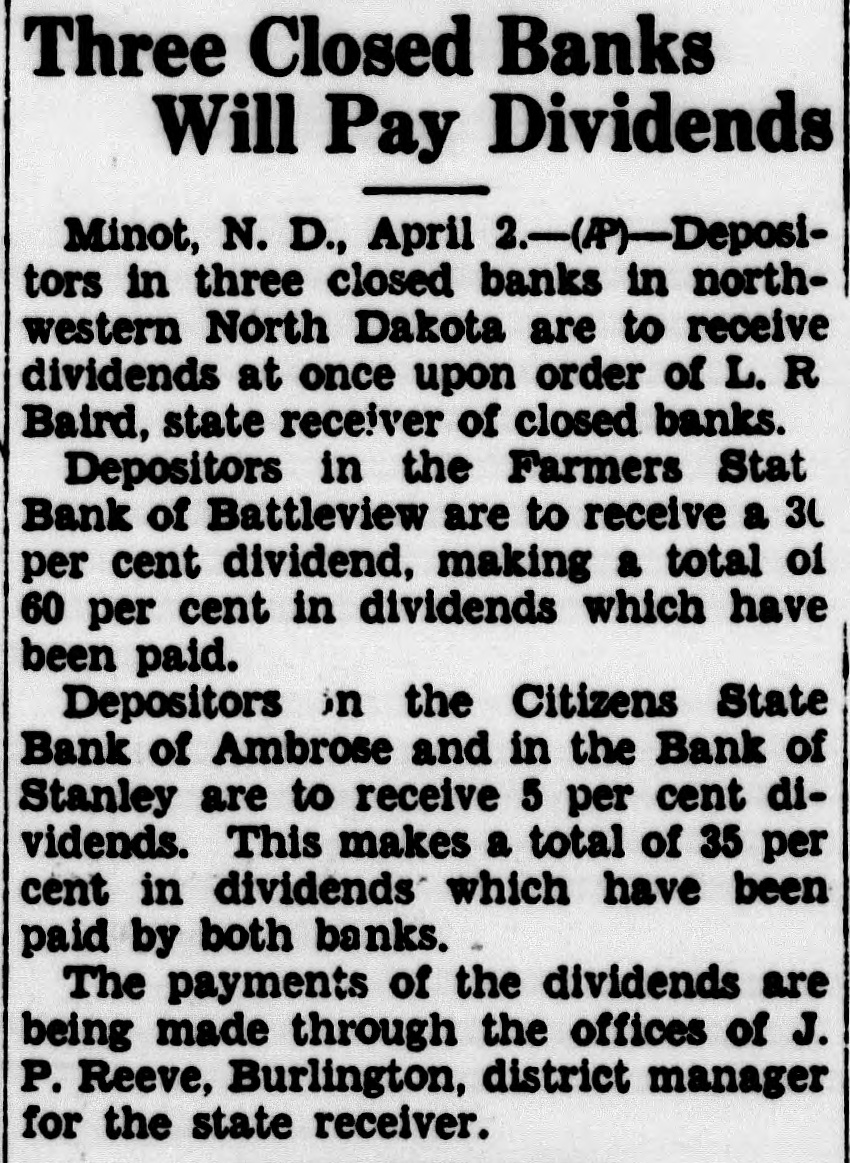

Three Closed Banks Will Pay Dividends Minot, N. D., April 2.-(P)-Depositors in three closed banks in northwestern North Dakota are to receive dividends at once upon order of L. R Baird, state receiver of closed banks. Depositors in the Farmers Stat Bank of Battleview are to receive a 30 per cent dividend, making a total of 60 per cent in dividends which have been paid. Depositors in the Citizens State Bank of Ambrose and in the Bank of Stanley are to receive 5 per cent dividends. This makes a total of 35 per cent in dividends which have been paid by both banks. The payments of the dividends are being made through the offices of J. P. Reeve, Burlington, district manager for the state receiver.