Article Text

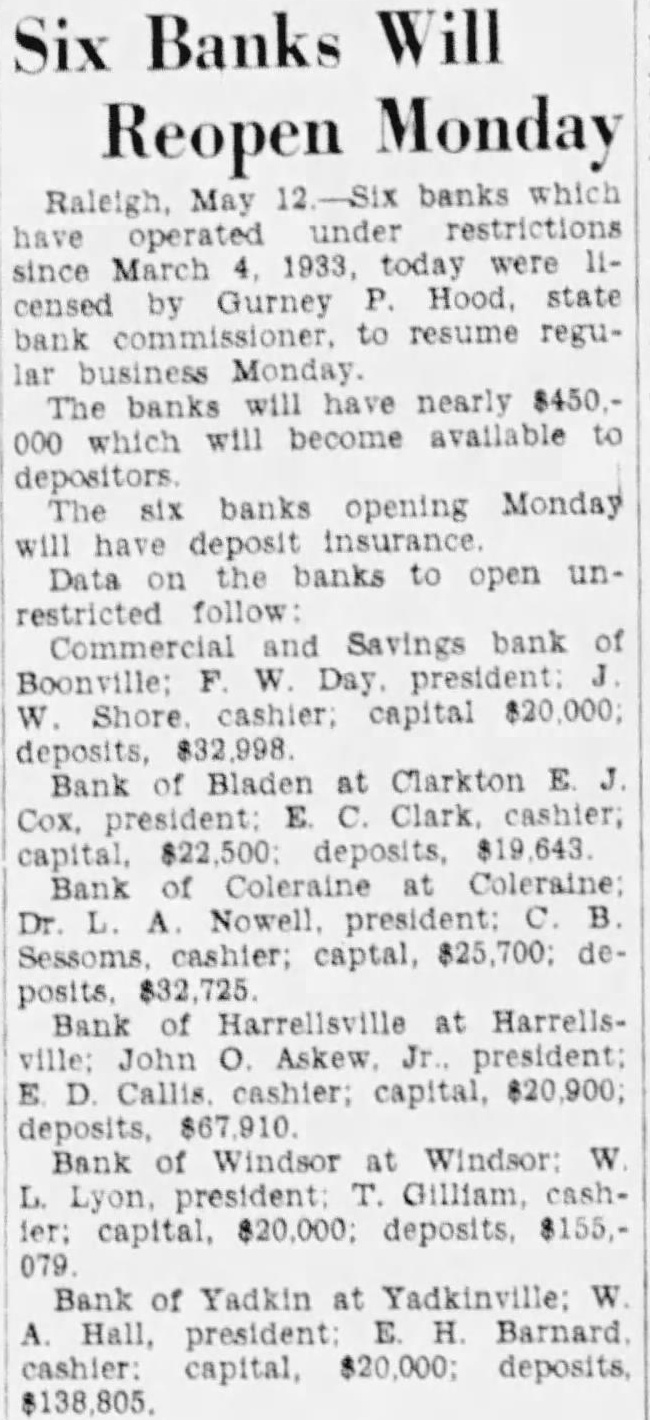

MOCKSVILLE AND DAVIE COUNTY. Board of industrial Improvements Elects Officers-A Seizure, Mocksville Courier, Nov. 2. E. E. Hunt, Jr., left Tuesday evening for Thomasville, where he goes to keep books for the Thomasville Chair Co. J. S. Walker, of Black Mountain, is filling Mr. McGlamery's place at the depot until Mr. McGlamery recovers from his recent injuries. A. L. Betts, of the Mocksville Cabinet Works, left for Yadkinville today with the counters and furniture for the Bank of Yadkin, which he has just completed. The Bank of Yadkin will open for business next Monday. the 6th day of November. Mrs. Ida Nail went to Clemonsville last week to meet her cousin, Mrs. Maud Taylor Turner, who was on her way to India as a missionary. She sails from New York the 4th of November and from Bombay will be carred 300 miles into the interior. J. M. Garwood died at his residence near Fork Church, this county. Monday night, October 30th, in the 64th year of his age. Mr. Garwood had been in bad health for some months past. He was a good farmer and a good citizen, and will be greatly missed in. his neighborhood. His remains were buried at Fork Church cemetery Wednesday, November 1st. The Board of Industrial Improvements met at the courthouse Monday night and elected officers for one year. The following were elected: J. B. Johnstone, president; C. E. dietn, vice-president; W. K. Clement, secretary T. J. Byerly, treasurer. The board will meet every 1st and 3rd Monday nights of each month. At the advanced age of 84 years Robert Rose died at the home of his son, Boone Rose, in Winston, on Sunday. October 99, 1905, from the effect of a paralytic stroke that he suffered some time ago. Mr. Rose was born and raised here and lived here the greater portion of nis long life. He was a son of the late Berry Rose, who for a long while was clerk of the court of this county, N. S. May, of Yadkin county, was in town Wednesday on his way to Salisbury and dropped in to see us. Mr. May tells us that Sheriff White, of Yadkin, made a raid a few days ago on blockaders and succeeded in capturing seven barrels of brandy, two two-horse wagons and teams and two men. This happened in the Nebo section of the county. The sheriff turned the brandy over to the internal revenue officers. W. J. Leach, of Salisbury, V18ited the county last week, and while here dropped in to see us and subscribed to the Courier. Mr. Leach showed us a razor that was the property of Beal Ijames, the father of the late Beal Denton Ijames, That makes the razor considerably over 100 years old, Mr. Leach tells us that it is very fine metal and does duty every week. and will shave two months without whetting. Bank for