Article Text

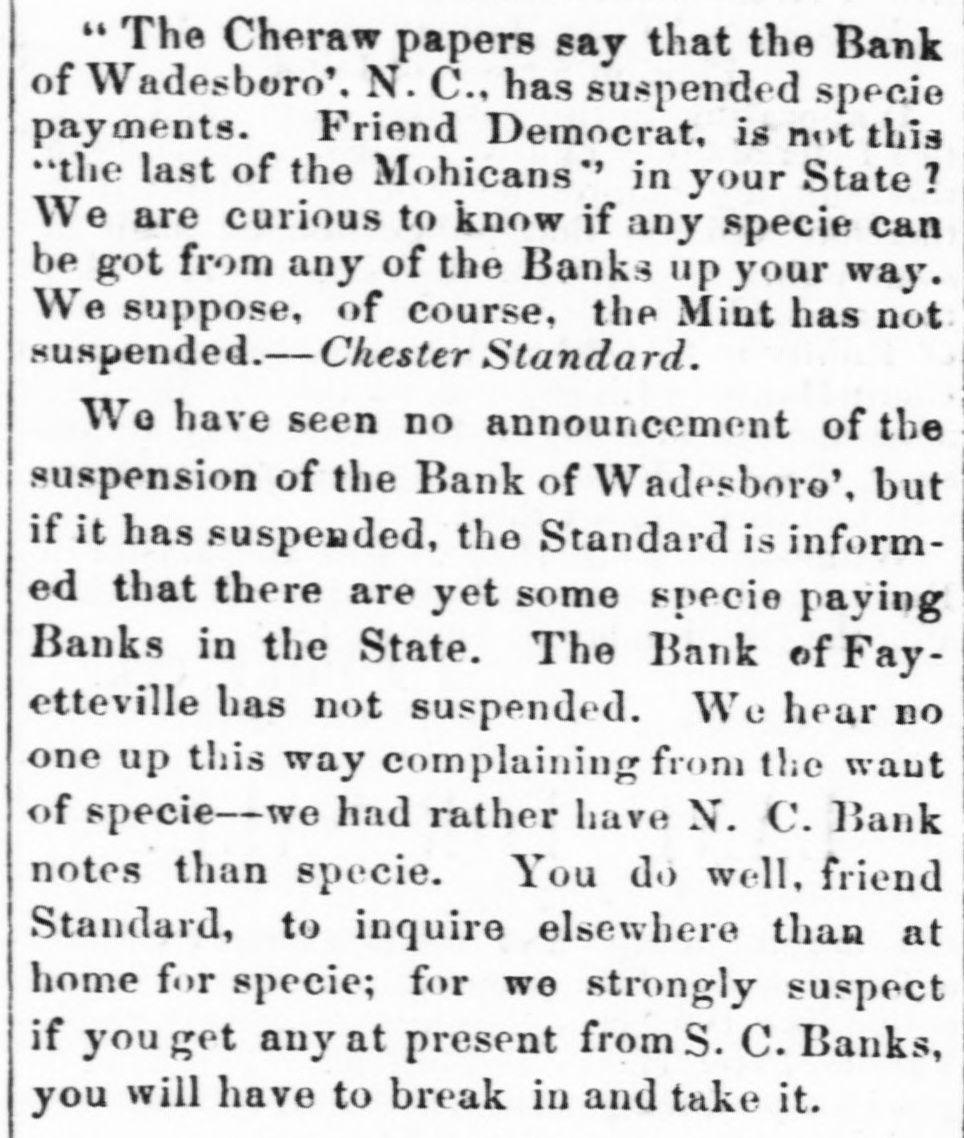

"The Cheraw papers say that the Bank of Wadesboro'. N. C., has suspended specie payments. Friend Democrat. is not this "the last of the Mohicans" in your State ? We are curious to know if any specie can be got from any of the Banks up your way. We suppose, of course, the Mint has not suspended.-Chester Standard. We have seen no announcement of the suspension of the Bank of Wadesboro', but if it has suspended, the Standard is informed that there are yet some specie paying Banks in the State. The Bank of Fayetteville has not suspended. We hear no one up this way complaining from the want of specie--we had rather have N. C. Bank notes than specie. You do well, friend Standard, to inquire elsewhere than at home for specie; for we strongly suspect if you get any at present from S. C. Banks, you will have to break in and take it.