Click image to open full size in new tab

Article Text

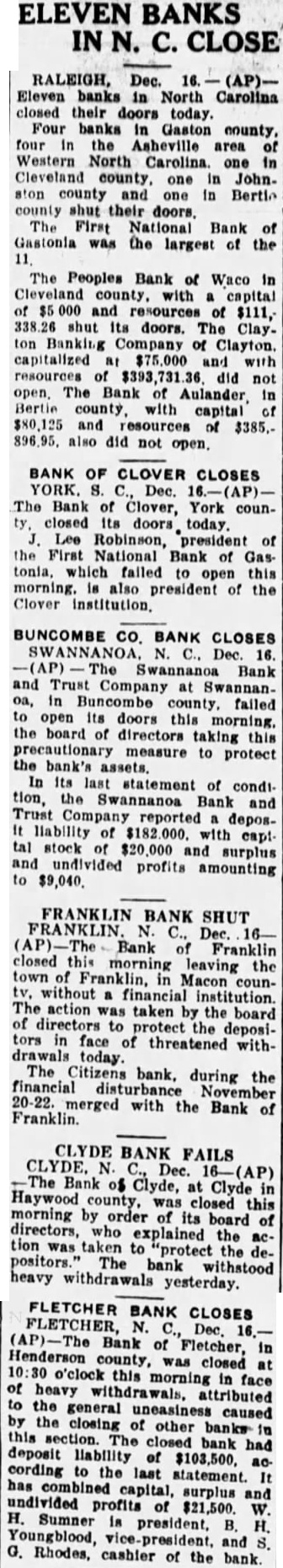

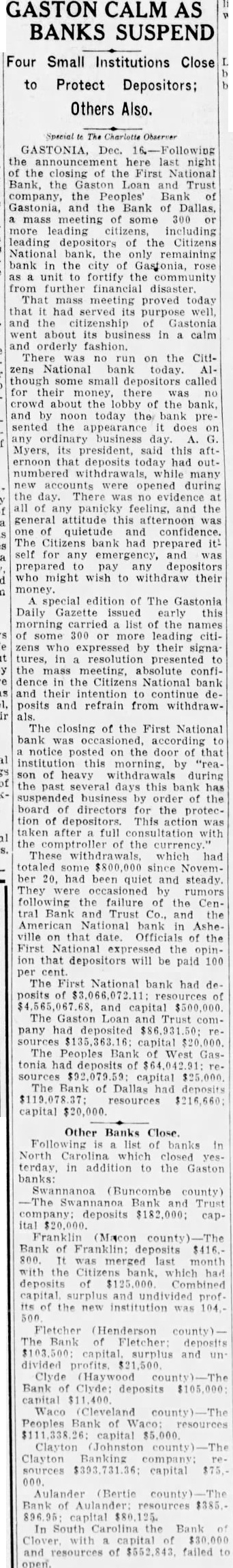

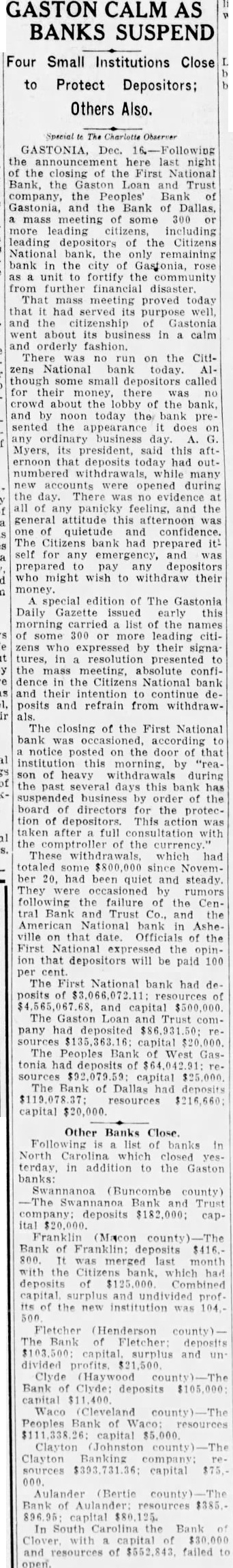

GASTON CALM AS BANKS SUSPEND

Four Small Institutions Close to Protect Depositors; Others Also.

Special Charlotte Observer the announcement here last night of the closing of the First National Bank, the Gaston Loan and Trust company, the Peoples' Bank of Gastonia, and the Bank of Dallas, a mass meeting of some 300 or more leading including leading depositors of the Citizens National bank, the only remaining bank in the city of Gastonia, rose as unit to fortify the community from further financial disaster. That mass meeting proved today that had served its purpose well, and the citizenship of Gastonia went about its business in a calm and orderly fashion. There was no run on the Citizens National bank today. Although some small depositors called for their money, there was no crowd about the lobby of the bank, and by noon today the bank presented the appearance it does on any ordinary business day. G. Myers, its president, said this afternoon that deposits today had outnumbered withdrawals, while many new accounts were opened during the day. There was no evidence at all of any panicky feeling, and the general attitude this afternoon was one of quietude and confidence. The Citizens bank had prepared it: self for any emergency, and was prepared to pay any depositors who might wish to withdraw their money. special edition of The Gastonia Daily Gazette issued early this morning carried list of the names of some 300 or more leading citizens who expressed by their signa tures, in resolution presented to the mass meeting, absolute confidence in the Citizens National bank and their intention to continue deposits and refrain from withdrawals. The closing of the First National bank according to notice posted on the door of that institution this morning, by "reason of heavy withdrawals during the past several days this bank has suspended business by order of the board of directors for the protection of depositors. This action was taken after full consultation with the comptroller of the currency. These withdrawals. which had totaled some $800,000 since November 20, had been quiet and steady. They were occasioned by rumors following the failure of the Central Bank and Trust Co., and the American National bank in Asheville on that date. Officials of the First National the opinion that depositors will be paid 100 per cent The First National bank had deposits of resources of The Gaston Loan and Trust company had deposited $86,931 resources $135,363.16 capital $20,000. The Peoples Bank of West Gastonia had deposits of $64,042.91 The Bank of Dallas had deposits capital $20,000.

Other Banks Close Following list of banks in North Carolina which closed yesterday, in addition to the Gaston banks: Swannanoa (Buncombe county) -The Swannanoa Bank and Trust company: deposits $182,000: capital Franklin (Macon county) Bank of Franklin: deposits $416.800. It was merged last month with the Citizens bank, which had deposits of $125,000 Combined capital surplus and undivided profits of the new institution was 104.500

Fletcher (Henderson county)The Bank of Fletcher: deposits capital surplus and un divided profits $21,500 Clyde (Haywood Bank of Clyde: deposits $105,000 Waco (Cleveland county Peoples Bank of Waco: resources Clayton (Johnston county)-The Clayton Banking company: Aulander (Bertie Bank of Aulander: resources $385.In South Carolina the Bank and resources of $552,843 failed to open.