Article Text

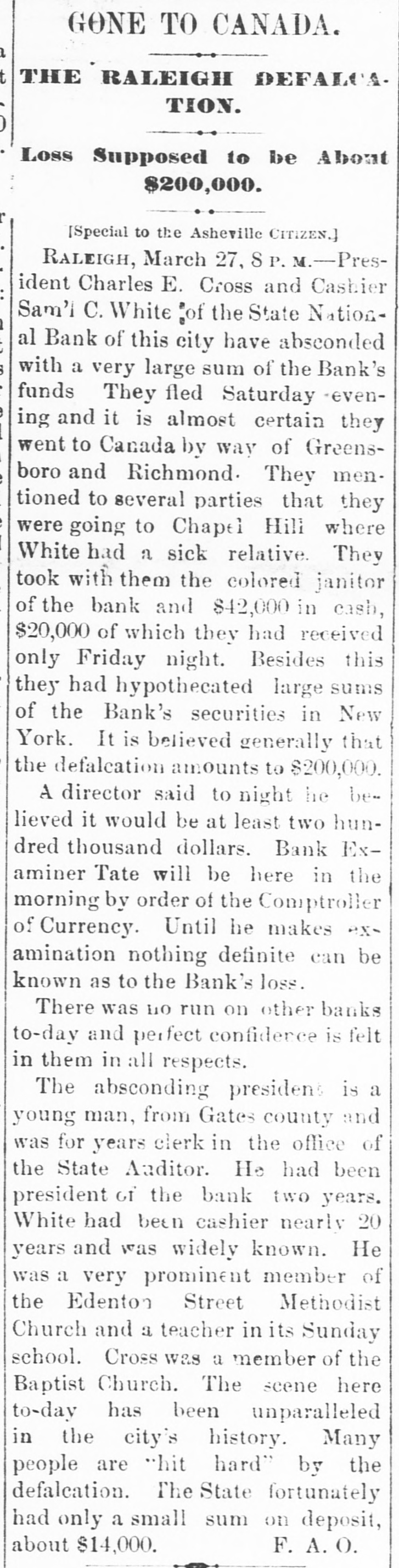

MARTINSBURG. W. VA.. SATURDAY. DECEMBER 29, 1888. 280(000),000 marks ps river steamer Joppa; M. T. Harrison Gar Va. 10. Rear Admiral Le-Roy, in New York. Lynchburg, stag, rett, of Baltimore, drowned. 12. Colorow, the Indian chief. Lord Landsdowne app Rev. Dr. Layton Coleman made Protestant Born 1823. 13. Gen. James C. Lane, in New York. Born 1823 of India Lord Stan bishopief Delaware. New York. Born 16. Mrs. Timothy Merrick (Proftssor Braislin), as 9. Operation of tracheot 16. Train robbery at Muscagee, L T. Holyoke, Mass. Born 1838. crown prince of Gert 17. Train sobbery near Junction City, M. T. 1928. Born 10. Verdict of the coron 18. Mme. Gen. Diss Debar sentenced tothe p6nBaltimore in Sun, AS THE WORLD WAGS. town, Ireland, evictie itentiary for six months. JANUARY. Lord. Dufferin resign 22. Disastrous floods in Mexico. Many hundreds of the Adams India. 4. Bark Alfred I. Show wrecked off Irish coasts drowned. lost. 18. Riots at Guyaquil, : 24. Holbrook, A. T., nearly destroyed in Boston. Born many wounded. 6. English steamer Maude foundered in Black 25. Paying Teller Pitcher, of the Union.bank of 15. The English reported sea; 12 lost. Providence, R. I., is a defaulter and fugitive. of the intion of Venezuela. 10. Thirteen killed at Haverhill bridge over the JULY. Merrimac on Boston and Maine railroad. Douglas Pyne, M. I 3. John F. Van Loan of the Second National bank in New Boggs, months imprisonmen 12. Blizzard in the northwest. Immense damage of Jersey city, defaulter in $15,000. 18. Memorial window in done; many frozen to death. 4. Mrs. James K. Polk, widow of President Polk, New M. in D., London, to John Mi 17. E. C. Walthall re-elected senator from Missisat Nashville, started the machinery of the Childs, unveiled. sippi. Cincinnati Exhibition by electricity. MAI 18. Norwegian bank Freidas sunk in collision with Wm. R. Flack lost his life trying to navigate in Fond du Lac, 1. Daniel Wilson, son-in British steamer Teronto off Ireland: 18 the whirlpool rapids, Niagara. diocese. Bord of France, convicted drowned. 9. Cal. Thos. L. Casey made chief of engineers tion with the sale-of Court Clerk Irion, of Birmingham, Ala, deof the army. in Ann Arbor, 17. Prince Oscar of Swe faulted in $20,000. 18. More than 500 killed by volcanie eruptions in ried at Bournemeuth 19. Hatfield-McCoy row. Japan. of ex-president 20. Gen. Caffarel convict 22. Fourteen burned to death at Tower, Minn. 17. Hronek, Chebouth, and Chapels, three Bo1799. Born a fine for complicity 23. Charles "Brien, cashier, and Elmer E. Morse, hemian Anarchists, arrested in Chicago, riffithsville, W. Va. scandal. Mme. Lime bookkeeper, Albany First National bank, decharged with conspiracy to burn the city. for ninety daily 21 Trial of Gen. Boulan faulted in $200,000. AUGUST. cided against him. 24. Colliery explosion at Wellington, B. C.; 25 % Blinky Morgan hanged in Columbus, O. 1821. Born 26. M. Wilson won his or killed. Twenty-one lives lost in a fire on the Bowery, Born Minn. tion with the French Paul, 25. United States Senator Wilson, of Iowa, reNew York SO. M. Tirard, premier of elected. 4. Terrible tornado in Cuba. Heavy loss of life. AP ishop of Toronto 25, 26. Great storm on the Atlantic coast. 9. Yellow fever well under way at Jacksonville, 2. German frontier poli 27. Deficit of $350,000 alleged in the accounts of Fla. in New and refused admittan Morgan, the late government of Manitoba. 10. Ten persons burned to death at Chattanooga, of any persons.not pr FEBRUARY. Tenn. New French cabinet 1. Twenty-two drowned in wreck of the British Hugh M. Brooks, alias Maxwell, hanged at St. Floquet, prime minis publisher of The bark Absacom near mouth of the Columbia Louis. 1807. of foreign affairs; E river. 14. Woman suffrage declared unconstitutional in war. of Born Paris. in 5. White Cap outbreak in Indiana. Wyoming. 8. Riots is Ireland at K 7. Failure of the Metropolitan National bank, 16. Collision of steamers Geyser and Thingvalla. in Jamaica Clark, rea, at meeting of the Cincinnati, President Means, Cashier Harper More than lost. proclaimed. and others arested. 21. Bill Miles, anti-Bald Knobber, shoots and kills Mass. 9. Goa. Boulanger elec Aged 8. Murder of Amos J. Snell, Chicago. (Tascott Capt. N. Kinney, Bald Knobber chief, at deputies the dep case). Ozark, Mo. declined to.serve. ag-Harman, under Henry Reece, cashier Continental hotel PhilaSevere storms on the gulf and Atlantic coasts. 1838. 10. Malietoa, king of St delphia, defaulter in $60,000. 22. Gigantic opium smuggling scheme unearthed. Sheridan Gen of Cameroons, Africa, b 11. James Albert won six-day go-as-you-please Frank Gardner and other guilty parties after15. Boulanger elected to walking match in New York, breaking world's ward convicted and imprisoned. from the department wburyport, Mass record. Thirty-four lives lost in steamer collision in San 10. Insurrection in Roum 17. Two American ships ordered to Tangiers, Francisco bay. troops and villages bi Germany King Morrocco, to settle row between the sultan 23. Fourteen killed by boiler explosion at Neemah, Boulanger took his se and the United States consul Neb. deputies. of York, England. 19. Tornado at Mt. Vernon, Ills.; 21 killed. 26. Quarantine ordered against Jacksonville, Fla. 20. Many strikes reported 21. Twenty-five killed by explosion of boiler of Robert Garrett reported demented. in chess Demonstration by 1, steamer in the United States of Colombia. player, 81. Charles H. Litchman resigns general secreagainst Boulanger. 22. Mackay and Flood quarrel over losses in wheat taryship of the Knights of Labor. jured. Peacedale, R. L and dissolve partnership. SEPTEMBER. 80. Much comment in E 2. Battle between outlaws and vigilantes near 27. Forty lost by explosion of a ferryboat at ValIsland. Born the pope's decree a Palladora, No Man's Land. Seventeen outlejo, Cal paign. laws killed. MARCH. MA in San Francisco. 3. Sarah Althea Hill jailed for three days for 1. International railway connecting Mexican Cen8. William O'Brien sent contempt of court. Judge Terry, her hustral with Southern opened for business. months' imprisonmer 1827. artist. Born band sent up for six months for brandishing 3. Discovery of graveyard insurance scheme, act. a knife in the court room. Charleston, S. C. An uprising of Social IreTullamore jail, 12. Floods in Mexico. Many lives lost. 4. Erastus J. Jones, ex-treasurer of Dauphin Berlin. 16. Disastrous floods in Georgia. county, Pa., defaulter in $61,000. 11. John Dillon, M. P., se formerly chaplain 20. John G. Parkhurst of Michigan, appointed U. 11, 12, 13. Famous blizzard along the Atlantic coast. imprisonment, witho in London. S. Minister to Belgium. Great damage done, railroads blocked, many 14. The Brazilian senate 24. The lone highwayman of Texas killed by Mrs. frozen to death, many shipwrecks. slavery which was I 1808. Born Lizzie Hay. 16. Gen. Adam Badeau brought suit against Mrs. deputies the previous Born Conn. 26. J. H. Oberly appointed Indian commissioner. Grant for compensation for assistance in preLord Wolseley having 27. W. R. Foster, of New York, defaulter in $168,paring Gen. Grant's Memoirs. Settled late in house of lords that If 1807. Y. Born 000. the year. men were to land in the of president Old Hutch's wheat corner begun in Chicago. 17. 19 killed on Savannah, Florida and Western its mercy. Lord Sali Born 1824. 28. Sioux Indians decline to accept the terms of railroad, near Blakshear, Ga. Lord Wolseley. The Cornwall-on-thethe proposed treaty. 18. Confession by a member of the Missouri Bald the result of the Brit Knobbers. OCTOBER. 17. Irish Catholic membe in Cincinnati, O., 20. State Treasurer Ky., defaulter in $250,000. 1. Traders' bank at Chicago suspended. Liabiliment issued a mani 22. Blizzard in the northwest. ties, $1,000,000. nizo the right of t senator and 25. Tornado destroys town of Ninnescah, Kan. 2. Severe storms on the great lakes. Many with the Irish peop 1813. Paris. Born 27. Terrible floods in Germany and Hungary; lives lost. their political affairs. near Dunmore, floods in many parts of the United States; 10. Seventy-eight killed in a railroad collision, Mud 21. Anti-Chinese agitatic many lives lost and much damage done. Run, Pa. and New Zealand as in Leavenworth, President Close and Cashier White of the State 18. H. S. Briggs of Rochester, defaulter in $14,dency. National bank of Raleigh, N. C., defaulted in 000. 22. Much trouble from N.Y. Born $75,000. 19. J. B. McClure and Hugh Flannigan robbed of Cuba. 29. 30 miners killed by explosion at Rich Hill, Mo. $12,000 and murdered near Wilkesbarre. 27. First train passed ove of Masonry, Capt. Paul Boytan adrift all day in the ice of to Samaracand, causi Train robbery at Peru, Ind. Lake Michigan. JU 23. Thos. Axworthy, treasurer, of Cleveland, O., APRIL. 15. Dom Pedro of Brazil défaulter in $500,000. of the army of 1. Diss Debar-Marsh spiritualistic sensation, New 25. Daniel Hand, of Connecticut, gave $1,000,000 28. Two French journal Mass. Born York, in full blast. for the education of the colored people in the for libeling the royal Secretary Bayard expressed dissatisfaction with former slave states. French senate passed Wyoming Territhe conduct of Germany in Samoa. 80. Lord Sackville given his passports. francs for war prepa 5. Twelve killed in railroad accident at Newhamp27. Steamer Haytian Republic seized by the Hay24. A papal encyclical u Mass. Born ton, Ohio. tians. the former decree ag 6. Gen. George Crook nominated for major NOVEMBER. plan of campaign. Conn. Born general in place of Gen. Terry. Col. John R. 1. Serious trouble with oyster dredgers on ChesJU Brooks made brigadier general in Crook's apeake bay. 5. The jury in the O'Do millionaire, in place. 4. Sixteen killed by mine explosion at Cook's suit returned a verdio 18. Failure of the American exchange in London; Run, Pa. 7. Alliance reported bet in RochFishes," Henry F. Gillig general manager; liabilities, 9. One hundred killed by mine explosion at Pittsgium, $4,000,000. burg, Kan. 9. The electors chosen : second bishop of 18. Eighteen burned to death at Celaya, Mex., by Thirty-seven killed by a fire in Rochester, N. Y. Gen. Porfirio Diaz as ocese of Michigan the burning of a stand for spectators of a bull 15. Marriage of Joseph Chamberlain and Miss En12. Gen. Boulanger, in fight. dicott. deputies, told the pre Now Lorn York Senator Stanford's racing stables burned at Failure of the bank of Durham, N. C. Liabilifore he could be cens Palo Alto, Cal. ties $400,000, involving other failures aggre18. Boulanger and Floqu in Calth atesman, 23. Thos. Tunstall of Mobile, Ala., made United gating $1,000,000. langer stuck through States consul to San Salvador. 17. Perry Belmont appointed minister to Spain. 20. Dr. Ridley, who atte 24. John H. Murphy, confidential clerk of Dr. 20. A. H. Colquitt re-elected United States senator P., in Tullamore jail, 100 Conn., Daniel Gray of Holmesburg, Pa., defaulted in aged from Georgia. 26. Ninth centennial of $27,000. 28. General Master Workman Powderly of the celebrated at Kief. Stamford, Conn. 27. Gen. Joseph E. Johnston admitted to contribuKnights of Labor re-elected. 81. Mr. Parnell charged 1 tory membership by Gen. E. D. Baker Post, J. E. Bedell, mortgage forger in New York, senvulged state secrets G. A. R. tenced to twenty-five years and four months the house of common New in York. 29. Ship Smyrna sunk in collision with steamer imprisonment. Great staike on in Paris Moto off Isle of Wight. Thirteen drowned. 24, 25, 26. Terrible storm on the Atlantic coast. Boston. AUG MAY. 27. Fisk will case decided against Cornell univerat rance, Madrid, 8. Italy notified the pow 1. Assistant Cashier De Baun, of the Park Nasity. possession of Massow tional bank, New York, defaulted in $95,000 Jacksonville reports a clean bill of health. tricts. 2. Ten thousand dollars stolen from registered 80, Calumet and Hecla copper mines fired by to. insolvent Traders' 7. Riots between Frenc letters near Harrisburg, Pa. cendiaries. Amiens and Paris. 8. Fifteen banks failed in Buenos Ayres. Treasurer Chas. G. Winehell, of Spink county, mpion of England. 11. Parnell took steps to 6. Cloud burst near Maize, Kan., causing flood Dakota, defaulted in $100,000. Born 1815. hicago. for libel in Scotland. which swept the house and entire family to a DECEMBER. in Paris. Hayti, 12. Strike among glass w watery death. 5. Frank H. Bates, employed by Old Hutch, de18. Count Von Moltke ret Explosion of a carload of dynamite at Locust faulted in $20,000. Boston at Herald, of Germany, and was Gap, Pa. Eight killed. 7. Wholesale arrests of White Cappers in CrawVon Waldersee. 12. Train robbery at Aguazarca, A. T. ord county, Ind. and former 14. Two thousand cottor 13. High water along the Missouri and Red rivers. 9. Mob attacked the jail at Birmingham, Ala., New in it is York, Several lives lost. burn, England, on str and attempt to lynch a murderer named of the passage Steel works at Land 18. Methodist general conference created an order Hawes. The sheriff fired on the mob, killing Thousands of men ou of deaconesses for charitable work. nine and wounding thirty. of PhiladelValsh, 15. Revolution reported in 22. Rev. John H. Vincent and Rev. James M. Fitz10. White Cap outrages becoming prevalent in mon left the Island. gerald made bishops by the general Methodist many parts of the country. the Swiss Repub16. Boulanger riots at conference. Rear Admiral Luce ordered to proceed with two France. 23. Rev. J. C. Joyce made bishop by the general war ships to Hayti and demand the release of New in York. Emperor William at a Methodist conference. the steamer Haytian Republic. Sailed the Oder, said 45,000,000 € Randall L. Gibson elected senator from Louisi12th. than give up Alsace-I ana. 14. Fifteen burned to death at a fire at NeumunsYork. Born 1830. 17. Close of the Paris str 24. Dr. John T. Newman and Rev. Dr. Goodsell ter, Prussia. at Brooklyn. 29. Honors conferred on made bishops by the general Methodist con17. Beginning of trouble between whites and no of the fisheries comm ference. groes in Mississippi. at Munich. Chamberlain Corner stone of the new Roman Catholic uniSEPTED versity laid at Washington. at anatomist, ACROSS THE MAIN. 1. Diary of the late Em] 25. Rev. J. M. Thoburn elected bishop of India many published. JANUARY. by the general Methodist conference. at New York. M. Floquet elected president.of French question 4. Gladstone hissed at W