Article Text

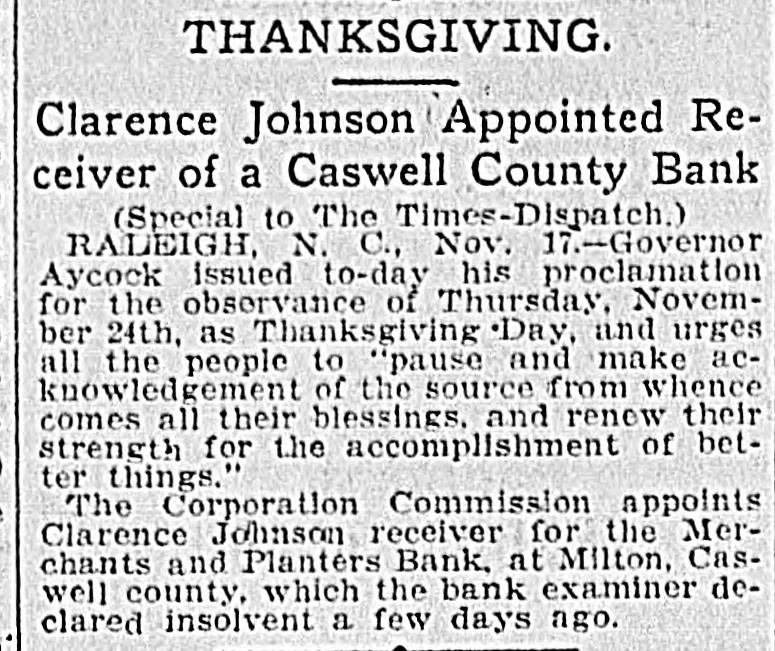

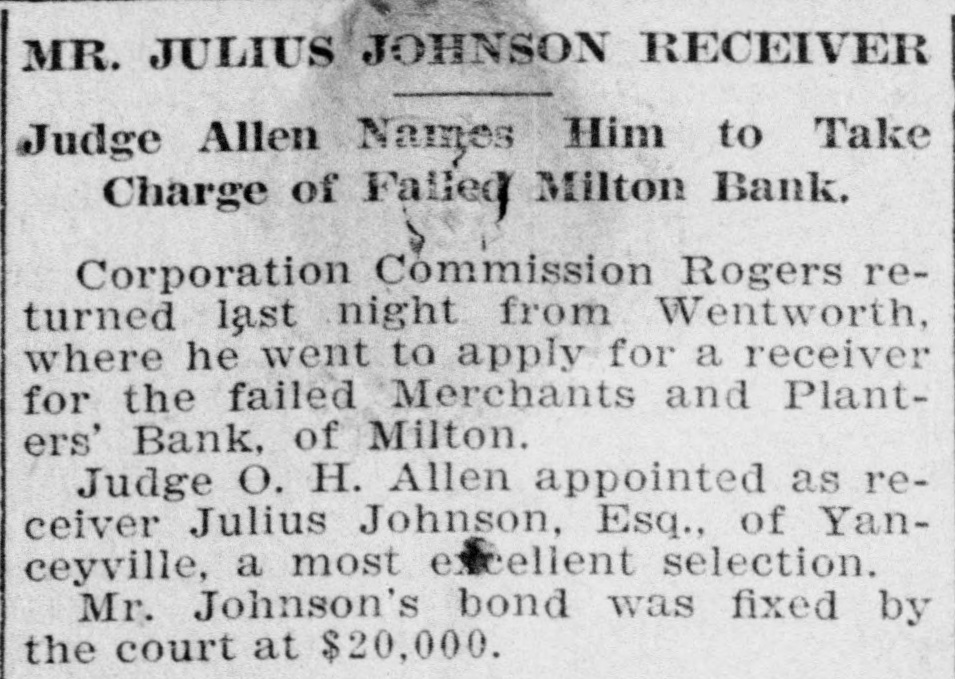

THANKSGIVING Clarence Johnson Appointed Receiver of a Caswell County Bank (Special to The Times-Dispatch.) RALEIGH, N. C., Nov. 17.-Governor Aycock issued to-day his proclamation for the observance of Thursday, November 24th, as Thanksgiving Day, and urges all the people to "pause and make acknowledgement of the source from whence comes all their blessings. and renew their strength for the accomplishment of better things." The Corporation Commission appoints Clarence Johnson receiver for the Merchants and Planters Bank, at Milton, Caswell county. which the bank examiner declared insolvent a few days ago.