Click image to open full size in new tab

Article Text

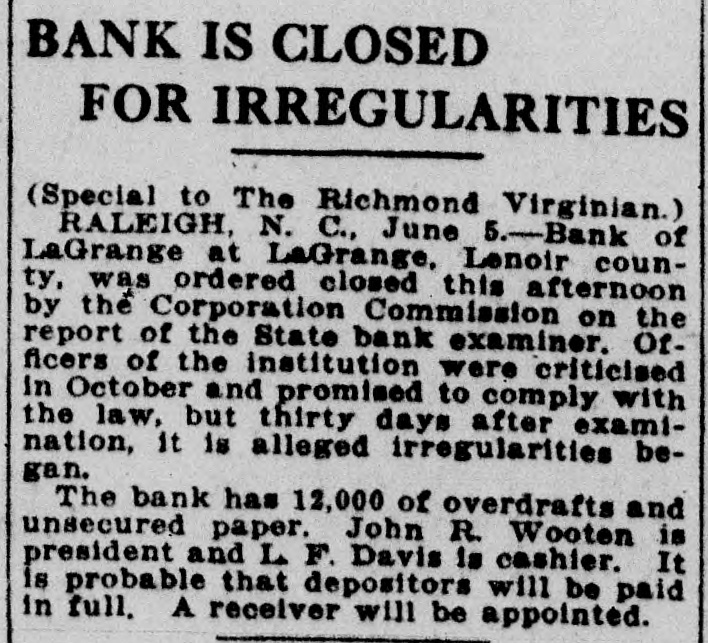

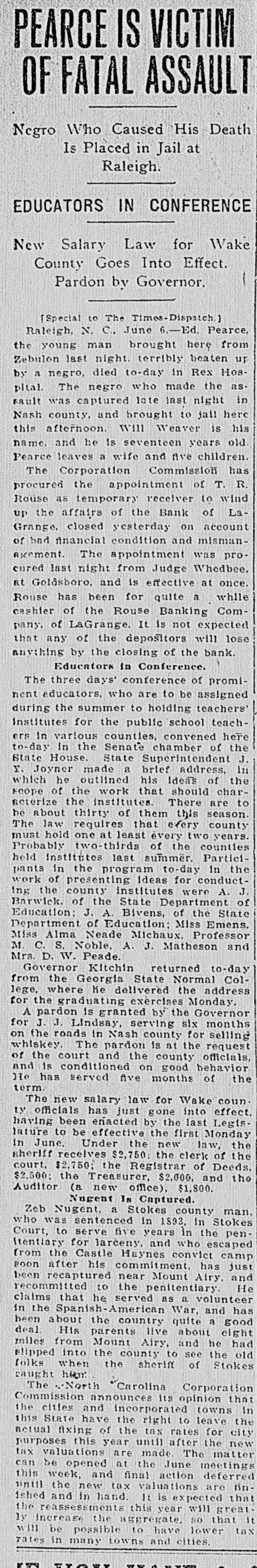

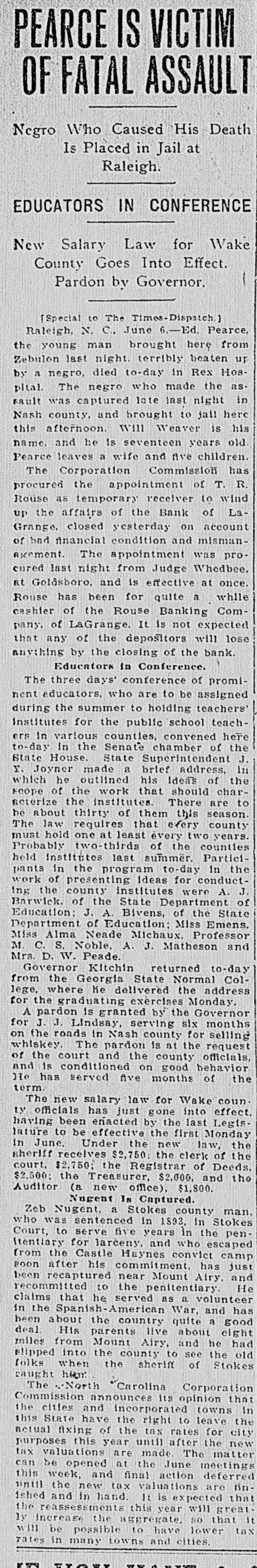

# PEARCE IS VICTIM OF FATAL ASSAULT

Negro Who Caused His Death

Is Placed in Jail at

Raleigh.

# EDUCATORS IN CONFERENCE

New Salary Law for Wake

County Goes Into Effect.

Pardon by Governor.

[Special to The Times-Dispatch.]

Raleigh, N. C., June 6.-Ed. Pearce, the young man brought here from Zebulon last night, terribly beaten up by a negro, died to-day in Rex Hospital. The negro who made the assault was captured late last night in Nash county, and brought to jail here this afternoon. Will Weaver is his name, and he is seventeen years old. Pearce leaves a wife and five children.

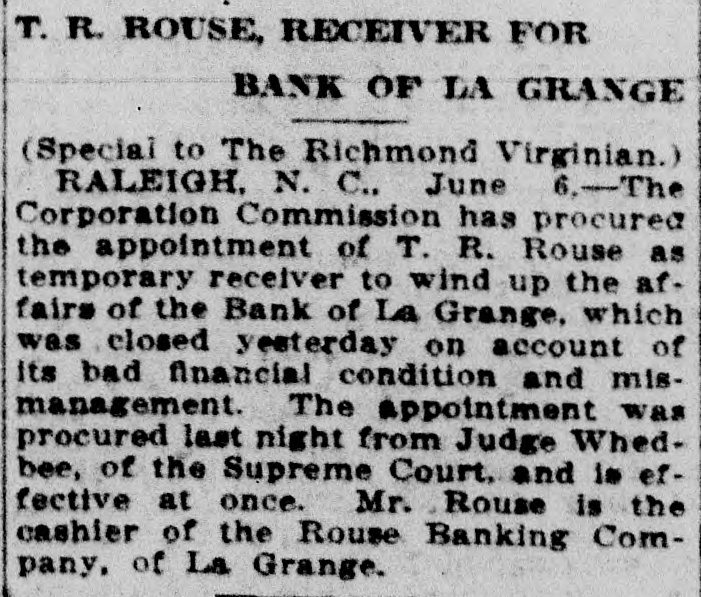

The Corporation Commission has procured the appointment of T. R. Rouse as temporary receiver to wind up the affairs of the Bank of La-Grange, closed yesterday on account of bad financial condition and mismanagement. The appointment was procured last night from Judge Whedbee, at Goldsboro, and is effective at once. Rouse has been for quite a while cashier of the Rouse Banking Company, of LaGrange. It is not expected that any of the depositors will lose anything by the closing of the bank.

Educators in Conference.

The three days' conference of prominent educators, who are to be assigned during the summer to holding teachers' Institutes for the public school teachers in various counties, convened here to-day in the Senate chamber of the State House. State Superintendent J. Y. Joyner made a brief address, in which he outlined his ideas of the scope of the work that should characterize the institutes. There are to be about thirty of them this season. The law requires that every county must hold one at least every two years. Probably two-thirds of the counties held institutes last summer. Participants in the program to-day in the work of presenting ideas for conducting the county institutes were A. J. Barwick, of the State Department of Education; J. A. Bivens, of the State Department of Education; Miss Emens, Miss Alma Neade Michaux, Professor M. C. S. Noble, A. J. Matheson and Mrs. D. W. Peade.

Governor Kitchin returned to-day from the Georgia State Normal College, where he delivered the address for the graduating exercises Monday. A pardon is granted by the Governor for J. J. Lindsay, serving six months on the roads in Nash county for selling whiskey. The pardon is at the request of the court and the county officials, and is conditioned on good behavior. He has served five months of the term.

The new salary law for Wake county officials has just gone into effect, having been enacted by the last Legislature to be effective the first Monday in June. Under the new law, the sheriff receives $2,750; the clerk of the court, $2,750; the Registrar of Deeds, $2,500; the Treasurer, $2,000, and the Auditor (a new office), $1,800.

# Nugent Is Captured.

Zeb Nugent, a Stokes county man, who was sentenced in 1893, in Stokes Court, to serve five years in the penitentiary for larceny, and who escaped from the Castle Haynes convict camp soon after his commitment, has just been recaptured near Mount Airy, and recommitted to the penitentiary. He claims that he served as a volunteer in the Spanish-American War, and has been about the country quite a good deal. His parents live about eight miles from Mount Airy, and he had slipped into the county to see the old folks when the sheriff of Stokes caught him.

The North Carolina Corporation Commission announces its opinion that the cities and incorporated towns in this State have the right to leave the actual fixing of the tax rates for city purposes this year until after the new tax valuations are made. The matter can be opened at the June meetings this week, and final action deferred until the new tax valuations are finished and in hand. It is expected that the reassessments this year will greatly increase the aggregate, so that it will be possible to have lower tax rates in many towns and cities.