Click image to open full size in new tab

Article Text

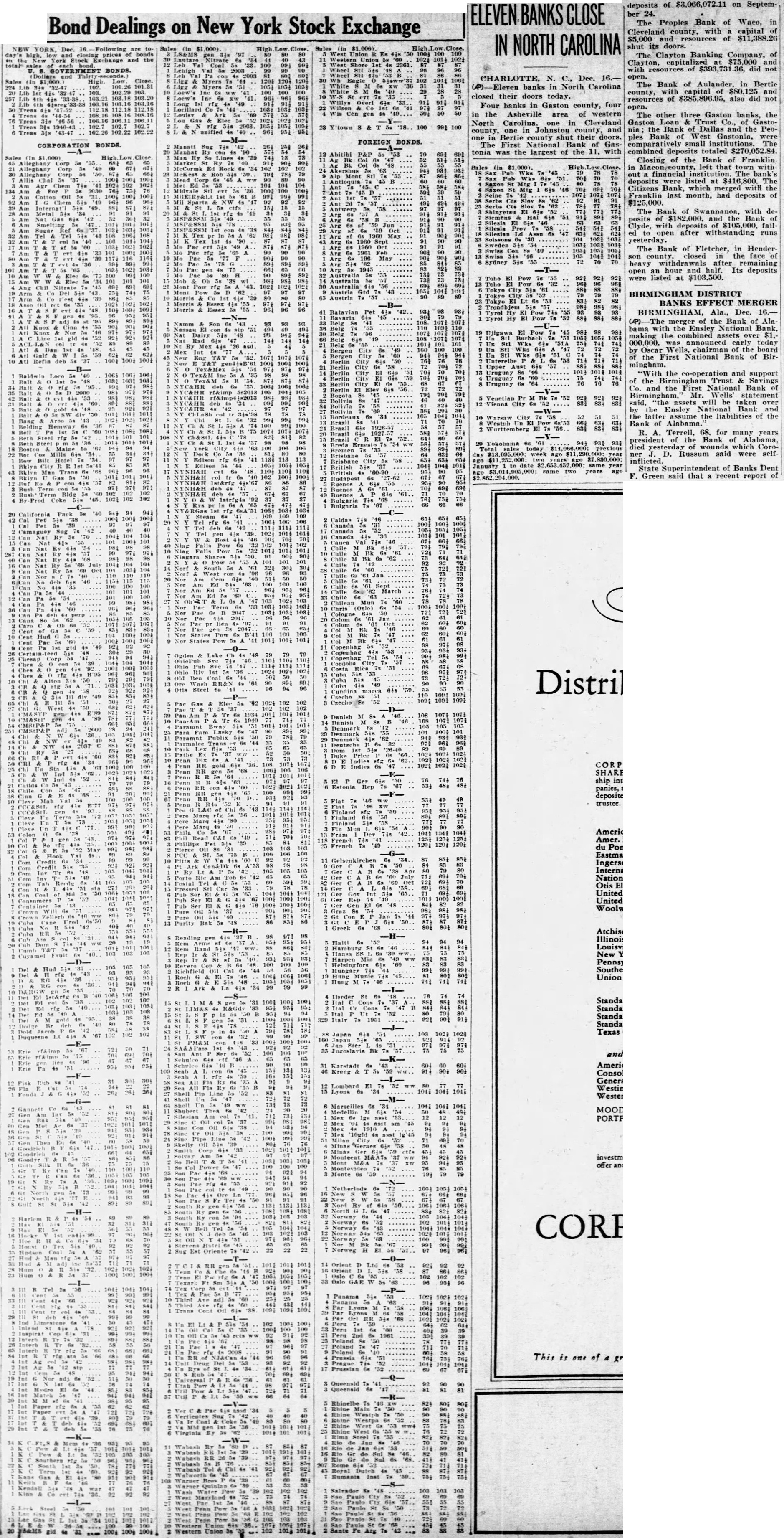

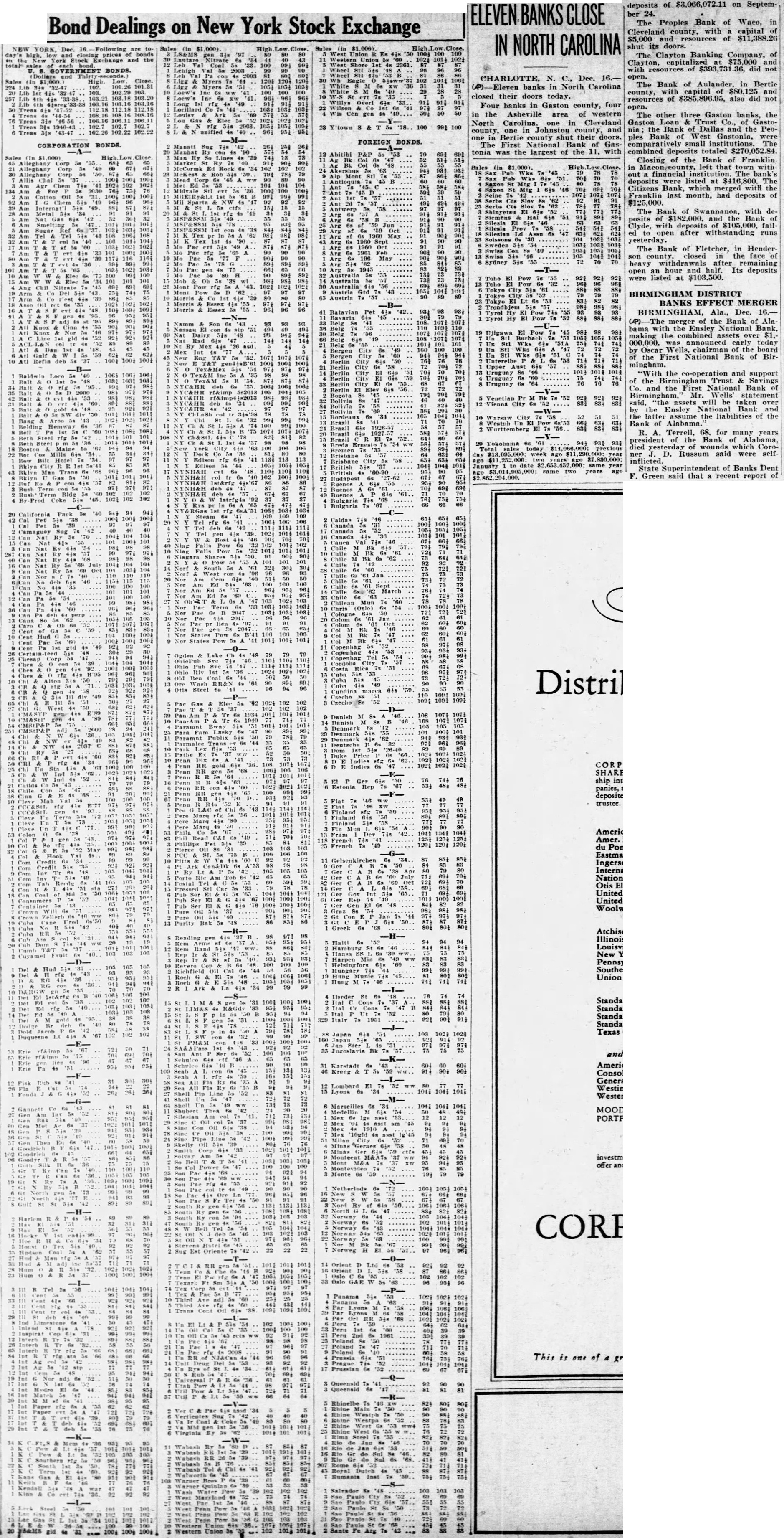

Bond Dealings on New York Stock Exchange

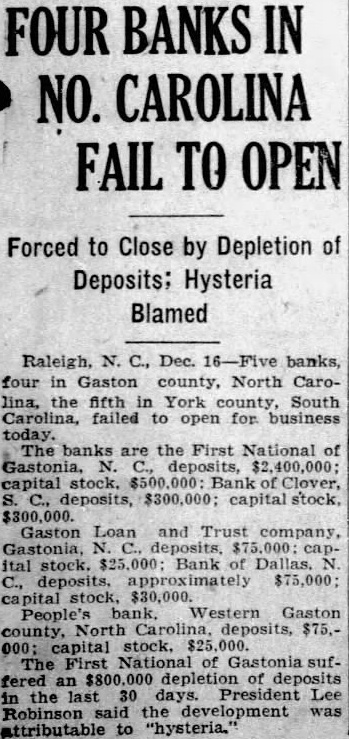

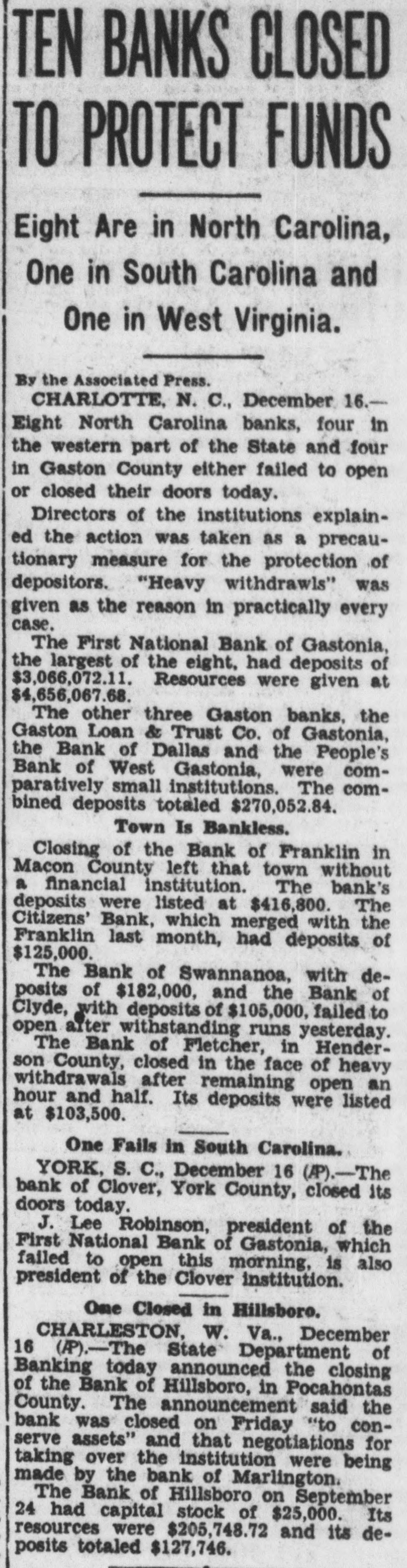

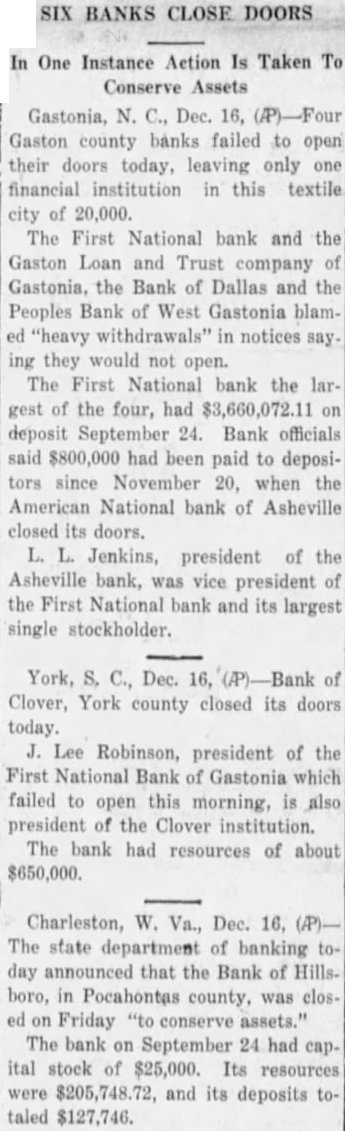

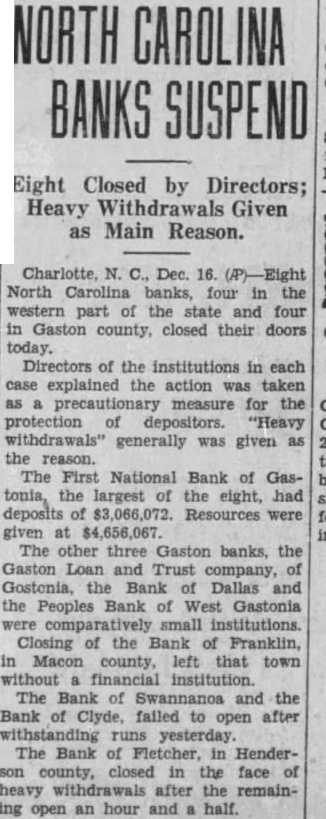

ELEVEN BANKS CLOSE IN NORTH CAROLINA

High prices Stock Western CHARLOTTE, N. C., Dec. 16.Close. (AP) Eleven banks in North Carolina closed their doors today. Four banks in Gaston county, four in the Asheville area of western North Carolina. one in Cleveland 100 county, one in Johnston county, and one in Bertie county shut their doors. FOREIGN BONDS. CORPORATION The First National Bank of GasManati tonia was the largest of the 11, with P&P Sales Close (in $1,000). High Sydney Hy Ujigawa Unterelbe Upper Venetian Vienna City Warsaw City Un Wurttemberg 831 6s 931 931 today ago January date same year same two years ago Danish trustee. du Pont Marseilles deposits of $3,066,072.11 on September 24. The Peoples Bank of Waco, in Cleveland county, with capital of $5,000 and resources of $11,388.26 shut its doors. The Clayton Banking Company, of Clayton, capitalized at $75,000 and with resources of $393,731.36, did not open. The Bank of Aulander. in Bertie county, with capital of $80,125 and resources of $385,896.95, also did not open. The other three Gaston banks, the Gaston Loan & Trust Co., of Gastonia; the Bank of Dallas and the Peoples Bank of West Gastonia, were comparatively small institutions. The combined deposits totaled $270,052.84. Closing of the Bank of Franklin in Macon/county, left that town without a financial institution. The bank' deposits were listed at $416,800. The Citizens Bank, which merged with the Franklin last month, had deposits of $125,000. The Bank of Swannanoa, with deposits of $182,000. and the Bank of Clyde, with deposits of $105,000, failed to open after withstanding runs yesterday. The Bank of Fletcher, in Henderson closed in the face of heavy withdrawals after remaining open hour and half. Its deposits were listed at $103,500.

BIRMINGHAM DISTRICT BANKS EFFECT MERGER

BIRMINGHAM, Ala., Dec. 16.merger of the Bank of Ala bama with the Ensley National Bank, making the combined assets over $1,000,000. was announced early today by Oscar Wells, chairman of the board the First National Bank of Birmingham. "With the co-operation and support of the Birmingham Trust & Savings Co. and the First National Bank of Birmingham, Mr. Wells statement said, "the assets will be taken over by the Ensley National Bank and the latter assume the liabilities of the Bank of Alabama. R. A. Terrell, 68. for many years president of the Bank of Alabama, died yesterday of wounds which Coroner D. Russum said were self State Superintendent of Banks Dent F. Green said that a recent report of