Article Text

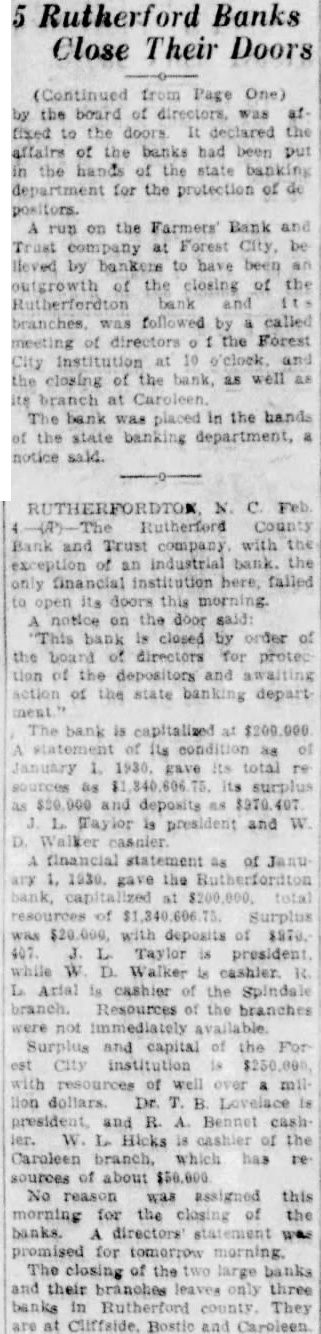

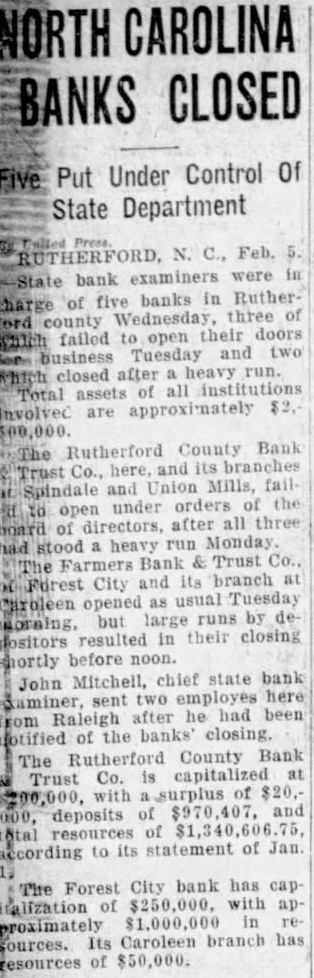

5 Rutherford Banks Close Their Doors (Continued from Page One) by the board of directors, was fixed to the doors declared the affairs of the banks had been put in hands the banking department for the protection of positors. on the Farmers' Bank and Forest lleved by bankers to outgrowth of the closing of the Rutherfordton followed by called meeting of directors the Forest City and the closing the as well its branch at The bank was placed in the hands the state banking department, notice sald. Feb Rutherford Bank and company with an industrial bank. the to this notice on the door "This closed by order of the directors for protec tion of the and action of the state banking depart The bank is capitalized its January total as surplus and deposits as Taylor president and Walker statement of Janu gave the deposits of Taylor president while W Walker cashier Arial cashier the Spindale branch. Resources the branches immediately Surplus and capital the est with of well lion dollars. Dr. president R. Hicks is cashier the Caroleen has re about $50.000 No this morning for the closing of the banks. was promised for morning. The closing of the and their branches only three banks in Rutherford They are at Bostic and Caroleen