Article Text

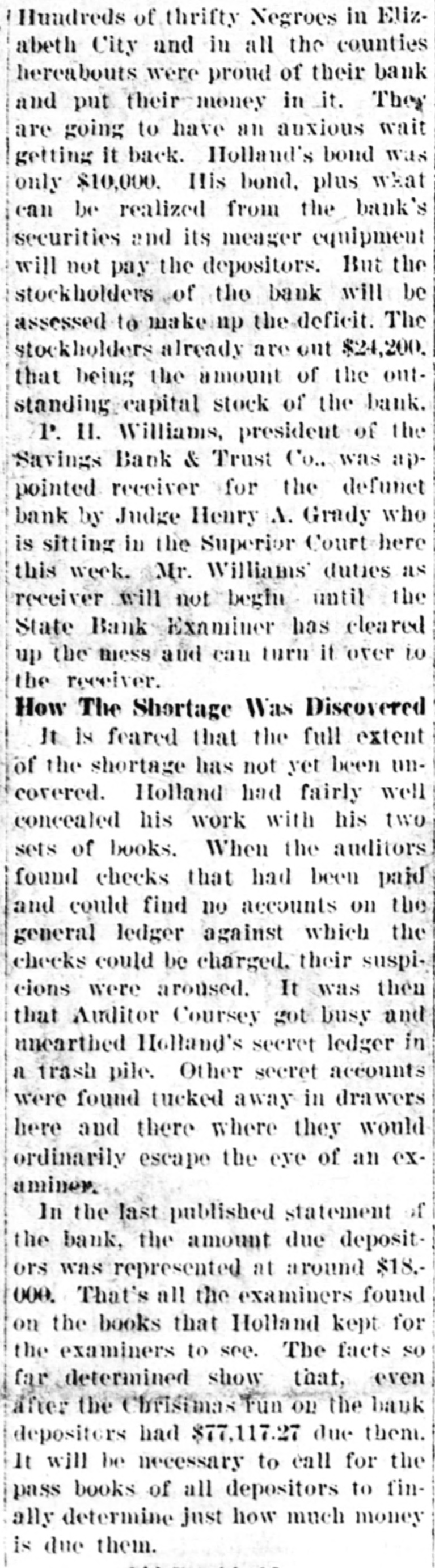

Hundreds of thrifty Negroes in Elizabeth City and in all the counties hereabouts were proud of their bank and put their money in it. They are going to have an auxious wait getting it back. Holland's bond was only $10,000. His bond, plus what can be realized from the bank's securities and its meager equipment will not pay the depositors. But the stockholders of the bank will be assessed to makeinp the deficit. The stockholders already are out $24,200. that being the amount of the outstanding capital stock of the bank. P. 11. Williams, presideut of the Savings Bank & Trust Co., was appointed receiver for the defunet bank by Judge Henry A. Grady who is sitting in the Superior Court here this week. Mr. Williams duties as receiver will not beglu until the State Bank Examiner has cleared up the miss and can turn if over to the receiver. How The Shortage Was Discovered It is feared that the full extent of the shortage has not yet been uncovered. Holland had fairly well concealed his work with his two sets of books. When the auditors found checks that had been paid and could find no accounts on the general ledger against which the checks could be charged. their suspicions were aroused. It was then that Auditor Coursey got busy and unearthed Holland's secret ledger in a trash pile. Other secret accounts were found tucked away in drawers here and there where they would ordinarily escape the eye of an examiner. In the last published statement of the bank, the amount due depositors was represented at around $18.000. That's all the examiners found on the books that Holland kept for the examiners to see. The facts so far determined show that, even after the Christmas run on the bank depositors had $77,117.27 due them. It will be necessary to call for the pass books of all depositors to finally determine just how much money is due them.