Article Text

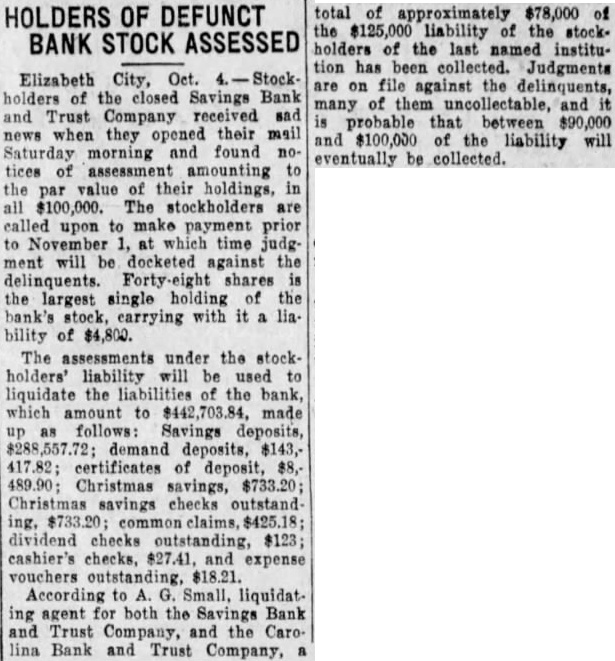

HOLDERS OF DEFUNCT BANK STOCK ASSESSED Elizabeth City, Oct. Stockholders of the closed Savings Bank and Trust Company received sad news when they opened their mail Saturday morning and found notices of assessment amounting to the par value of their holdings, in all $100,000. The stockholders are called upon to make payment prior to November 1, at which time judgment will be docketed against the delinquents. Forty-eight shares is the largest single holding of the bank's stock, earrying with it a liability of $4,800. The assessments under the stockholders' liability will be used to liquidate the liabilities of the bank, which amount to made up as follows: Savings deposits, $288,557.72; demand deposits, $143,417.82; certificates of deposit, $8,489.90; Christmas savings, $733.20; Christmas savings checks outstand ing, $733.20; common claims, $425.18; dividend checks outstanding, $123; cashier's checks, $27.41, and expense vouchers outstanding, $18.21. According to A. G. Small, liquidating agent for both the Savings Bank and Trust Company, and the Carolina Bank and Trust Company, a total of approximately $78,000 of the $125,000 liability of the stockholders of the last named institution has been collected. Judgments are on file against the delinquents, many of them uncollectable, and it is probable that between $90,000 and $100,000 of the liability will eventually be collected.