Article Text

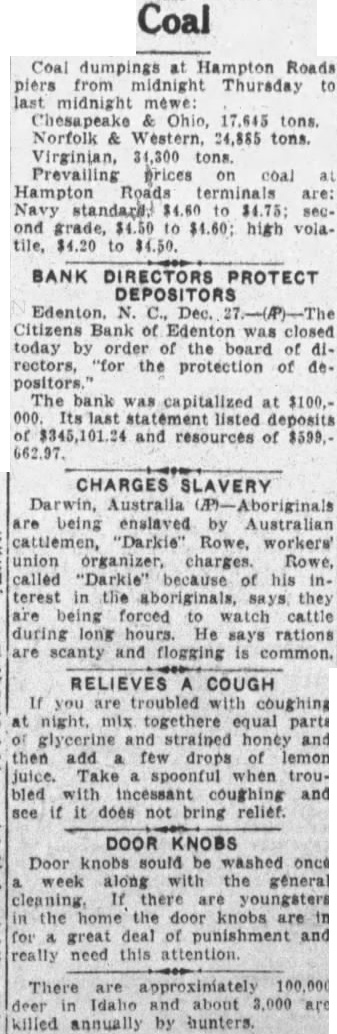

Coal Coal dumpings at Hampton Roads piers from midnight Thursday midnight Chesapeake Ohio, tons. Norfolk & 24,885 tons. Prevailing prices coal Hampton are: to $4.60; high volatile, $4.20 $4.50. BANK DIRECTORS PROTECT DEPOSITORS N. Dec. Citizens Bank of Edenton was closed today by order of the board of rectors, "for the protection of depositors. The bank capitalized at $100,000 of and resources of $599.- CHARGES SLAVERY are being by Australian cattlemen, "Darkie" Rowe, workers' union organizer, charges. Rowe, called "Darkie" because his terest the aboriginals, says they forced watch cattle during He says rations are scanty and flogging is common. RELIEVES COUGH If troubled coughing at night, mix togethere equal parts and then add few drops of lemon juice. Take troubled coughing and see if it does not bring relief. DOOR KNOBS Door knobs sould be washed once along with the general there youngsters the home the door knobs are great deal of punishment and really need this attention. There are approximately 100,000 deer about are killed annually by hunters.