Article Text

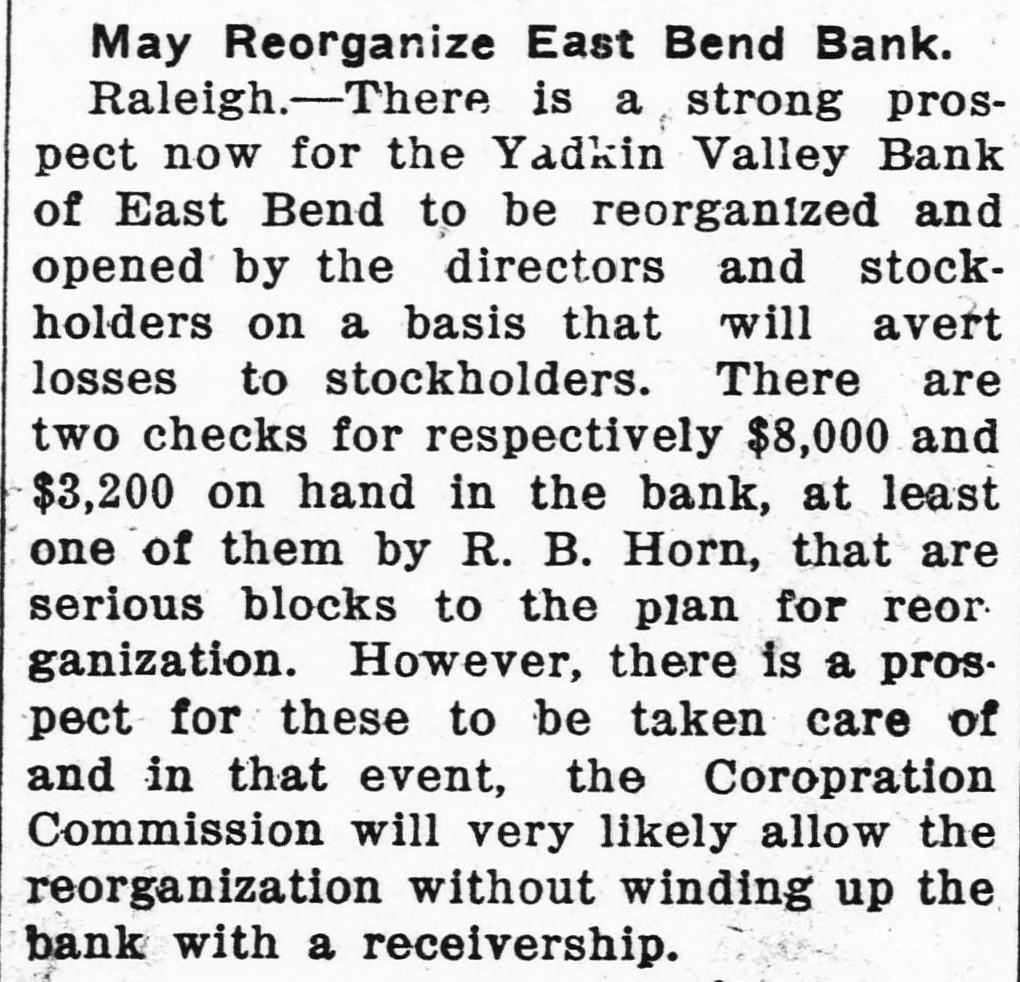

May Reorganize East Bend Bank. Raleigh.-There is a strong prospect now for the Yadkin Valley Bank of East Bend to be reorganized and opened by the directors and stockholders on a basis that will avert losses to stockholders. There are two checks for respectively $8,000 and $3,200 on hand in the bank, at least one of them by R. B. Horn, that are serious blocks to the plan for reor ganization. However, there is a prospect for these to be taken care of and in that event, the Coropration Commission will very likely allow the reorganization without winding up the bank with a receivership.