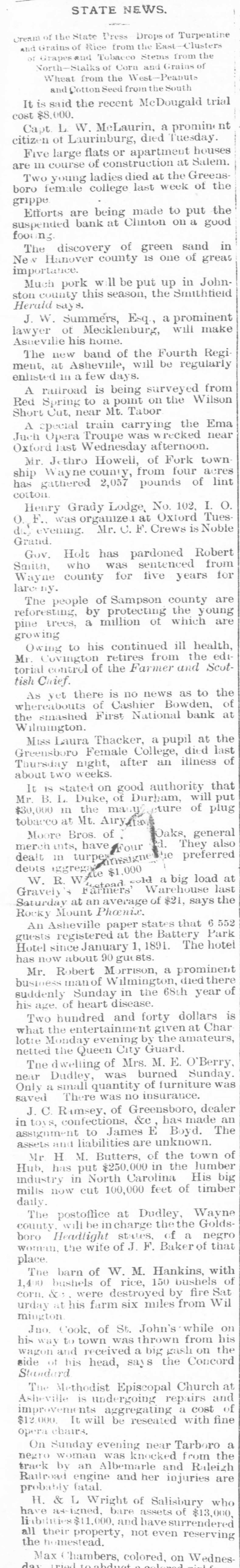

Article Text

Cream of the State Press Drops of Turpentine and Grains of Rice from the East-Clusters of Grapes &nd Tobacco Stems from the North-Stalks of Corn and Grains of Wheat from the West-Peanuts and Cotton Seed fromtheSouth It is said the recent McDougald trial $8,000. Capt. L. W. McLaurin, a promine nt citizen of Laurinburg, died Tuesday. Five large flats or apartment houses are in course of construction at Salem. Two young ladies died at the Greensboro female college last week of the grippe Efforts are being made to put the suspended bank at Clinton on a good fooung The discovery of green sand in New Hanover county is one of great importance. Much pork W 11 be put up in Johnston county this season, the Smithfield Herald say J. W. Summers, Esq., a prominent lawyer of Mecklenburg, will make Asneville his home. The new band of the Fourth Regiment, at Ashevile, will be regularly enlisted In a few days. A railroad is being surveyed from Red Spring to a point on the Wilson Short Cut, near Mt. Tabor A special train carrying the Ema Juch Opera Troupe was recked near Oxford last Wednesday afternoon. Mr. Jethro Howell, of Fork township Wayne county, from four acres has gathered 2,057 pounds of lint cotton. Henry Grady Lodge. No. 102, I. O. 0. F., was organized at Oxford Tuesdul evening. Mr. U. F. Crews is Noble Grand. Gov. Holt has pardoned Robert Smith, who was sentenced from Wayne county for five years for lare ny. The people of Sampson county are reforesting, by protecting the young pine trees, a million of which are growing Owing to his continued ill health, Mr. Covington retires from the editorial control of the Farmer and Scottish Chief. As yet there is no news as to the whereabouts of Cashier Bowden, of the smashed First National bank at Wilmington. Miss Laura Thacker, a pupil at the Greensboro Female College, died last Thursday night, after an illness of about two weeks. It is stated on good authority that Mr. B. L. Duke, of Durham, will put $30,000 in the many ture of plug tobacco at Mt. Airy tave Oaks, general Moore Bros. of merch ints, have Four Pd. They also dealt in turper he preferred debts aggrega W. R. used Ate $1,000 cold a big load at Gravely S Farmers Warehouse last Saturday at an average of $21, says the Rocky Mount Phoenix. An Asheville paper states that 6 552 guests registered at the Battery Park Hotel since January 1, 1891. The hotel has now about 90 guests. Mr. Robert Morrison, a prominent business manof Wilmington, died there suddenly Sunday in the 68th year of his age, of heart disease. Two hundred and forty dollars is what the entertainment given at Char lotte Monday evening by the amateurs, netted the Queen City Guard. The dwelling of Mrs. M. E. O'Berry, near Dudley, was burned Sunday. Only a small quantity of furniture was saved There was no insurance. J. C. Ramsey, of Greensboro, dealer in toys, confections, &c, has made an assignment to James E Boyd. The assets and liabilities are unknown. Mr H M. Butters, of the town of Hub, has put $250,000 in the lumber industry in North Carolina His big mills now cut 100,000 feet of timber daily. The postoffice at Dudley, Wayne county. will be incharge the the Goldsboro Headlight states, of a negro woman, the wite of J. F. Baker of that place. The barn of W. M. Hankins, with 1,400 bushels of rice, 150 bushels of corn. & were destroyed by fire Sat urday at his farm six miles from Wil mington. Jno. Cook, of St. John's while on his way to town was thrown from his wagon and received a big gash on the