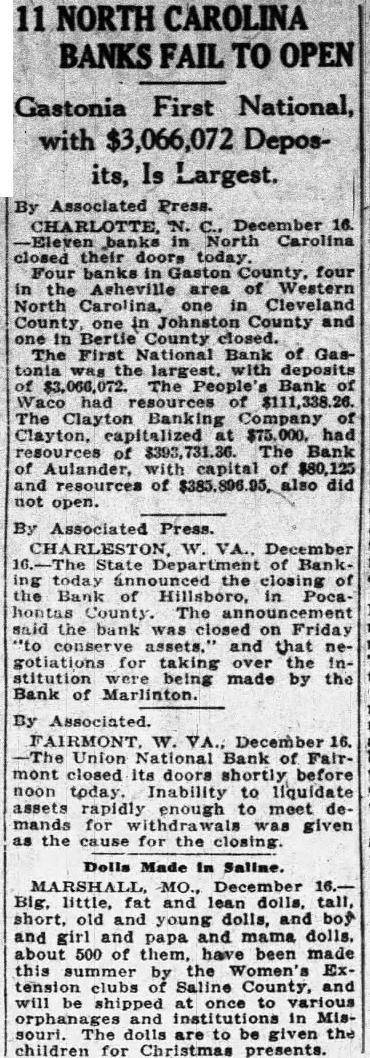

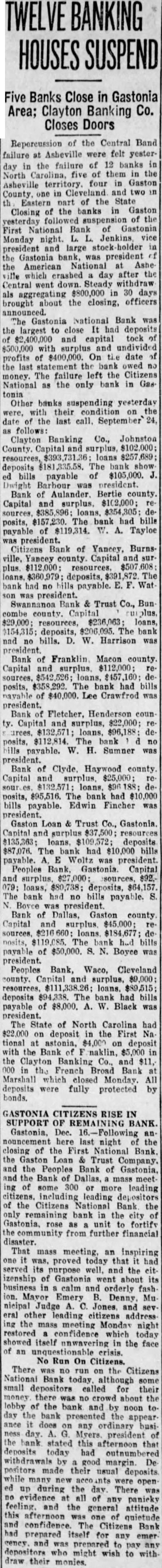

Article Text

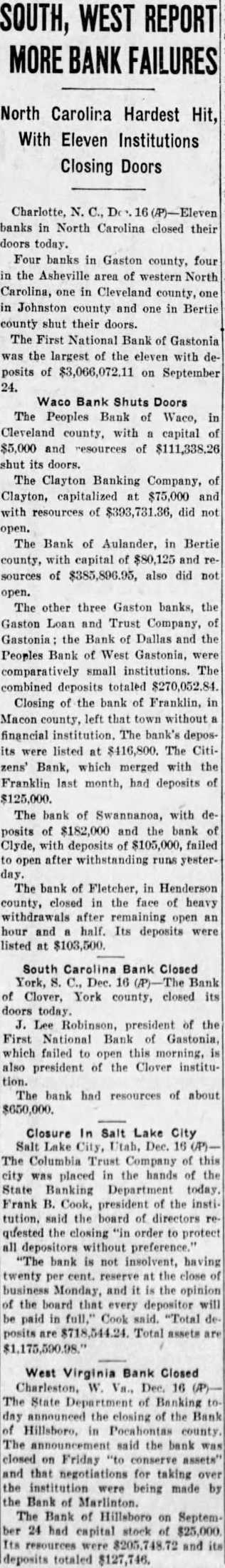

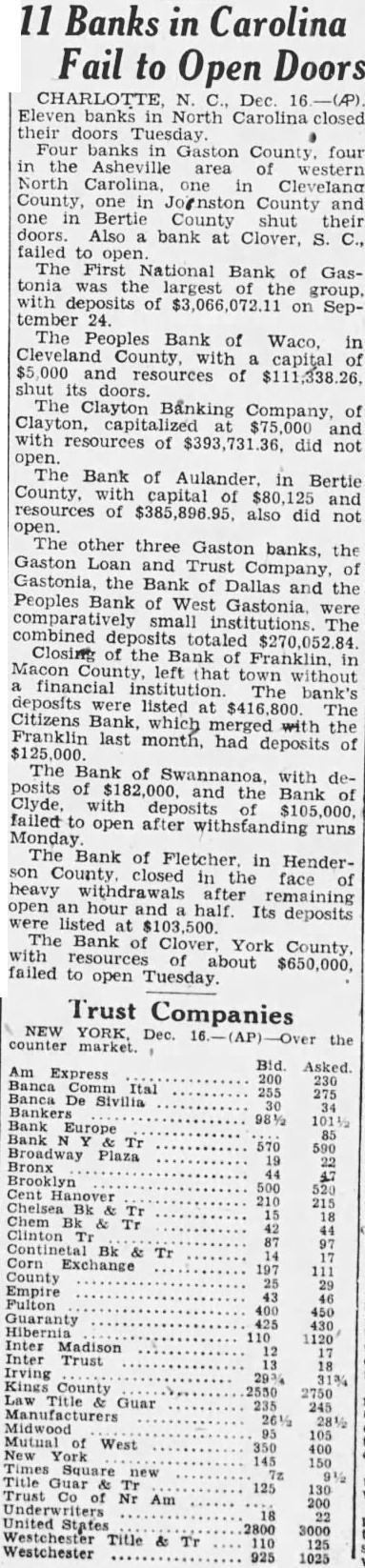

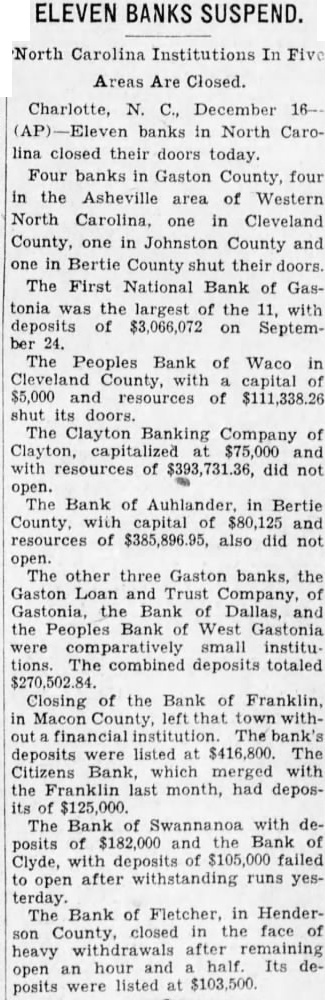

WEST FAILURES North Carolina Hardest Hit, With Eleven Institutions Closing Doors Charlotte, banks in North Carolina closed their doors today. Four banks in Gaston county, four the Asheville area of western North Carolina, one in Cleveland Johnston county and one in Bertie county shut their doors. The First National Bank Gastonia the largest of the eleven with posits of $3,066,072.11 September 24. Waco Bank Shuts Doors The Peoples Bank Waco, Cleveland county, with capital and resources of shut its doors. The Clayton Banking Company, Clayton, capitalized $75,000 and with resources did The Bank of Aulander, in Bertie county, with capital of and sources of also did open. The other three Gaston banks, the Gaston Loan and Trust Company, the Bank of Dallas the Peoples Bank of West Gastonia, small The deposits totaled $270,052.84 Closing of the bank of Franklin, Macon county, left that town without financial institution. The bank's its were listed $416,800. The CitiBank, which merged with the Franklin last month, had deposits $125,000. The bank of Swannanoa, with posits of $182,000 and the bank with deposits failed open runs yesterThe bank of Fletcher, in Henderson county, closed the face of heavy after open hour and half. Its deposits listed South Carolina Bank Closed York, Dec. Bank Clover, York county, closed Lee Robinson, president of the First National Bank Gastonia, which failed open this morning, also president of the Clover instituThe bank had resources of about $650,000. Closure In Salt Lake City Salt Lake City, Dec. The Columbia Trust Company of this city placed the hands of the State Banking Department today. Frank B. Cook, president of the institution. said the board of quested the closing order to protect bank not insolvent, twenty the business Monday, and the opinion the board that every depositor will paid Cook said. posits assets West Virginia Bank Closed The State Department of announced closing of the Bank Hillsboro, Pocahontas county. The said the bank Friday and that for taking institution were being made Bank of Marlinton. The Bank of Hillsboro 24 had capital stock resources and deposits totaled $127,746.