Click image to open full size in new tab

Article Text

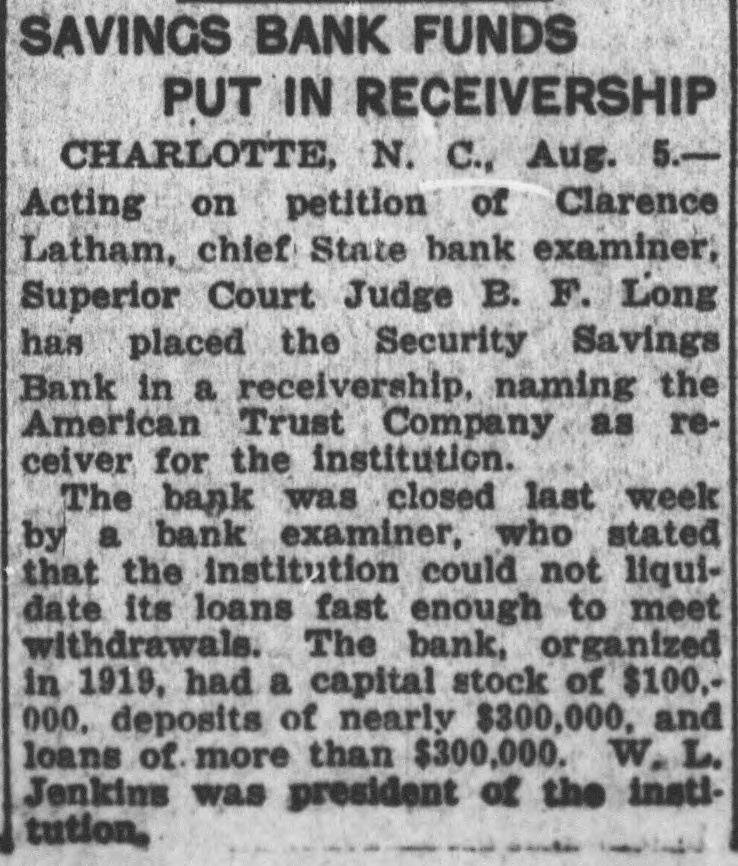

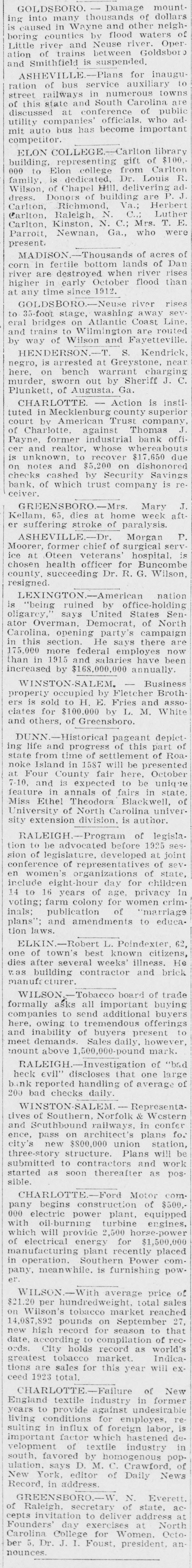

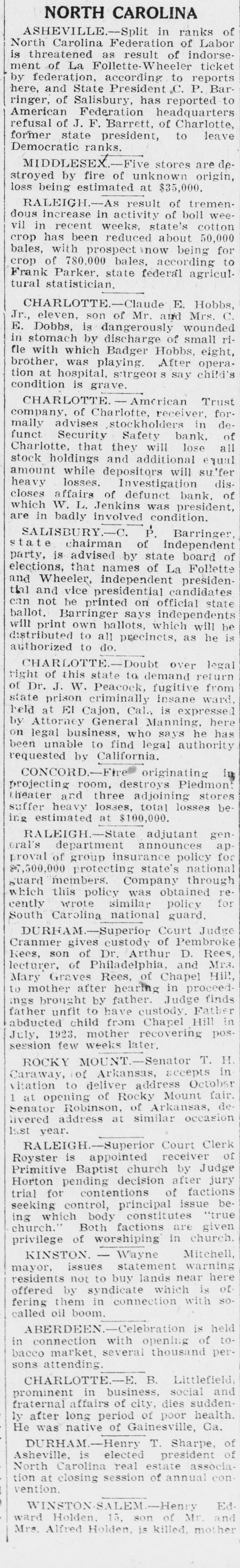

RALEIGH.-As result of tremendous increase in activity of boll weevil in recent weeks, state's cotton crop has been reduced about 50,000 bales, with prospect now being for crop of 780,000 bales, according to Frank Parker, state federal agricultural statistician. CHARLOTTE.-Claude E. Hobbs, Jr., eleven, son of Mr. and Mrs. C. E. Dobbs, is dangerously wounded in stomach by discharge of small rifle with which Badger Hobbs, eight, brother, was playing. After operation at hospital, surgeor S say child's condition is grave. CHARLOTTE. American Trust company. of Charlotte, receiver, formally advises stockholders in defunct Security Safety bank, of Charlotte, that they will lose all stock holdings and additional equal amount while depositors will su'fer heavy losses. Investigation discloses affairs of defunct bank. of which W. L. Jenkins was president, are in badly involved condition. SALISBURY.-C. P. Barringer, state chairman of independent party, is advised by state board of elections, that names of La Follette and Wheeler, independent presidential and vice presidential candidates can not be printed on official state ballot. Barringer says independents will print own ballots, which will be distributed to all precinets, as he is authorized to do. CHARLOTTE.-Doubt over legal right of this state to demand return of Dr. J. W. Peacock, fugitive from state prison criminally insane ward, held at El Cajon, Cal., is expressed by Attorney General Manning, here on legal business, who says he has been unable to find legal authority requested by California. CONCORD.-Fire originating in projecting room, destroys Piedmont theater and three adjoining stores suffer heavy losses, total losses be. ing estimated at $100,000. RALEIGH-State adjutant genoral's department announces approval of group insurance policy for $7,500,000 protecting state's national suard members. Company through which this policy was obtained recently wrote similar policy for South Carolina national guard. DURHAM.-Superior Court Judge Cranmer gives custody of Pembroke Kees, son of Dr. Arthur D. Rees, lecturer, of Philadelphia, and Mrs. Mary Graves Rees, of Chapel Hil!, to mother after hearing in proceedmgs brought by father. Judge finds father unfit to have custody. Father abducted child from Chapel Hill in July, 1923, mother recovering possession few weeks later. ROCKY MOUNT.-Senator T. H. Caraway, of Arkansas, accepts in vitation to deliver address October 1 at opening of Rocky Mount fair. Senator Robinson, of Arkansas, delivered address at similar occasion last year. RALEIGH.-Superior Court Clerk Royster is appointed receiver of Primitive Baptist church by Judge Horton pending decision after jury trial for contentions of factions seeking control, principal issue being which body constitutes "true church." Both factions are given privilege of worshiping in church. KINSTON. - Wayne Mitchell, mayor, issues statement warning residents not to buy lands near here offered by syndicate which is of fering them in connection with socalled oil boom. ABERDEEN.-Celebration is held in connection with opening of tobacco market, several thousand persons attending. CHARLOTTE.-E. B. Littlefield prominent in business, social and fraternal affairs of city, dies sudden ly after long period of poor health. He was native of Gainesville, Ga. DURHAM.-Henry T. Sharpe, of Asheville, is elected president of North Carolina real estate association at closing session of annual con vention. WINSTON-SALEM.-Henry Edward Holden. 15, son of Mr. and Mrs Alfred Holden is killed mother