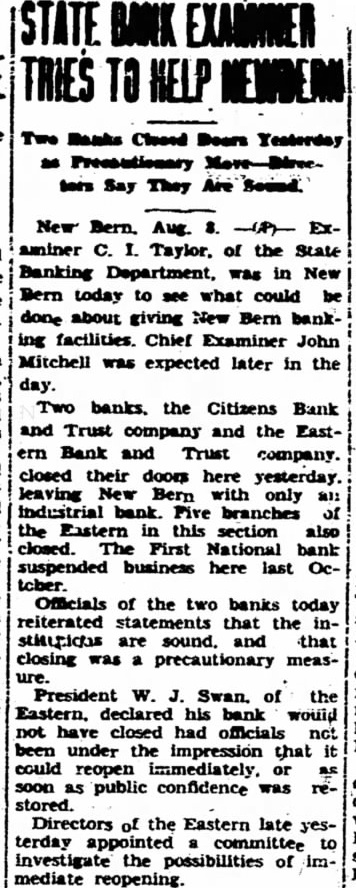

Article Text

Bern. Aug. the State Banking New today to could about giving facilities. Chief Examiner John Mitchell was expected later in the the Citizens Bank Trust company and the EastBank and Trust company. closed their doors here yesterday. leaving Bern only Industrial Five branches this section also First National bank suspended business here last OcOfficials of the two banks today reiterated that the and that measPresident Swan. of the declared his bank would closed had officials not been under the impression that reopen immediately. public confidence was Directors of the Eastern late yesthe possibilities of reopening.