Click image to open full size in new tab

Article Text

NEWS OF SOUTH PASADENA, ALTADENA, LA CANADA, SIERRA MADRE AND SAN MARINO

BOY ESCAPES AUTO INJURY

SOUTH PASADENA, April 7. Narrowly escaping death or severe injury, three and one-half-year-old Akio Kishiro of 915 Meridian avenue, yesterday was grazed by an automobile driven by Fred Taylor of 97 Ventura street, Altadena. The accident to the little Japanese child happened at the intersection of El centro avenue and Meridian street. Taylor was not arrested by police and was absolved of al blame in the near casualty. Thed river declared that the little child ran directly in front of his car from behind a parked car. The parents of the child stated that little Akio had wandered away without being seen by them.

P.-T. A. SPONSORS DANCE SOUTH PASADENA, April 7. With large attendance of students, the second Parent-Teachers association dance was held Saturday evening in the Woman's clubhouse The dances are sponsored by the South Pasadena high school ParentTeachers asociation, of which Mrs. Earle Walker is the president. The reception committee included Lester Sanson, student body commissioner general, who was chairman of the group: Valerie Easterbrook, of the Girls' league; and Robert Keedy, Boys' league prexy. Proceeds of the affair will be divided among the Girls' and Boy's leagues of the senior high school.

BOND VOTE POSTPONED SAN MARINO, April -Re-vote on the $75,000 school bond issue will be held on April 30, according to the of Superintendent of Schools Elmer C. Neher, yesterday. The date was assigned by the county council. The re-vote is necessary because of the stinging defeat in the election last Tuesday, when the measure was defeated by vote of 36 to 27. The bond issue will provide for the landscaping of the Stoneman school on Granada and Huntington drive, in the course of construetion, and the allotting of funds for the construction of further new buildings in the local school system.

HORSE STOLEN SOUTH PASADENA, April 7. The days of horse stealing are far from being over. according to police reports, although the days of hanging for the offense are in the past. A horse was stolen Friday evening from the Huntington Riding stables. A description of the rider was not given by the police. The horse was branded on the left though with the initials "G. M. C." The animal according to its owners, was six years old and weighed 1150 pounds. It was brown with black mane and tail. Stolen with the horse was dark red western saddle with pockets.

SCOUT WINS AWARD SOUTH PASADENA, April 7. Formal presentation of the gold medal for heroism will be made to Eagle Scout Bruce Estey, popular South Pasadena Boy Scout, at the annual field day jamboree, April 12 of the South Pasadena council Awarding of the medal, the highest honor paid by the National council of the organization, resulted from the act last September of Scout Estey, who saved the life of Miss Grace Clark at Manhattan Beach. Miss Clark, having given up all hope of being saved, was disappearing for the third time, when rescued by Estey. She and a companion swimmer were caught in strong rip tide and were being swept out to sea. The award was accompanied by a letter of commendation from Daniel Carter Beard, national scout commissioner.

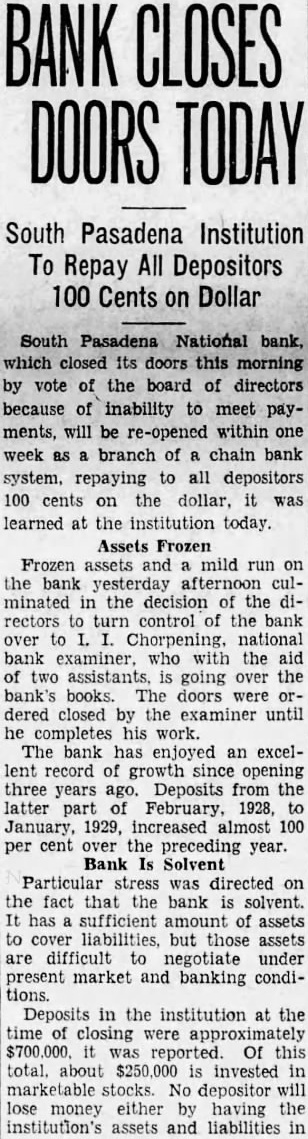

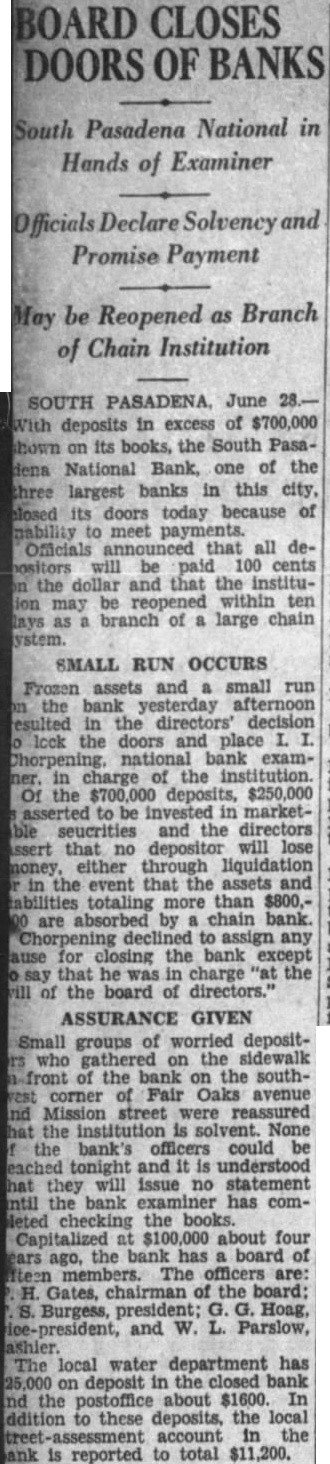

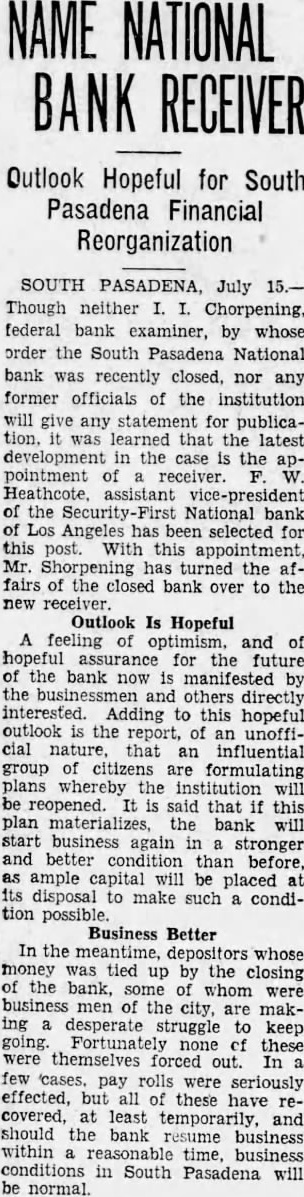

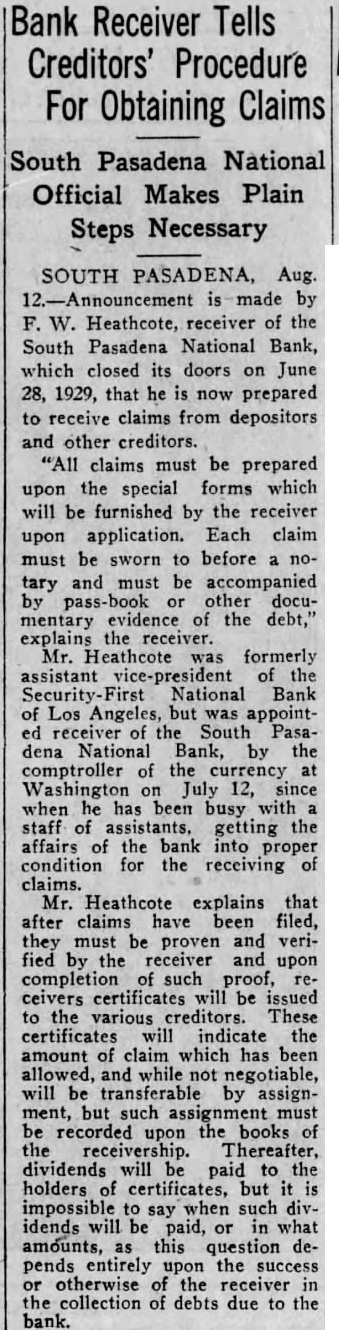

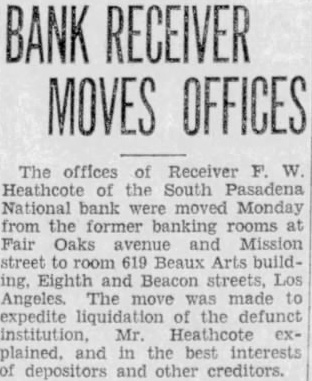

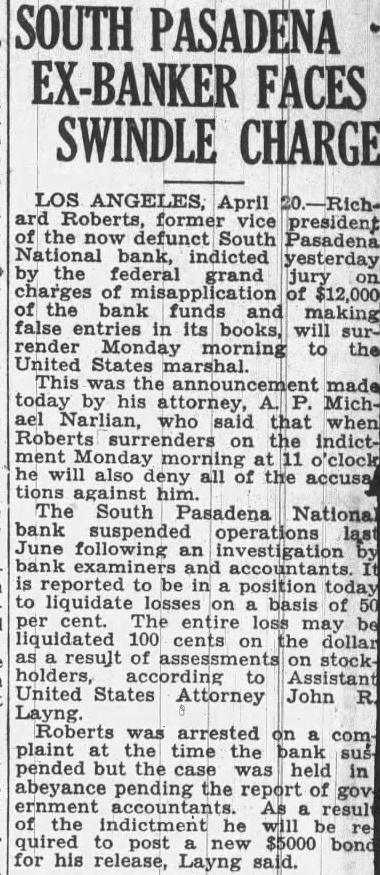

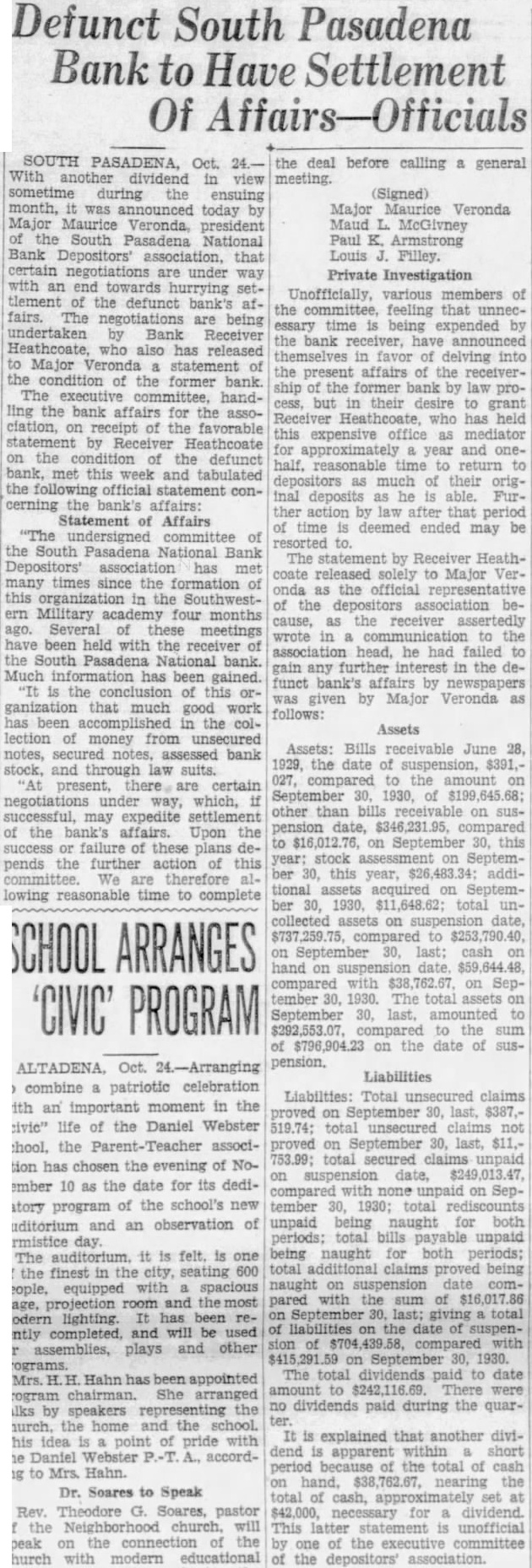

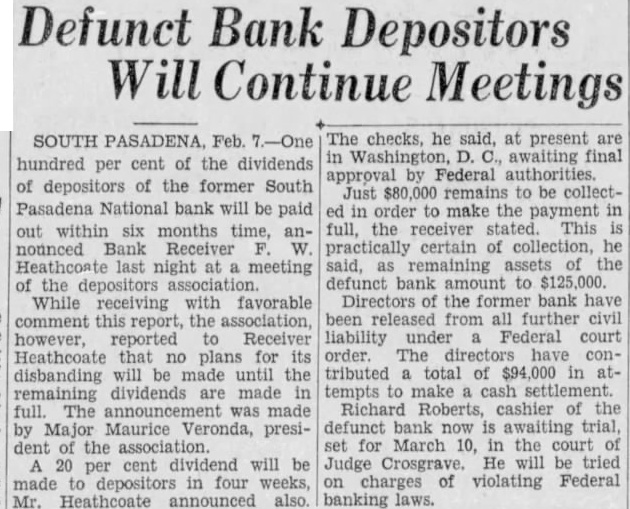

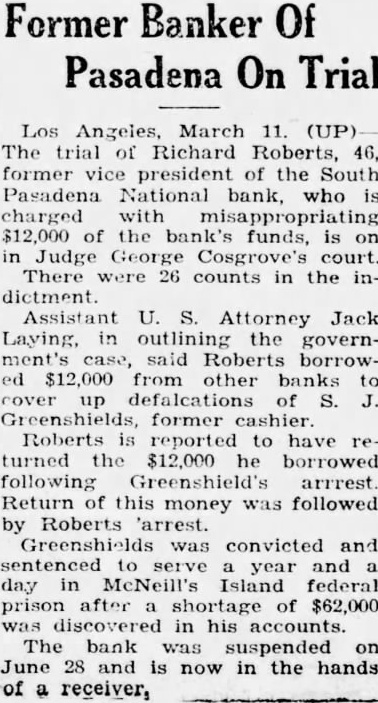

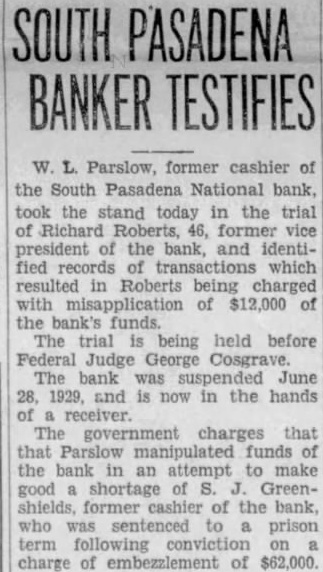

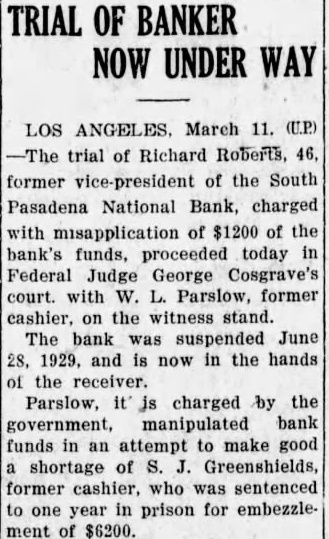

BANK ASSETS TOLD SOUTH PASADENA, April 7. Total assets of the former South Pasadena National bank now amount to $338,559.42 according to the announcement of F. W. Heathcote, federal receiver. Total liabilities amount to $417,760.73. The figures represent sums accounted for on March 31 of this year. Listed under the heading of assets, $229,764.96 are for bills receivable. $16,115.78 for other than bills receivable, $36,541.85 for stock $10,030.84 for additional assets acquired, $292,453.43 for total uncollected assets, $46,105.99 for cash on hand. Under liabilities, $386,279.56 are for total unsecured claims proved. for total unsecured claims not proved, total rediscounts unpaid, total secured claims unpaid, and total bills payable unpaid are not listed while total additional claims proved amounted to $15,Dividend paid during the last quarter, to March 31, amounted to $36,138.50. and total dividend paid to date amounted to $200,786.67 In his comments upon the condition of the former bank, Receiver Heathcote said, "I am sorry that it is not possible for me to give any indication at this time, as to when or in what an other dividend will be paid. Up to this time, there has been but one dividend of 50 per cent. and most of this already has been paid out. While the cash on hand, as shown in the statement, might indicate the posibility of another early dividend, considerable pending litigation makes it essential that a sufficient cash reserves shall be maintained to cover possible emergencies.

LEASE FLINTRIDGE HOME LA CANADA, April 7.-Mrs. P. J. Carroll and sister of La Porte drive have returned from a short vacation at Catalina Island. Mr. and Mrs. Robert Carroll and family, who have been residing in Los Angeles, have located in Flintridge, leasing the Walker estate, on Keswick road. The Carrolls are recent arrivals from Ohio.