Click image to open full size in new tab

Article Text

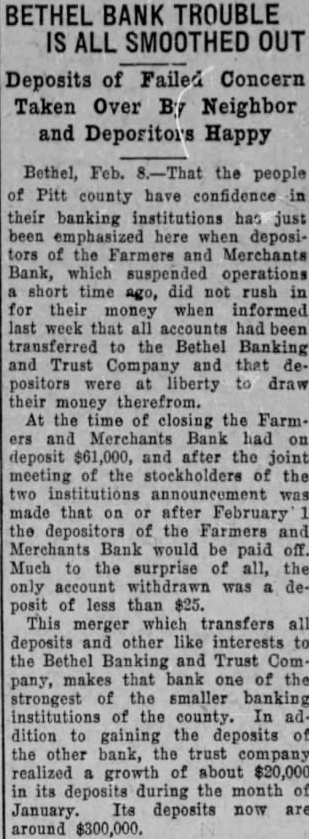

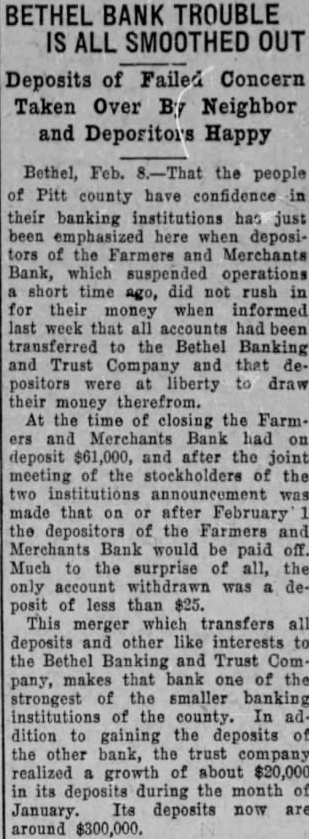

BETHEL BANK TROUBLE IS ALL SMOOTHED OUT Deposits of Failed Concern Taken Over By Neighbor and Depositors Happy

Bethel, Feb. -That the people of Pitt county have confidence in their banking has just been here when depositors of the Farmers and Merchants Bank, which suspended operations short time ago, did not rush in for their money when informed last week that all accounts had been transferred to the Bethel Banking and Trust Company and that depositors were at liberty to draw their money therefrom. At the time of closing the Farmers and Merchants Bank had on deposit $61,000, and after the joint meeting of the stockholders of the two institutions announcement made that on or after February the depositors the Farmers and Merchants Bank would be paid off. Much to the surprise all, the only account withdrawn was a deposit of less than $25. This merger which transfers all deposits other like interests to the Bethel Banking and Trust Company, makes that bank one of the strongest the smaller banking institutions of the county. In addition gaining the deposits of the other bank, the trust company realized growth about $20,000 in its deposits during the month of January. Its deposits now are around $300,000.