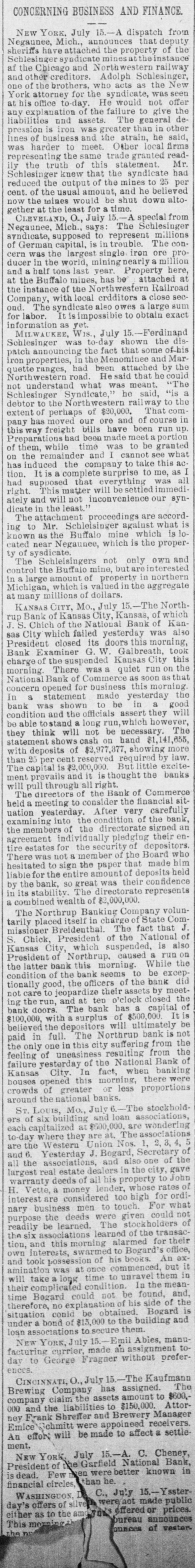

Click image to open full size in new tab

Article Text

AND from YORK. New dispatch that Mich., the of the sheriffs and railway Chicago Adolph as New the acts seen office af and the ot! er creditors brothers who sy indicate, not was offer of one of the for the He would to give the deYork attorney o-day the failure general other at his expl lana tion assets. treater The than in said, harder liabilities and was strain he firms same is iron and the Other local readlines of business to meet trade granted Mr statement. had was senting truth the of that this the syndicate to 25 per ly the ger knew of the and mines he believed altoreduced Schlesin the the usual output amount be shut down from cent. the of wines would for a time. A special now gether at the least O., July The Schlesinger CLEVELA Mich., says to represent The con- procern single the condicate, Negaunee. supposed capital, is in trouble. iron ore world, year. of German was the larges mining Property here, at "attached and ducer in half tons mines, last has be close Railroad second. at the instance Buffalo of the crdditors a a large sum It is labor. yet the Company, The syndiconpogsible with local also owes to obtain Ferdinana for information as Wis. July shown 15 the of MILWAUKE was to-day fact that some and Mar his ranges, Schlesinger announce cing in the the attached by could the meant. iron patch properties, had been He said that he "The a indicate, the the Northderstand road. what was he said, way to "is of of in moved Schlesinger not Nort Syndhestern $20,000. rail That com course meet debtor extent of to perhaps our ore have and been portion run up. pany way has freight had bills been made was to be granted what this while time and cannot take see this of them, the remainder the company to to me, as on has induced complete everything was immed right will not and tion. It is that will settled our BYI had upposed This matter inconvenience ately in the least. are accord what known dicate The attachment against which is 10 Negaunee, of ty cated verdicate. near own ing to as Mr. the Buffalo which is the proper- and not only Schleisingers but are mine, in large is control The the amount Buffalo of valued in the Michigan, millions which of dollars. 15. The North rup of the Chich at many CITY, Mo City, July Cansas, of of Kanvesterday KANSAB Bank of Kansas rational Bank was al30 morning, sas J.S City which closed failed its doors Galbreath, this took this There President Examiner ended G W Kansas run City on the Commerce this charge Bank of the sust was a quiet as SOOD that morning a concern statement to in be morning National opened Bank of for business made vesterday good the will they assert long bank In was and shown the officials run, which how wever, The think 055, on cash be condition able tostand will a not be hand necessary $1,141,055, more showing deposits they statement state shows of $2,977,377, by excite- law. capital it with than 25 cent is $2,000 000.000 is thought the banks of ment The and all right. Commerce will pull directors through of the Bank the financial carefully sitheld The a meeting to consider After very of the bank, an yeareday. the condition te signed nation examining into of the directorate pledging depositors. their enthe member individo of who agreement the the Board him for member of that made liable There not sign 8 the paper of deposits held directorate hesitated for the to entire great amount was their represents by the bank, The $2,000,000. its stab of volunplaced combined Banking Company of State Com- J. of The Northrup itself in charge The fact National that Chick, which suspended a on run tarily missioner President reidenthal of the is also be Kansas City, of Northrup. morning caused While excep- the tionally President latter bank this bank seems the to bank meet- did pardize o'clock ing condition the good, of the the officers their of assets closed by the of The of not the run, care to jeopa and at bank ten has $500,000. a capital It be is bank doors. with a surplus ositors will ultimately bank is not from believed $100,000, the full deposit The Northrup suffering from the the failure paid the only in one in this city resulting National Bank of In feeling vesterday of uneasiness of the fact, when there banking were houses greater Kansas opened City this morning less proportions crowds of national banks. The stockholdeach around LOUIS, the MO., July and 6. loan wondering at. ers ST. of six building at $600,000. The are are they where 1, 2.3,4, Nos. Union of Secretary to-day the Western J. Bogard, one of the are and Yesterday and in also the city, gave John all the real estate dealers all his all property rates to of largest warranty deeds of lender, whose for ord! nary Vette, a money considered too high For what business were deeds H interest are men to touch. given could not of holders stock the learned. learned The of the transac their and readily be ociations alarmed for the six this morning to Bogard An office, 2xamination own tion, interests, swarmer of his commenced. books. but it time and took posses was at once to unravel the mean them in complicated not of will take long condition be In found, and, the situation time their Bogard explana could of his side Bogard is therefore, could no $15,000 be obtained to the building and manu under bond of to secure them. Abies, loan octations July 15. Emil assignment to to day George facturing New YORK, currier Fragner made an without prefer The Kaufmann claim ences CINCINN O., July has 15. assigned. to $600, The company to Brewing Company the assets $150,000 amount AttorManager Emice 000 and the Shreffer liabilities and appoineed Brewery receivers. be will An effort nev Frank Schmitt were made to affect a settle ment. C. A. Cheney, President July 15. National Bank in dead. Few NEW ORK of Garfield were better known han he. financial circle July 15.--YssterWASHINGUOS of offers day's or were not made public offered prices. the to as either ounces This bureau ounces of vestor