Click image to open full size in new tab

Article Text

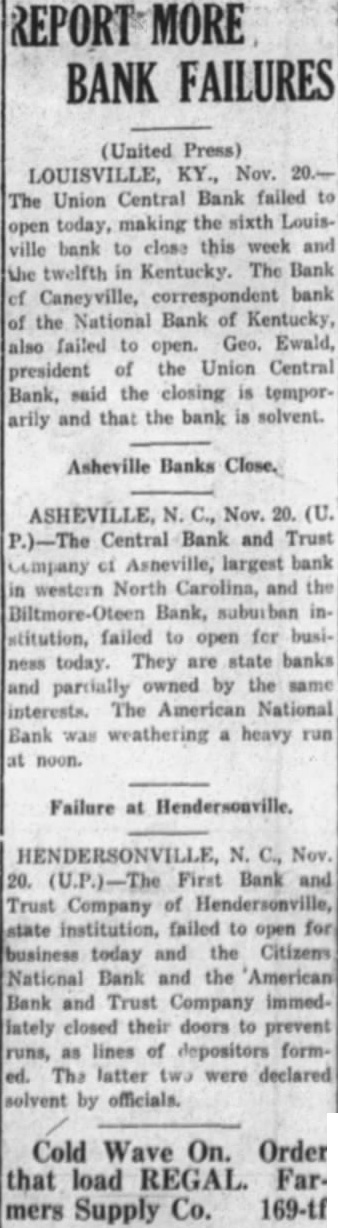

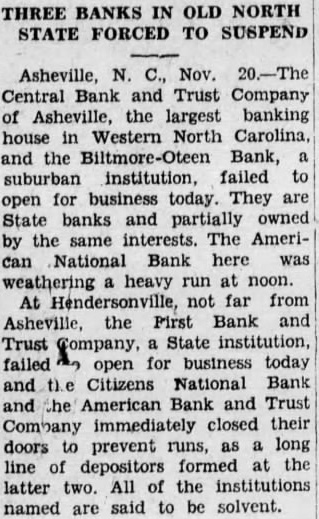

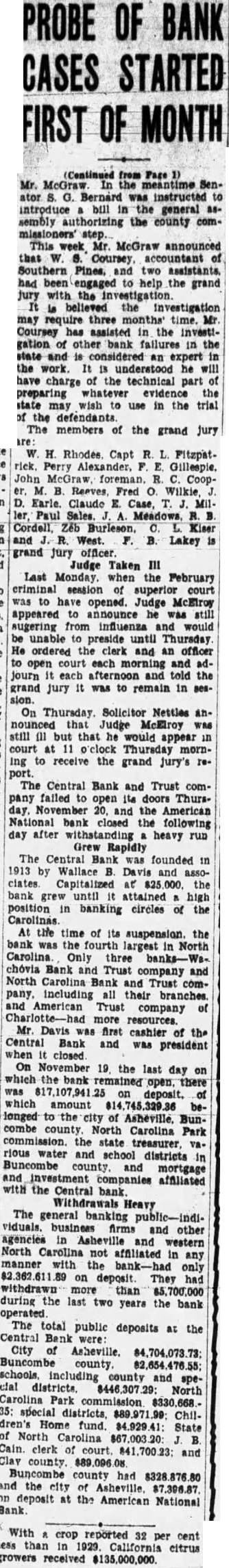

BANKS CLOSED IN TWO

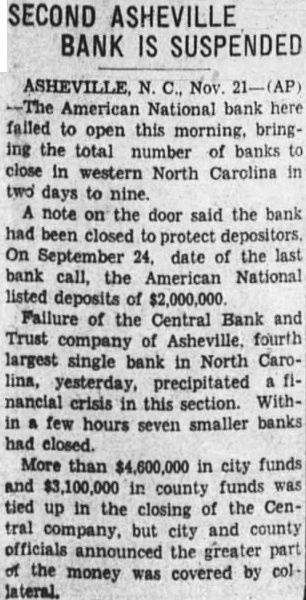

American National of Asheville Fails to Open for Business Today.

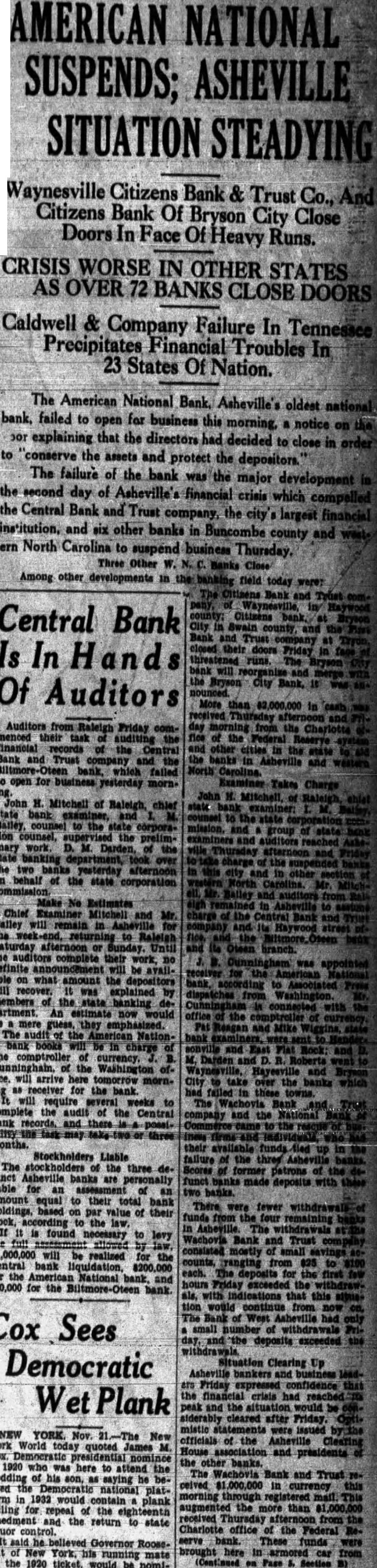

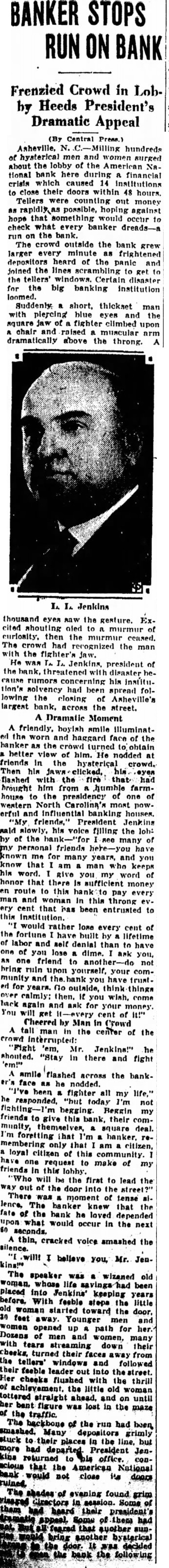

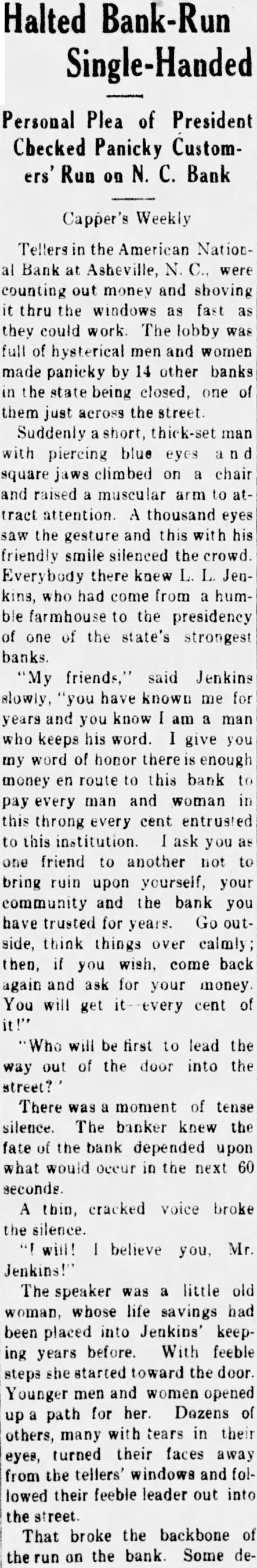

United of the American National Bank of Asheville, Citizens Bank Bryson City which merge with Bryson City Bank and with the Bryson City Bank day brought to 10 the total number of banks closed in North Carolina since Thursday morning. These three banks closed today. Ten of the institutions are Western North Carolina. The other one, the Bank of Lowell, located in Gaston County. Its fallconnected with that of the banks in the Asheville district. While considerable money was brought in aid the American National Bank here, its directors decided late last night that was sufficient justify opening today face probable tracted withdrawals. Jenkins, president and state textile mill operator, made effort to prevent closing down, pledging personal fortune several million dollars. The however, did not feel rectors, justified in accepting his sonal money. To Aid Rebuilding mass meeting of 1000 citizens last night pledged their personal means toward rebuilding the lossand fostering confidence in the financial structure Western North Carolina. similar meeting at Brevard took the same action. The American National Bank capitalized and has deposits of approximately $2,000,State bank officials attributed Thursday's developments to collapse of the real estate boom of 1926.

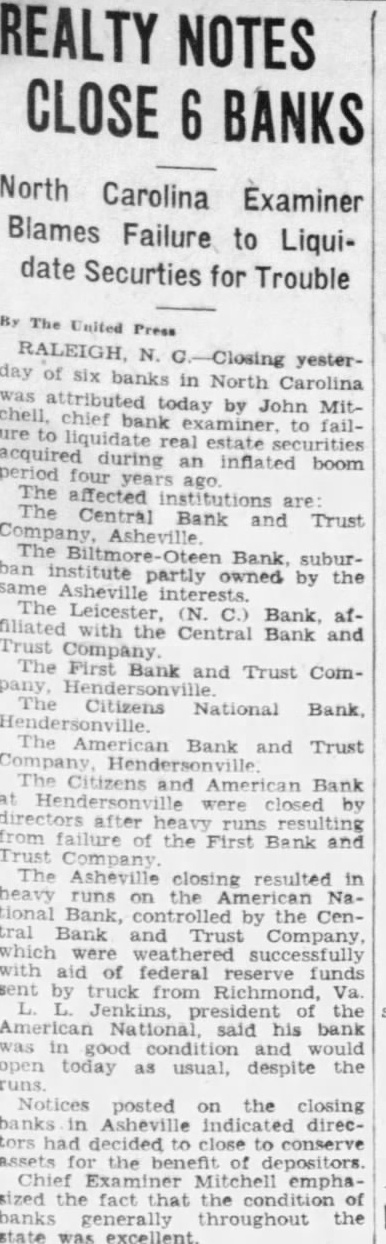

List Given The other institutions involved. their last posted assets and liabilities: Central Bank Trust Asheville, resources deposits First Bank Trust Hendersonville, resources deposits, American Bank Trust Co., Hendersonville, resources deposits, Bank, Asheville, resources deposits, Bank of Liecester, resources $224,640; deposits, Clay County Bank. Hayesville, resources $78,075; Bank Lowell, Lowell, resources $139,188; Citizens Natitonal Bank, Hendersonville, capital and surplus deposits Closed First The Central Bank Trust Co. closed first after series heavy withdrawals. Others felt the feet and followed Still other banks buttressed their business with Federal Reserve funds. One consolidation occurred at Asheville. John Mitchell, chief state bank examiner. issued statement declaring the failures were due to the collapse of real estate boom in western North Carolina, and asserting there no cause whatever alarm about stability of other banks. Prior to yesterday, 27 state banks closed this year, six reopening for business. The last call showed 321 state banks and 84 branches in operation.

POLICE GUARD BANK

By guards were around the Central Bank Trust Co. building and the home of president, Wallace Davis, today, cautionary possible mob from angry positors and

TO RESUME OPERATIONS LITTLE ROCK, tion business number Arkansas banks which suspended operations week appeared likely today following conference Most of reports word American Exchange Trust Little Rock, whose suspension precipitated temporary closing 34 out-state banks which the B. Banks Co. was interested, expected to reopen for business soon. Yesterday, following two-day conference, officials the bank indicated would be impossible to open the bank saying they could tell when reorganization plans would be complete. Banks in which the Banks Co. interested and which failed suspended are gradually reorganizing selves. At Helena in Eastern Arkansas, citizen's committee had cooperated with bank they plan open new bank take assets of the Merchants and Planters Bank, which suspended Monday with deposits Morrillton reopening of the First State Bank is being considered.

CLOSE IN INDIANA Ind. Six Southern banks were closed today by voluntary action of their directors, the State Banking announced Officials of the department said the closings resulted from disturbed banking conditions in Louisville,

The closed institutions were the New Albany Liberty State Bank, the Bank Trust New the Crawford