Article Text

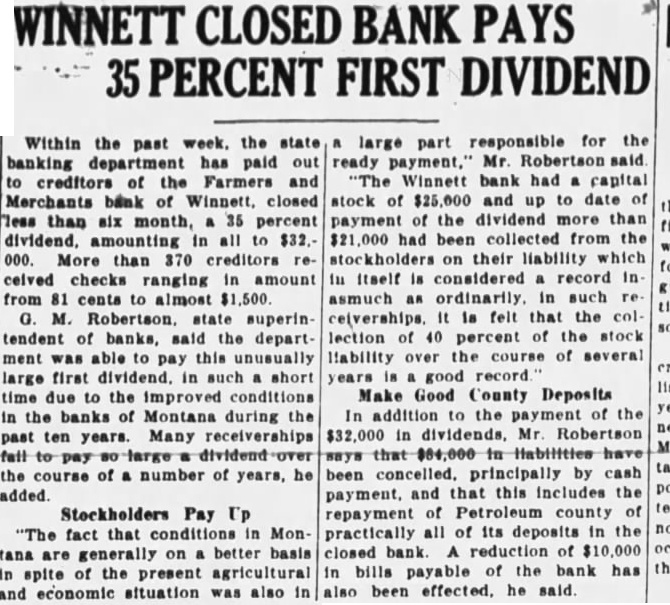

WINNETT CLOSED BANK PAYS 35 PERCENT FIRST DIVIDEND Within the past week. the state banking department has paid out to creditors of the Farmers and Merchants bank of Winnett, closed Tess than six month, 35 percent dividend. amounting in all to $32.000. More than 370 creditors recelved checks ranging in amount from 81 cents to almost $1,500 G. M. Robertson. state superintendent of banks, said the department was able pay this unusually large first dividend. in such short time due to the improved conditions in the banks of Montana during the past ten years. Many receiverships fall to pay large the course of a number of years, he Stockholders Pay Up "The fact that conditions in Mon tana are generally on better basis in spite of the present agricultural and economic situation was also in large part responsible for the ready payment,' Mr. Robertson said "The Winnett bank had capital stock of $25,000 and up to date of payment of the dividend more than $21,000 had been collected from the stockholders on their liability which in itself is considered record in asmuch as ordinarily. in such ceiverships. It is felt that the colsor lection of 40 percent of the stock liability over the course of several years good record Make Good County Deposits In addition to the payment of the $32,000 in dividends, Mr Robertson says that $84,000 in have been concelled. principally by cash payment, and that this includes the repayment of Petroleum county of practically all of its deposits in the closed bank. A reduction of $10,000 in bills payable of the bank has also been effected. he said