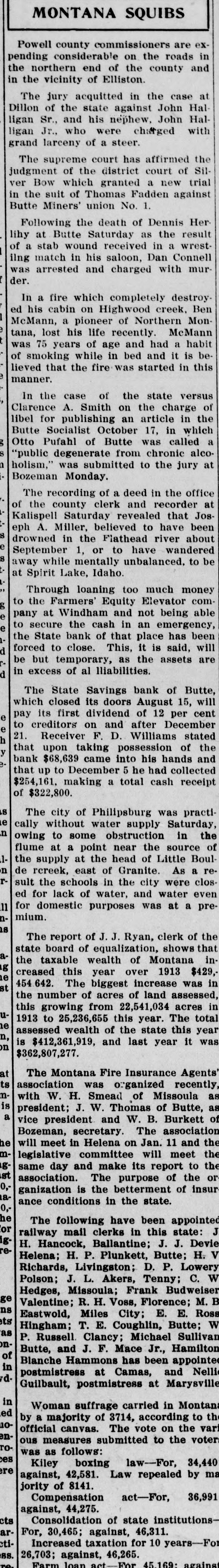

Article Text

montana SQUIBS Powell county commissioners are expending the considerable on the roads in in the northern end of the county and vicinity of Elliston. Dillon The jury acquitted in the case at ligan of the state against John Hal ligan Sr., and his nephew, John Halgrand Jr., who were charged with larceny of a steer. The supreme court has affirmed the judgment ver Bow of the district court of Silin the which granted a new trial Butte suit of Thomas Fadden against Miners' union No. 1. Following the death of Dennis Herof lihy a at Butte Saturday as the result ilng stab wound received in a wrestwas match in his saloon, Dan Connell der. arrested and charged with murIn his a fire which completely destroy. ed McMann, cabin on Highwood creek, Ben tana, a pioneer of Northern Mon was 75 lost his life recently. McMann of years of age and had a habit lieved smoking while in bed and it is bemanner. that the fire was started in this In the case of the state versus libel Clarence A. Smith on the charge Butte for publishing an article in of Otto Socialist October 17, in which the "public Pufahl of Butte was called holism," degenerate from chronic alco- a Bozeman was Monday. submitted to the jury at The the recording of a deed in the office of county clerk and recorder Kalispell eph A. Saturday revealed that Jos at drowned Miller, believed to have been September in the Flathead river about away while 1, or to have wandered at Spirit Lake, mentally Idaho. unbalanced, to be Through the loaning too much money to pany Farmers' Equity Elevator com to secure at Windham and not being able the the cash in an emergency forced State bank of that place has been d be but to close. This, it is said, will in temporary, as the assets are d excess of al Iliabilities. which The State Savings bank of Butte, pay its closed its doors August 15, will e to creditors first dividend of 12 per cent e 21. on and after December h that Receiver F. D. Williams stated y bank upon taking possession of the that $68,639 came into his hands $254,161. up to December 5 he had collected and of $322,800. making a total cash receipt S e cally The city of Philipsburg was practin owing without water supply Saturday flume to some obstruction in the 1the at a point near the source of n de supply at the head of Little Boul rsult rcreek, the east of Granite. As a ed for schools in the city were clos re11 for lack of water, and water even P. mium. domestic purposes was at a pre is The report of J. J. Ryan, clerk of the astate the board of equalization, shows that g creased taxable wealth of Montana e 454.642. this year over 1913 $429, in st the The biggest increase was in this number of acres of land assessed -n1913 growing from 22,541,034 acres in he to 25,236,655 this year. The total n, assessed is wealth of the state this on $362,807,277. $412,361,919, and last year it year was at ts The Montana Fire Insurance Agents nassociation with W. was organized recently H. Smead of Missoula is a president; vice J. W. Thomas of Butte, as president and W. B. Burkett as he Bozeman, will secretary. The association o mmeet in Helena on Jan. 11 and the glegislative committee will meet the st same day and make its report to the 0,association. The purpose of the aganization is the betterment of insur or 0,ance conditions in the state. he or The following have been appointed 1grailway H. mail clerks in this state: reHancock, Ballantine; J. J. Devie J Helena; H. P. Plunkett, Butte; H. V Richards, Livingston; D. P. Lowery Polson; J. L. Akers, Tenny; C. ge Hedges, Missoula; Frank Budweiser W ns Valentine; R. H. Voss, Florence; M. B ets Eastwold, Miles City; E. E. Ross as Hingham; P. T. E. Coughlin, Butte; onRussell. Clancy; Michael Sullivan W of Butte, and J. F. Mace Jr., Hamilton in Blanche Hammons has been appointed dpostmistress at Camas, and Nelli Guilbault, postmistress at Marysville in ed Woman a suffrage carried in Montana uoby majority of 3714, according to the enofficial canvas. The vote on the roous measures submitted to the voter vari was as follows: es ere Kiley boxing law-For, 34,440 against, 42,581. Law repealed by ma jority of 8141. Compensation act-For, 36,991 against, 44,275. cts Consolidation of state institutionsarFor, 30,465; against 46.311