Article Text

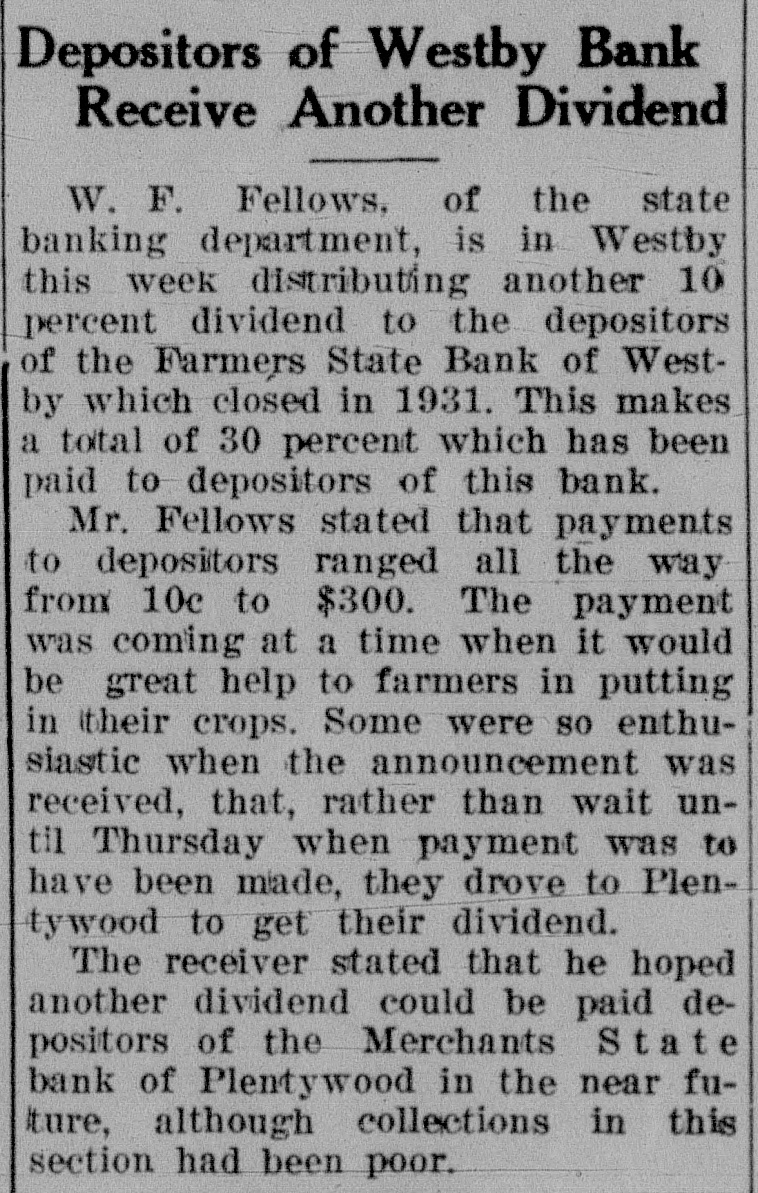

Depositors of Westby Bank Receive Another Dividend W. F. Fellows, of the state banking department, is in Westby this week distributing another 10 percent dividend to the depositors of the Farmers State Bank of Westby which closed in 1931. This makes a total of 30 percent which has been paid to depositors of this bank. Mr. Fellows stated that payments to depositors ranged all the way from 10c to $300. The payment was coming at a time when it would be great help to farmers in putting in their crops. Some were so enthusiastic when the announcement was received, that, rather than wait until Thursday when payment was to have been made, they drove to Plentywood to get their dividend. The receiver stated that he hoped another dividend could be paid depositors of the Merchants State bank of Plentywood in the near future, although collections in this section had been poor.