Article Text

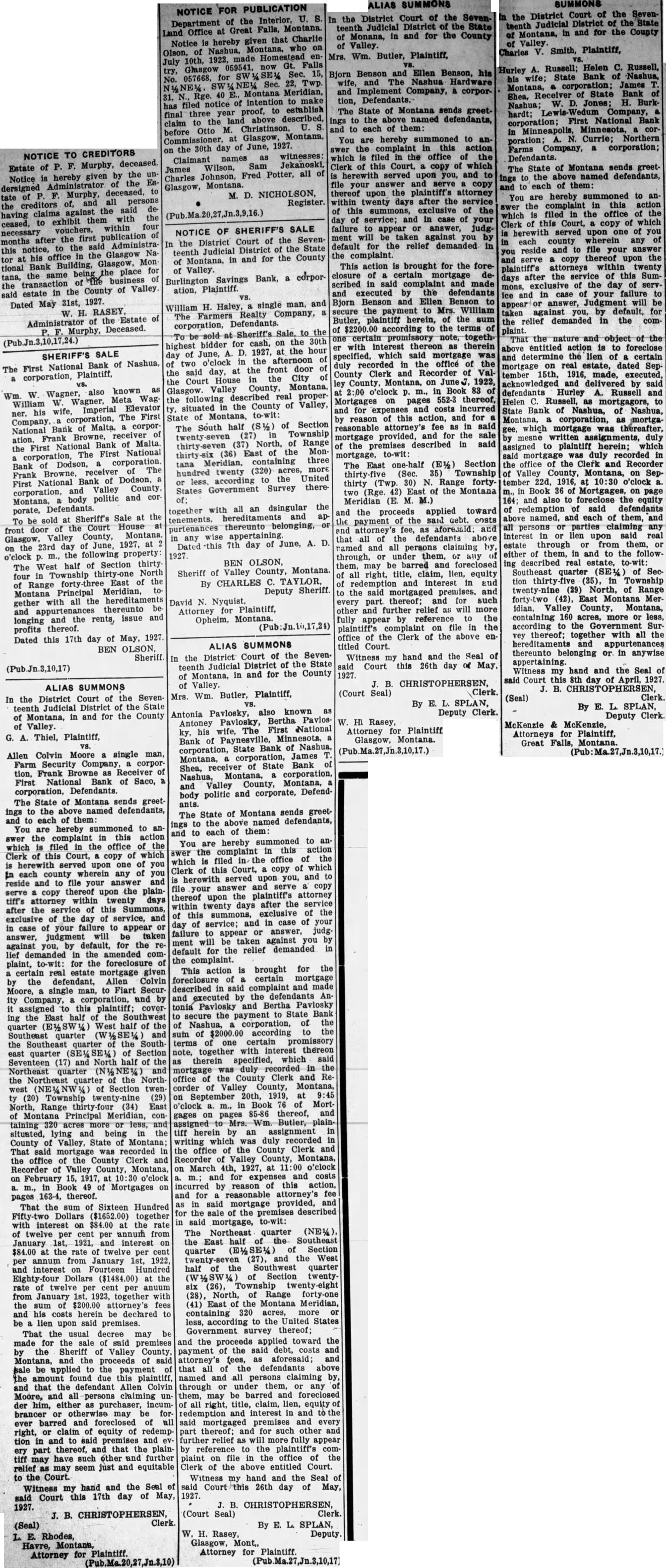

NOTICE TO CREDITORS Estate of P. F. Murphy, deceased. Notice is hereby given by the undersigned Administrator of the Estate of P. F. Murphy, deceased, to the creditors of, and all persons having claims against the said deceased, to exhibit them with the necessary vouchers, within four months after the first publication of this notice, to the said Administrator at his office in the Glasgow National Bank Building, Glasgow, Montana, the same being the place for of the transaction of the business said estate in the County of Valley Dated May 31st, 1927. W. H. RASEY, Administrator of the Estate of P. F. Murphy, Deceased. (Pub.Jn.3,10,17,24.)

SHERIFF'S SALE The First National Bank of Nashua, a corporation, Plaintiff,

Wm. W. Wagner, also known as William W. Wagner, Meta Wagner, his wife, Imperial Elevator Company, corporation, The First National Bank of Malta, a corporation, Frank Browne, receiver of the First National Bank of Malta. corporation, The First National Bank of Dodson, a corporation. Frank Browne, receiver of The First National Bank of Dodson, a corporation, and Valley County. Montana, body politic and corporate, Defendants. To be sold at Sheriff's Sale at the at front door of the Court House Glasgow, Valley County, Montana, on the 23rd day of June, 1927, at 2 o'clock p. m., the following property The West half of Section thirty four in Township thirty-one North of Range forty-three East of the to Montana Principal Meridian, gether with all the hereditaments and appurtenances thereunto belonging and the rents, issue and profits thereof. Dated this 17th day of May, 1927. BEN OLSON, Sheriff.

(Pub.Jn.3,10,17)

ALIAS SUMMONS In the District Court of the Seventeenth Judicial District of the State of Montana, in and for the County of Valley. G. A. Thiel, Plaintiff,

Allen Colvin Moore a single man, Farm Security Company, corportion, Frank as Receiver of First National Bank of Saco, a corporation, Defendants. The State of Montana sends greetings to the above named defendants, and to each of them: You are hereby summoned to answer the complaint in this action which is filed in the office of the Clerk of this Court, a copy of which is herewith served upon one of you in each county wherein any of you reside and to file your answer and serve a copy thereof upon the plaintiff's attorney within twenty days after the service of this Summons, exclusive of the day of service, and in case of your failure to appear or answer, judgment will be taken against you, by default, for the relief demanded in the amended complaint, to-wit: for the foreclosure of a certain real estate mortgage given by the defendant, Allen Colvin Moore, a single man, to Fiart Security Company, a corporation, and by it assigned to this plaintiff; covering the East half of the Southwest quarter (E%SW%) West half of the Southeast quarter (W½SE% and the Southeast quarter of the Southeast quarter (SE% of Section Seventeen (17) and North half of the Northeast quarter (N½NE%) and the Northeast quarter of the Northwest (NEWNW) of Section twen (20) Township twenty-nine (29) North, Range thirty-four (34) East of Montana Principal Meridian, containing 320 acres more or less, and situated, lying and being in the County of Valley, State of Montana; That said mortgage was recorded in the office of the County Clerk and Recorder of Valley County, Montana, on February 15, 1917, at o'clock a. m., in Book 49 of Mortgages on pages 163-4, thereof. That the sum of Sixteen Hundred Fifty-two Dollars ($1652.00) together with interest on $84.00 at the rate of twelve per cent per annum from January 1st, 1921, and interest on $84.00 at the rate of twelve per cent per annum from January 1st, 1922, and interest on Fourteen Hundred Eighty-four Dollars ($1484.00) at the rate of twelve per cent per anuum from January 1st, 1923, together with the sum of $200.00 attorney's fees and his costs herein be declared to be lien upon said premises. That the usual decree may be made for the sale of said premises by the Sheriff of Valley County, Montana, and the proceeds of said sale be applied to the payment of the amount found due this plaintiff, and that the defendant Allen Colvin Moore, and all persons claiming under him, either as purchaser, incumbrancer or otherwise may be forever barred and foreclosed of all right, or claim of equity of redemption in and to said premises and every part thereof, and that the plaintiff may have such other and further relief as may seem just and equitable to the Court. Witness my hand and the Seal of said Court this 17th day of May, 1927.

J. B. CHRISTOPHERSEN,

(Seal) L. E. Rhodes, Havre, Montana, Attorney for Plaintiff.

NOTICE FOR PUBLICATION Department of the Interior, U. S. Land Office at Great Falls, Montana. Notice is hereby given that Charlie Olson, of Nashua, Montana, who on July 10th, 1922, made Homestead entry, Glasgow 059541, now Gt. Falls No. 057668, for SW1 SE% Sec. 15, NE%, SW NE% Sec. 22, Twp 31, N., Rge. 40 E., Montana Meridian, has filed notice of intention to make final three year proof, to establish claim to the land above described, before Otto M. Christinson, U. S. Commissioner, at Glasgow, Montana, on the 30th day of June, 1927. Claimant names as witnesses: James Wilson, Sam Jekanoski, Charles Johnson, Fred Potter, all of Glasgow, M. D. NICHOLSON, Register.

(Pub.Ma.20,27,Jn.3,9,16.)

NOTICE OF SHERIFF'S SALE In the District Court of the Seventeenth Judicial District of the State of Montana, in and for the County of Valley. Burlington Savings Bank, a corporation, Plaintiff.

William H. Haley, a single man, and a The Farmers Realty Company, corporation, Defendants. To be sold at Sheriff's Sale, to the highest bidder for cash, on the 30th day of June, A. D. 1927, at the hour of two o'clock in the afternoon of the said day, at the front door of the Court House in the City of Glasgow. Valley County, Montana, the following described real property, situated in the County of Valley, State of Montana, to-wit: The South half (S½) of Section twenty-seven (27) in Township thirty-seven (37) North, of Range thirty-six (36) East of the Montana Meridian, containing three hundred twenty (320) acres, more or less, according to the United States Government Survey there- together with all an dsingular the tenements. hereditaments and appurtenances thereunto belonging, or in any wise appertaining. Dated this 7th day of June, A. D.

1927.

BEN OLSON, Sheriff of Valley County, Montana. By CHARLES C. TAYLOR, Deputy Sheriff.

David N. Nyquist, Attorney for Plaintiff, Opheim, Montana.

ALIAS SUMMONS In the District Court of the Seven. teenth Judicial District of the State of Montana, in and for the County of Valley. Mrs. Wm. Butler, Plaintiff,

ALIAS SUMMONS

In the District Court of the Seventeenth Judicial District of the State of Monana, in and for the County of Valley. Mrs. Wm. Butler, Plaintiff,

Bjorn Benson and Ellen Benson, his wife, and The Nashua Hardware and Implement Company, a corportion, Defendants. The State of Montana sends greetings to the above named defendants, and to each of them: You are hereby summoned to answer the complaint in this action which is filed in the office of the Clerk of this Court, a copy of which is herewith served upon you, and to file your answer and serve a copy thereof upon the plaintiff's attorney within twenty days after the service of this summons, exclusive of the day of service; and in case of your failure to appear or answer, judgment will be taken against you by default for the relief demanded in the complaint. This action is brought for the foreclosure of certain mortgage described in said complaint and made and executed by the defendants Bjorn Benson and Ellen Benson to secure the payment to Mrs. William Butler, plaintiff herein, of the sum of $2200.00 according to the terms of one certain promissory note, together with interest thereon as therein specified, which said mortgage was duly recorded in the office of the County Clerk and Recorder of Valley County, Montana, on June 1922, at 2:00 o'clock p. m., in Book 83 of Mortgages on pages 552-3 thereof, and for expenses and costs incurred by reason of this action, and for a reasonable attorney's fee as in said mortgage provided, and for the sale of the premises described in said mortgage, to-wit: The East one-half (E½) Section thirty five (Sec. 35) Township thirty (Twp. 30) N. Range fortytwo (Rge. 42) East of the Montana Meridian (E. M. M.) and the proceeds applied toward the payment of the said debt. costs and attorney's fee, as aforesaid: and that all of the defendants above named and all persons claiming by through, or under them, or any of them, may be barred and foreclosed of all right, title, claim, lien, equity of redemption and interest in and to the said mortgaged premises. and every part thereof; and for such other and further relief as will more fully appear by reference to the plaintiff's complaint on file in the office of the Clerk of the above entitled Court. Witness my hand and the Seal of said Court this 26th day of May. 1927.

J. B. CHRISTOPHERSEN, (Court Seal) Clerk. By E. L. SPLAN, Deputy Clerk.

Antonia Pavlosky, also known as Antoney Pavlosky, Bertha Pavlosky, his wife, The First National Bank of Paynesville, Minnesota, a corporation, State Bank of Nashua, Montana, a corporation, James T. Shea, receiver of State Bank of Nashua, Montana, a corporation, and Valley County, Montana, body politic and corporate, Defendants. The State of Montana sends greetings to the above named defendants, and to each of them: You are hereby summoned to answer the complaint in this action which is filed in the office of the Clerk of this Court, a copy of which is herewith served upon you, and to file your answer and serve a copy thereof upon the plaintiff's attorney within twenty days after the service of this summons, exclusive of the day of service; and in case of your failure to appear or answer, judgment will be taken against you by default for the relief demanded in the complaint. This action is brought for the foreclosure of a certain mortgage described in said complaint and made and executed by the defendants Antonia Pavlosky and Bertha Pavlosky to secure the payment to State Bank of Nashua, corporation, of the sum of $2000.00 according to the terms of one certain promissory note, together with interest thereon as therein specified, which said mortgage was duly recorded in the office of the County Clerk and Recorder of Valley County, Montana, on September 20th, 1919, at 9:45 o'clock a. m., in Book 76 of Mortgages on pages 85-86 thereof, and assigned to Mrs. Wm. Butler, plaintiff herein by an assignment in writing which was duly recorded in the office of the County Clerk and Recorder of Valley County, Montana, on March 4th, 1927, at 11:00 o'clock a. m.; and for expenses and costs incurred by reason of this action, and for reasonable attorney's fee as in said mortgage provided, and for the sale of the premises described in said mortgage, to-wit: The Northeast quarter (NE%), the East half of the Southeast quarter (E%SE%) of Section twenty-seven (27), and the West half of the Southwest quarter (W%SW) of Section twentysix (26), Township twenty-eight (28), North, of Range forty-one (41) East of the Montana Meridian, containing 320 acres, more or less, according to the United States Government survey thereof; and the proceeds applied toward the payment of the said debt, costs and attorney's fees, as aforesaid; and that all of the defendants above named and all persons claiming by, through or under them, or any of them, may be barred and foreclosed of all right, title, claim, lien, equity of redemption and interest in and to the said mortgaged premises and every part thereof; and for such other and further relief as will more fully appear by reference to the plaintiff's complaint on file in the office of the Clerk of the above entitled Court. Witness my hand and the Seal of said Court this 26th day of May, 1927.

J. B. CHRISTOPHERSEN, (Court Seal) Clerk. By E. L. SPLAN, W. H. Rasey, Deputy.

Glasgow, Mont, Attorney for Plaintiff. (Pub.Ma.27,Jn.3,10,17)

W. H\ Rasey, Attorney for Plaintiff, Glasgow, Montana. (Pub.Ma.27,Jn.3,10,17.)

SUMMONS In the District Court of the Seventeenth Judicial District of the State of Montana, in and for the County Valley. Charles of V. Smith, Plaintiff,

Hurley A. Russell; Helen C. Russell, his wife; State Bank of Nashua, Montana, a corporation; James T Shea, Receiver of State Bank of Nashua; W. D. Jones; H. Burkhardt; Lewis-Wedum Company, a corporation; First National Bank in Minneapolis, Minnesota, cor poration; A. N. Currie; Northern Farms Company, a corporation; Defendants. The State of Montana sends greetings to the above named defendants, and to each of them: You are hereby summoned to answer the complaint in this action which is filed in the office of the Clerk of this Court, a copy of which is herewith served upon one of you in each county wherein any of you reside and to file your answer and serve a copy thereof upon the plaintiff's attorneys within twenty days after the service of this Summons, exclusive of the day of service and in case of your failure to appear answer, Judgment will be taken against you, by default, for the relief demanded in the complaint. That the nature and object of the above entitled action is to foreclose and determine the lien of a certain mortgage on real estate, dated September 15th, 1916, made, executed, acknowledged and delivered by said defendants Hurley A. Russell and Helen C. Russell, as mortgagors, to State Bank of Nashua, of Nashua, Montana, a corporation, as mortgagee, which mortgage was thereafter. by mesne written assignments, duly assigned to plaintiff herein; which said mortgage was duly recorded in the office of the Clerk and Recorder of Valley County, Montana, on September 22d, 1916, at 10:30 o'clock a. m., in Book 36 of Mortgages, on page 164; and also to foreclose the equity of redemption of said defendants above named, and each of them, and all persons or parties claiming any interest in or lien upon said real estate through or from them, or either of them, in and to the following described real estate, to-wit: Southeast quarter (SE% of Section thirty five (35), in Township twenty-nine (29) North, of Range forty-two (42), East Montana Meridian, Valley County, Montana, containing 160 acres, more or less, according to the Survey thereof; together with all the hereditaments and appurtenances thereunto belonging or in anywise appertaining. Witness my hand and the Seal of said Court this 8th day of April, 1927. J. B. CHRISTOPHERSEN, (Seal) Clerk. By E. L SPLAN, Deputy Clerk

McKenzie & McKenzie, Attorneys for Plaintiff, Great Falls, Montana. (Pub:Ma.27,Jn.3,10,17.)