Click image to open full size in new tab

Article Text

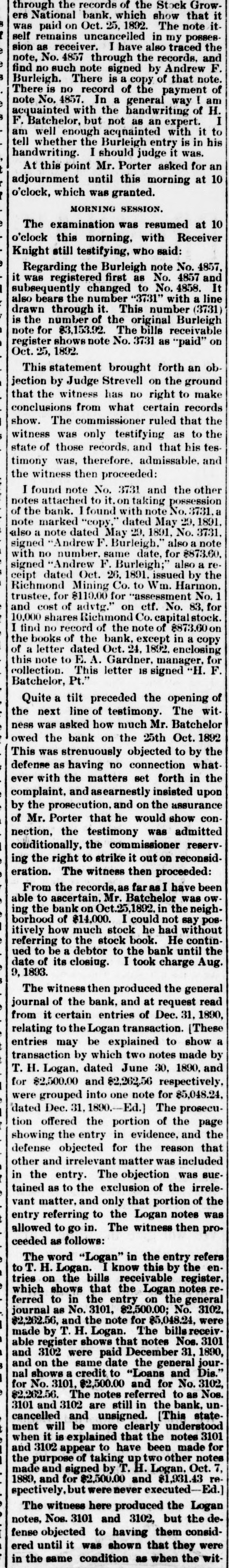

through the records of the Stock Growers National bank, which show that it was paid on Oct. 25, 1892. The note itself remains uncancelled in my possession as receiver. I have also traced the note, No. 4857 through the records, and find no such note signed by Andrew F. Burleigh. There is a copy of that note. There is no record of the payment of note No. 4857. In a general way I am acquainted with the handwriting of H. F. Batchelor, but not as an expert. I am well enough acquainted with it to tell whether the Burleigh entry is in his handwriting. I should judge it was.

At this point Mr. Porter asked for an adjournment until this morning at 10 o'clock, which was granted.

# MORNING SESSION.

The examination was resumed at 10 o'clock this morning, with Receiver Knight still testifying, who said:

Regarding the Burleigh note No. 4857, it was registered first as No. 4857 and subsequently changed to No. 4858. It also bears the number "3731" with a line drawn through it. This number (3731) is the number of the original Burleigh note for $3,153.92. The bills receivable register shows note No. 3731 as "paid" on Oct. 25, 1892.

This statement brought forth an objection by Judge Strevell on the ground that the witness has no right to make conclusions from what certain records show. The commissioner ruled that the witness was only testifying as to the state of those records, and that his testimony was, therefore, admissable, and the witness then proceeded:

I found note No. 3731 and the other notes attached to it, on taking possession of the bank. I found with note No. 3731, a note marked "copy," dated May 29, 1891, also a note dated May 29, 1891, No. 3731, signed "Andrew F. Burleigh," also a note with no number, same date, for $873.60, signed "Andrew F. Burleigh;" also a receipt dated Oct. 26, 1891, issued by the Richmond Mining Co. to Wm. Harmon, trustee, for $110.00 for "assessment No. 1 and cost of advtg." on etf. No. 83, for 10,000 shares Richmond Co. capital stock. I find no record of the note of $873.60 on the books of the bank, except in a copy of a letter dated Oct. 24, 1892, enclosing this note to E. A. Gardner, manager, for collection. This letter is signed "H. F. Batchelor, Pt."

Quite a tilt preceded the opening of the next line of testimony. The witness was asked how much Mr. Batchelor owed the bank on the 25th Oct. 1892. This was strenuously objected to by the defense as having no connection whatever with the matters set forth in the complaint, and asearnestly insisted upon by the prosecution, and on the assurance of Mr. Porter that he would show connection, the testimony was admitted conditionally, the commissioner reserving the right to strike it out on reconsideration. The witness then proceeded:

From the records, as far as I have been able to ascertain, Mr. Batchelor was owing the bank on Oct.25, 1892, in the neighborhood of $14,000. I could not say positively how much stock he had without referring to the stock book. He continued to be a debtor to the bank until the date of its closing. I took charge Aug. 9, 1893.

The witness then produced the general journal of the bank, and at request read from it certain entries of Dec. 31, 1890, relating to the Logan transaction. [These entries may be explained to show a transaction by which two notes made by T. H. Logan, dated June 30, 1890, and for $2,500.00 and $2,262.56 respectively, were grouped into one note for $5,048.24, dated Dec. 31, 1890.-Ed.] The prosecution offered the portion of the page showing the entry in evidence, and the defense objected for the reason that other and irrelevant matter was included in the entry. The objection was sustained as to the exclusion of the irrelevant matter, and only that portion of the entry referring to the Logan notes was allowed to go in. The witness then proceeded as follows:

The word "Logan" in the entry refers to T. H. Logan. I know this by the entries on the bills receivable register, which shows that the Logan notes referred to in the entry on the general journal as No. 3101, $2,500.00; No. 3102, $2,262.56, and the note for $5,048.24, were made by T. H. Logan. The bills receivable register shows that notes Nos. 3101 and 3102 were paid December 31, 1890, and on the same date the general journal shows a credit to "Loans and Dis." for No. 3101, $2,500.00 and for No. 3102, $2,262.56. The notes referred to as Nos. 3101 and 3102 are still in the bank, uncancelled and unsigned. [This statement will be more clearly understood when it is explained that the notes 3101 and 3102 appear to have been made for the purpose of taking up two other notes made and signed by T. H. Logan. Oct. 7, 1889, and for $2,500.00 and $1,931.43 respectively, but were never executed-Ed.]

The witness here produced the Logan notes, Nos. 3101 and 3102, but the defense objected to having them considered until it was shown that they were in the same condition as when the wit-