Click image to open full size in new tab

Article Text

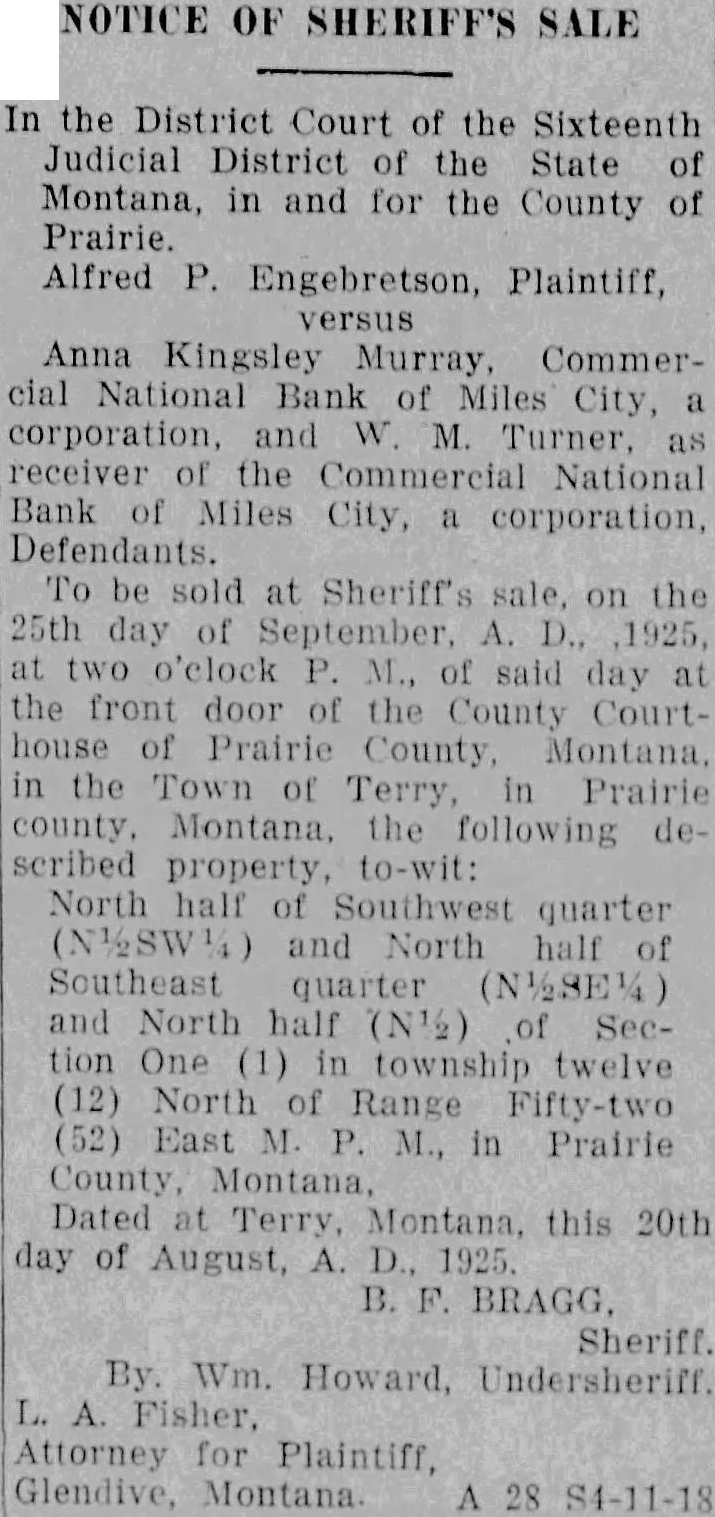

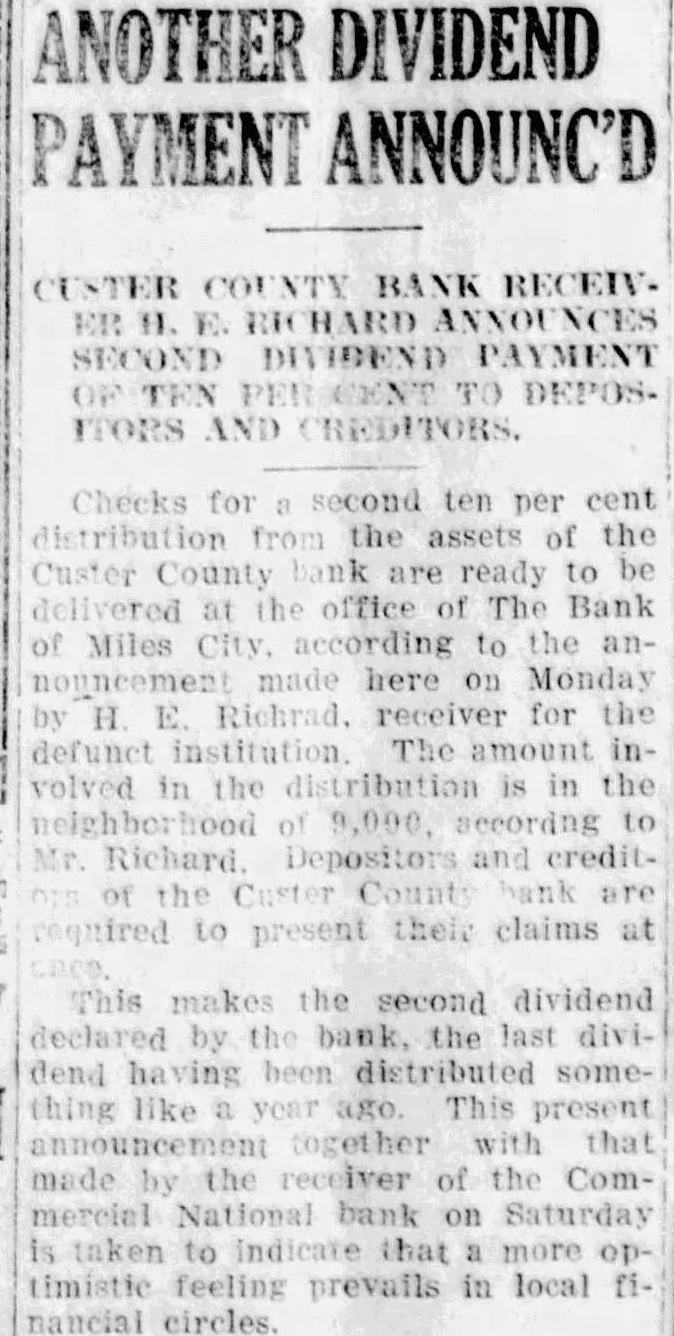

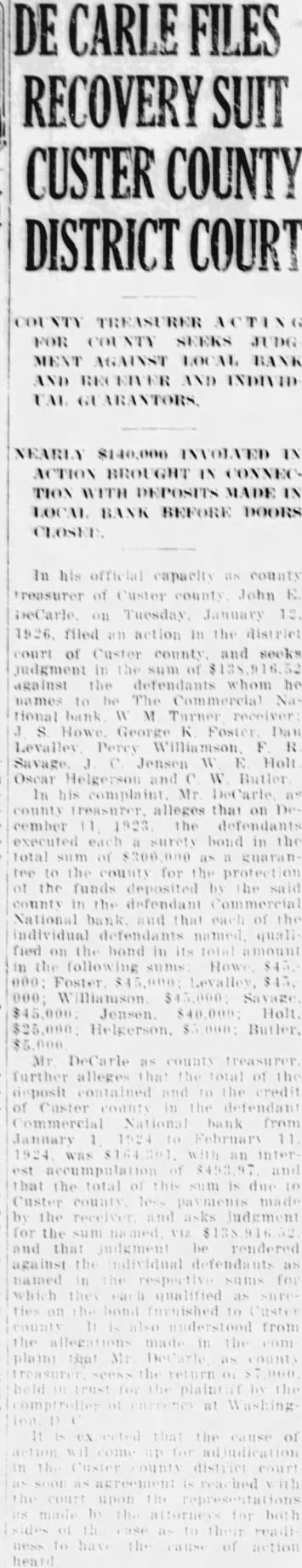

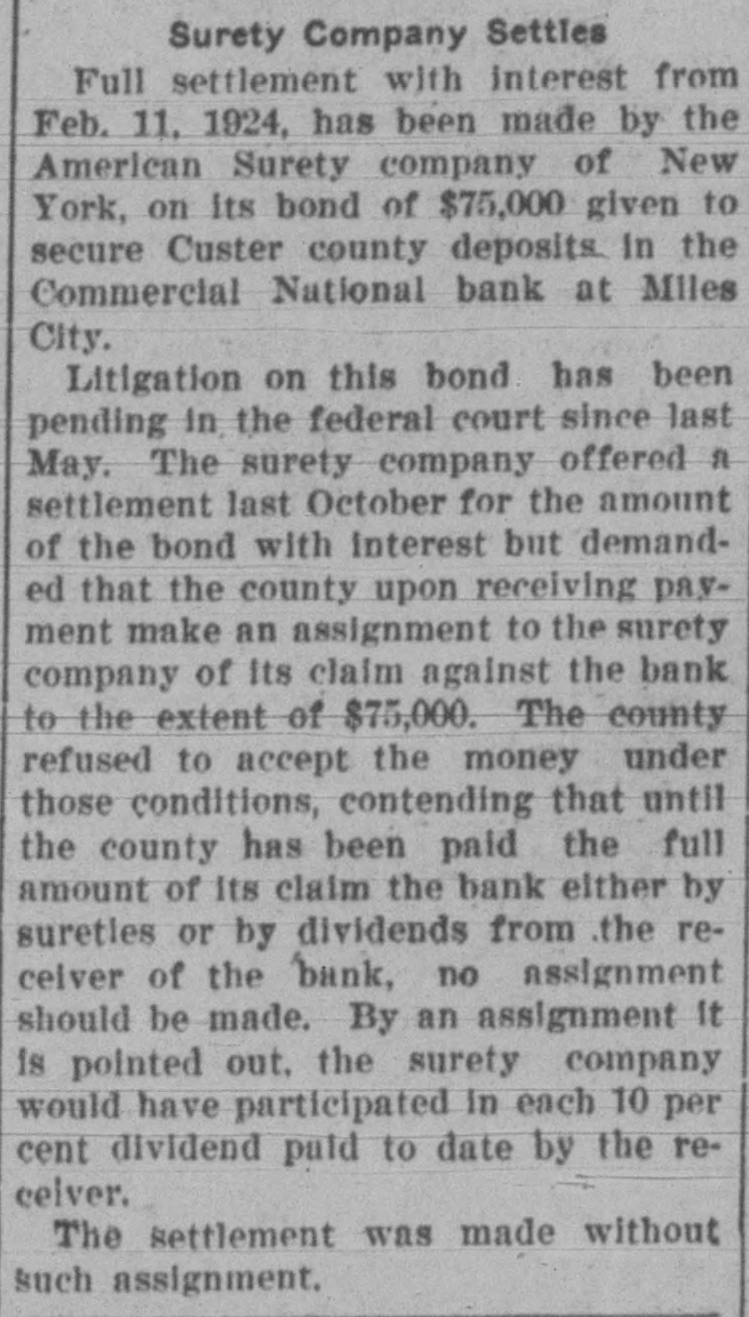

(By Our Helena Correspondent.) Contract for the grading and surfacing with crushed gravel of a 19-mile stretch of the Roosevelt highway in Valley and Roosevelt countes west of the city of Wolf Point, was awarded by the state highway commission to Fitzgerald & Stanton of Great Falls, on a bid of $111,355.93. The contractors have until August 1, 1927, in which to complete the work. The contract for the erection of two steel bridges and 12 timber trestles on the same piece of work was let to J. F. Harrington of Missoula, at $33,909.50. Fitzgerald & Staunton also obtained the contract for the grading and surfacing of a piece of work on the Lewistown-Grass Range highway in Fergus county, extending easterly a distance of 3.8 miles from the city of Lewistown, at a figure of $16,565.54. The Security Bridge company of Billings was given the contract for the erection of a steel bridge across Boyd creek on this piece of work, at $4,170.98. For the surfacing with crushed gravel of 5.42 mies of the Livingston-Wilsall road out of Clyde Park in Park c ounty, the contract was awarded to J. N. Brown & Son of Bozeman at $11,621.78. F. E. Collison of Billings was the low bidder at $9,501.98 on the surfacing with crushed gravel of the Witt Hill section of the Yellowstone trail in Stillwater county, 5.22 miles in length. But one bid being received for the resurfacing of a piece of the Bitter Root road out of Hamilton, in Ravalli county, the contract was not awarded. In view of the condemnation of the Sun River bridge near Great Falls, the Cascade county board of commissioners has asked the state highway commission and the bureau of public roads for a joint reconnaisance looking to whether it would be wise to create a federal aid project starting to 1 the top of Gore hill and including the e bridge in a federal aid project, which would extend through the Sixth street viaduct on the west side, providing the city should wish to participate. 1 The commission will endeavor to arrange to have this done directly after Engineer E. M. Hulce of the highway com0 mission completes the examination of a contemplated project in Judith Basin county, within a few days. e So long as rail service between given t points is adequate and reasonably meets 0 public convenience and necessity, applicants for motor bus line certificates from e the Montana railroad commission must be t disappointed. This position the commission makes clear in an order issued denying e the application of Hugh Kelly for a line between Missoula and Philipsburg, Eight trains a day now run between e Drummond and Philipsburg, with mixed service. This train cost the railroad about $2,581.70 to operate from March, 1925 to e February, 1926, while its revenues were about $1.380 from passenger service for the same period, the commission found. Admitting that it would be a convenience n if business visitors to Philipsburg could arrive in the morning and leave in the r afternoon, the commission points out that such service is not a matter of necessity and both factors must appear in order to e warrant issuance of a bus line certificate 0 Admission of a bus line, the commission h declares, would, on the face of the showing made by the railroads in objecting to the d application mean the elimination of the S train service now available. y Upon a writ of error allowed by the t Montana supreme court on the application of Loud and Leavitt, counsel for the Com e mercial National bank of Miles City, and d its receiver, W. M. Turner, and for the Miles City National bank, in three cases ;, against Custer county and its county n treasurer involving the taxation of shares ; of stock in those national banking insti tutions, those three actions, consolidated ¿ as one, are being taken to the supreme court of the United States on appeal from e the judgment of the Montana courts. et The cases involve the right of the taxing authorities of Montana to assess the stock is of national banks, under the state classi 1. fication statute, at 40 per cent of their true e value, whereas moneyed capital in the hands of individuals or concerns other le than banks, is assessed at but seven per