Article Text

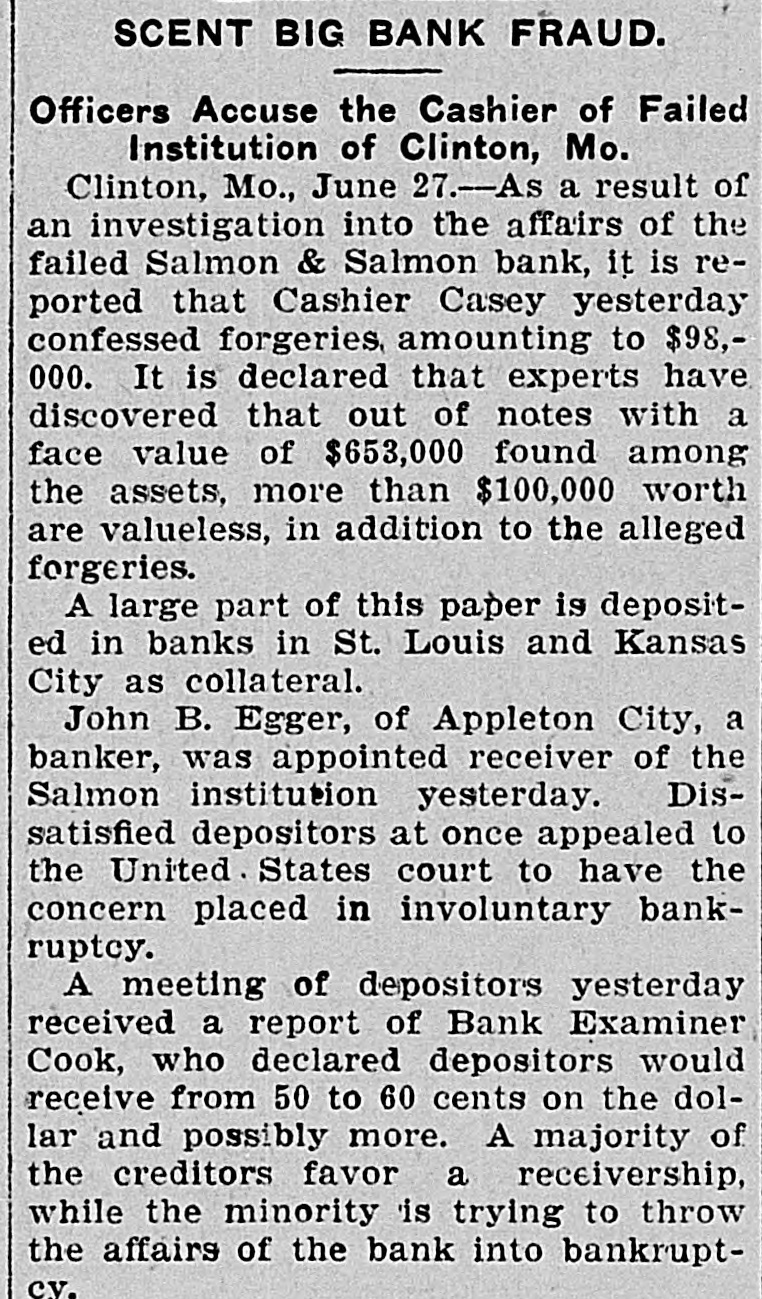

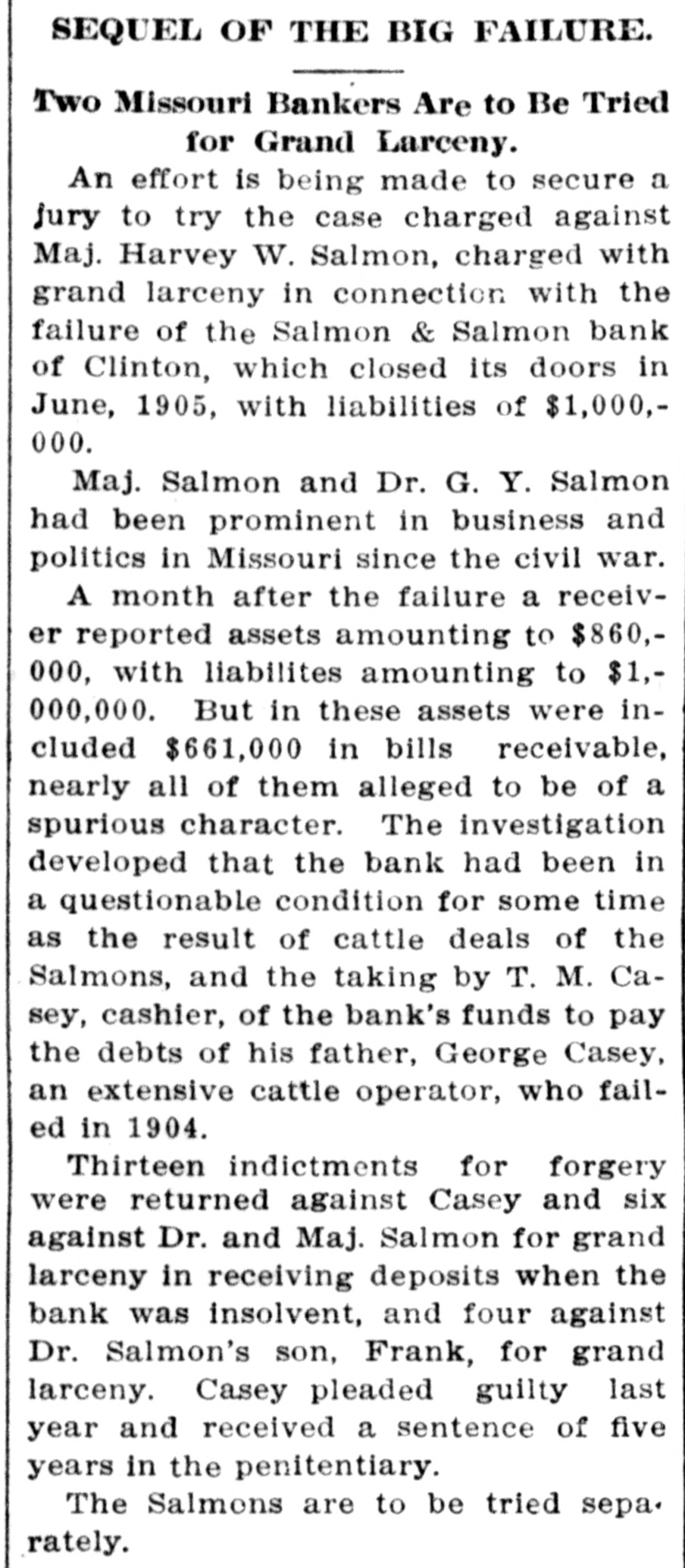

SCENT BIG BANK FRAUD. Officers Accuse the Cashier of Failed Institution of Clinton, Mo. Clinton, Mo., June 27.-As a result of an investigation into the affairs of the failed Salmon & Salmon bank, it is reported that Cashier Casey yesterday confessed forgeries, amounting to $98,000. It is declared that experts have discovered that out of notes with a face value of $653,000 found among the assets, more than $100,000 worth are valueless, in addition to the alleged forgeries. A large part of this paper is deposited in banks in St. Louis and Kansas City as collateral. John B. Egger, of Appleton City, a banker, was appointed receiver of the Salmon institution yesterday. Dissatisfied depositors at once appealed to the United. States court to have the concern placed in involuntary bankruptcy. A meeting of depositors yesterday received a report of Bank Examiner Cook, who declared depositors would receive from 50 to 60 cents on the dollar and possibly more. A majority of the creditors favor a receivership, while the minority is trying to throw the affairs of the bank into bankruptcv.