Article Text

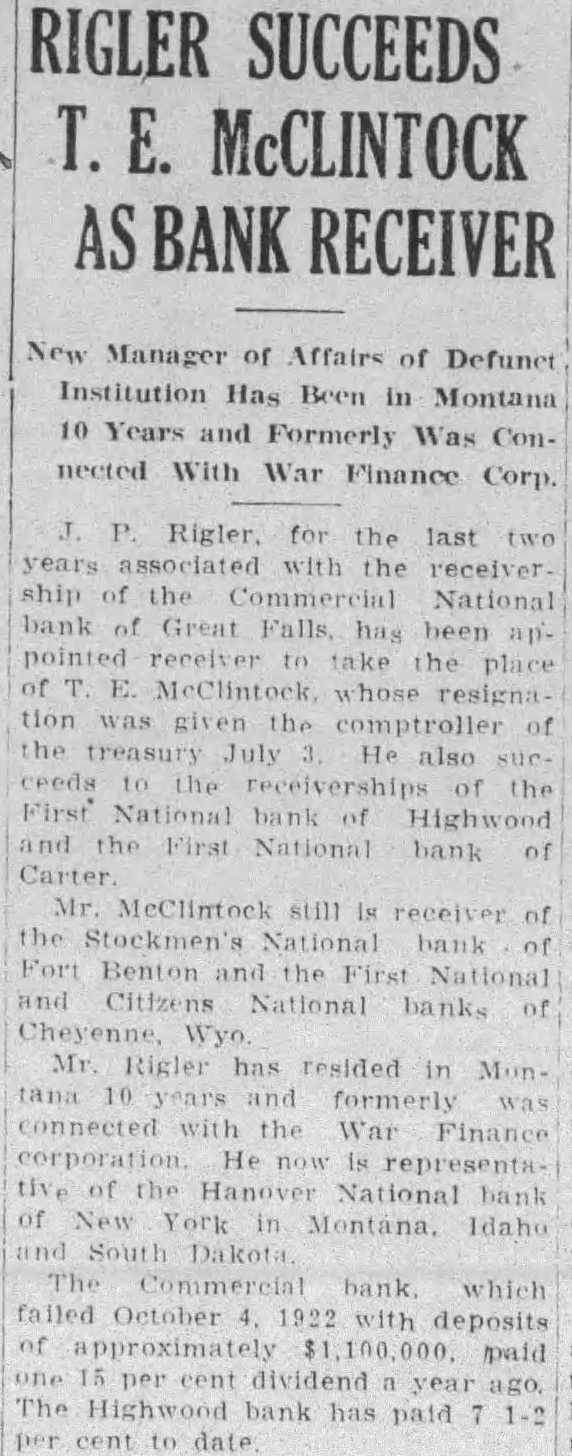

RIGLER SUCCEEDS T. E. McCLINTOCK AS BANK RECEIVER New Manager of Affairs of Defunct Institution Has Been in Montana 10 Years and Formerly Was Connected With War Finance Corp. J. P. Rigler. for the last two years associated with the receiver. ship of the Commercial National bank of Great Falls, has been appointed receiver take the place of T. E. McClintock whose resignation was given the comptroller of the treasury July He also sueceeds the receiverships of the First National bank of Highwood and First National bank of Carter Mr. McClintock still Is receiver of the Stockmen's National bank of Fort Benton and the First National and Citizens National banks of Wyo Mr. Rigler has resided in Montana 10 years and formerly was connected with the War Finance corporation He now is representa tive of the Hanover National bank of New York in Montana, Idaho and South Dakota. The Commercial bank which failed October 4. 1922 with deposits one 15 per cent dividend year ago The Highwood bank has paid 1-2 per cent to date