Article Text

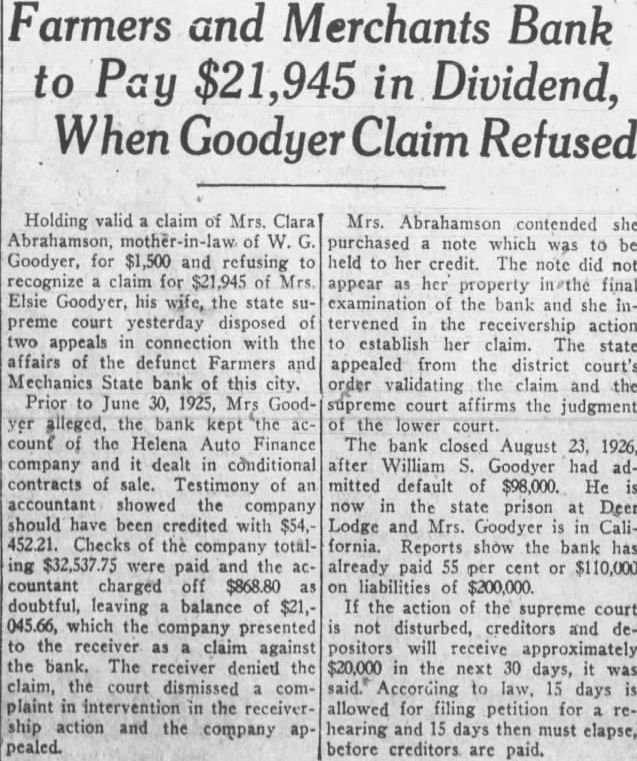

Farmers and Merchants Bank to Pay in Dividend, When Goodyer Refused Holding valid claim of Mrs. Clara Abrahamson, of W. Goodyer, for $1,500 and refusing recognize claim for $21,945 of Mrs. Elsie Goodyer, his wife, the state supreme court yesterday disposed two appeals with the affairs of the defunct Farmers and Mechanics State bank of this city. Prior to June 1925, Mrs Goodyer alleged, the bank kept "the count the Helena Auto Finance company and dealt in conditional contracts of sale. Testimony of accountant showed company should have been credited with $54,452.21. Checks of the totalcompany $32,537.75 were paid and the countant charged off $868.80 doubtful, leaving balance $21,045.66, which the presented company the receiver as claim against The receiver denied the claim, court dismissed plaint in intervention in the receiveraction and the company pealed. Mrs. Abrahamson contended she purchased note which was held to her credit. The note did not appear her property final examination of the bank and she intervened in the action establish her claim. The state appealed from the district court's order validating the claim and the supreme court affirms the judgment the lower court. The bank closed August 1926, after William Goodyer had admitted default of $98,000. He in the state prison Deer Lodge and Mrs. Goodyer in California. Reports show the bank has already paid 55 per cent or $110,000 liabilities of $200,000. the action the supreme court not disturbed, creditors depositors will receive approximately $20,000 the next 30 days, According to days allowed for filing petition for hearing and 15 days then must clapse, before creditors are paid.