Article Text

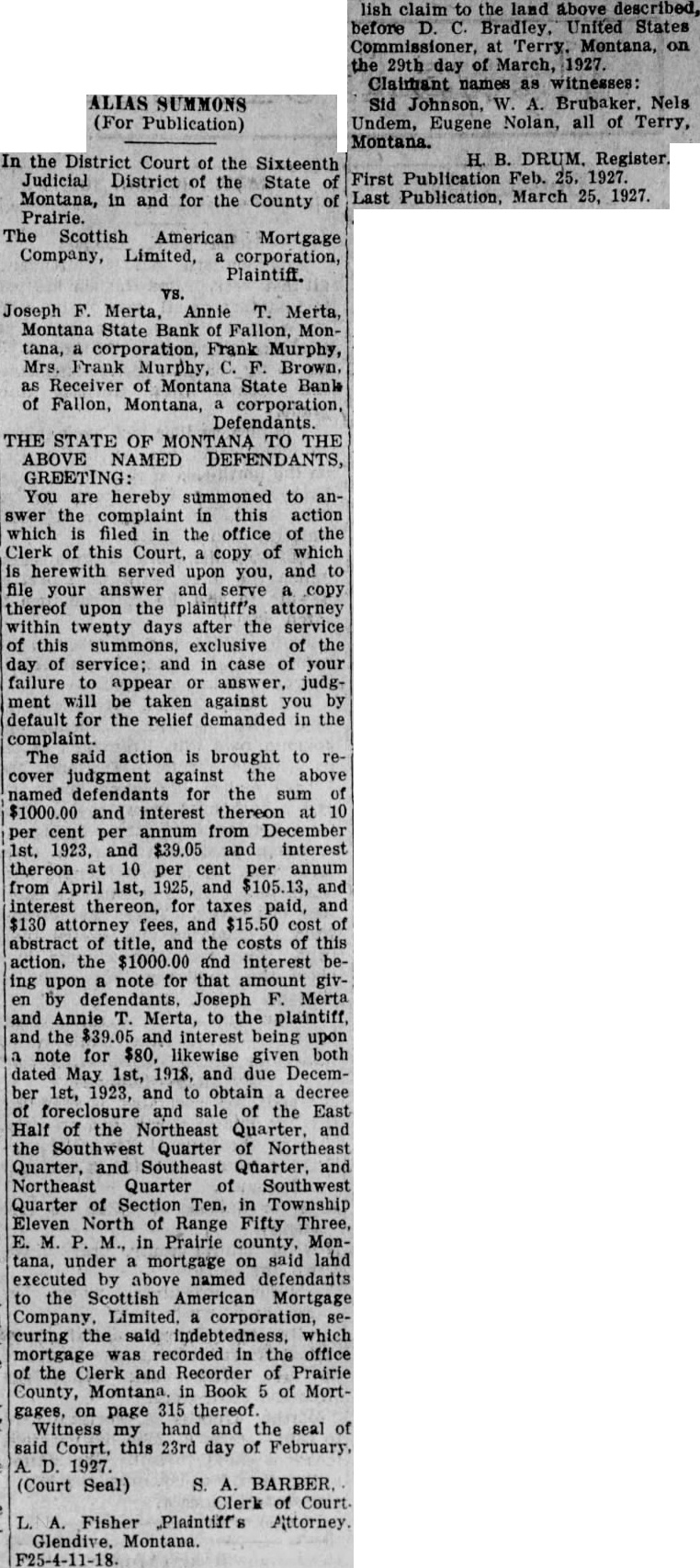

SUMMONS (For Publication) In the District Court of the Sixteenth Judicial District of the State Montana, in and for the County Prairie. The Scottish American Mortgage Company, Limited, corporation, Plaintiff. Joseph Merta, Annie T. Merta, Montana State Bank of Fallon, Montana, corporation, Frank Murphy, Mrs. Frank Murphy, Brown. as Receiver of Montana State Bank of Fallon, Montana, corporation, THE STATE OF TO THE ABOVE NAMED DEFENDANTS, GREETING: You are hereby summoned to answer the complaint in this action which filed in the office of the Clerk of this Court, copy of which herewith served upon you, and file your answer and serve copy thereof upon the plaintiff's attorney twenty days after the service this summons, exclusive of the day of service; and case of your failure appear or judgment be taken against you by default for the relief demanded in the complaint. The said action is brought to cover judgment against the above named defendants for the sum and interest thereon cent per annum from December 1923, and $39.05 and interest thereon at 10 per cent per annum from April 1st, 1925, and and interest thereon, for taxes paid, and $130 fees, and cost of abstract of title, the costs of this action. the $1000.00 and interest ing upon note for that amount by Joseph Merta Annie Merta, to the plaintiff, the $39.05 and interest being upon note for likewise given both dated May 1st, 1918, and due December 1st, 1923, and to obtain decree foreclosure and sale the East Half the Northeast Quarter, and Quarter of Northeast Quarter, and Southeast Quarter. Northeast Quarter of Southwest Quarter of Section Ten. in Township Eleven North of Range Fifty Three, Prairie county, Montana, under mortgage on said land executed by above named defendants to the Scottish American Mortgage curing the said which was recorded in the office of the Clerk and Recorder of Prairie County, Montana in Book of Mortgages, on page 315 thereof. Witness my hand and the seal of Court, this 23rd day of (Court Seal) BARBER. Clerk Court Fisher Plaintiff's Attorney Glendive. Montana. lish claim to the land above before Bradley, United States Commissioner, at Terry. Montana, on 29th day of March, Claimant names as witnesses: Sid Johnson, Nels Undem, Eugene Nolan, all of Terry, Montana. DRUM. Register. First Publication Feb. 25. 1927. Last March 25, 1927.